-

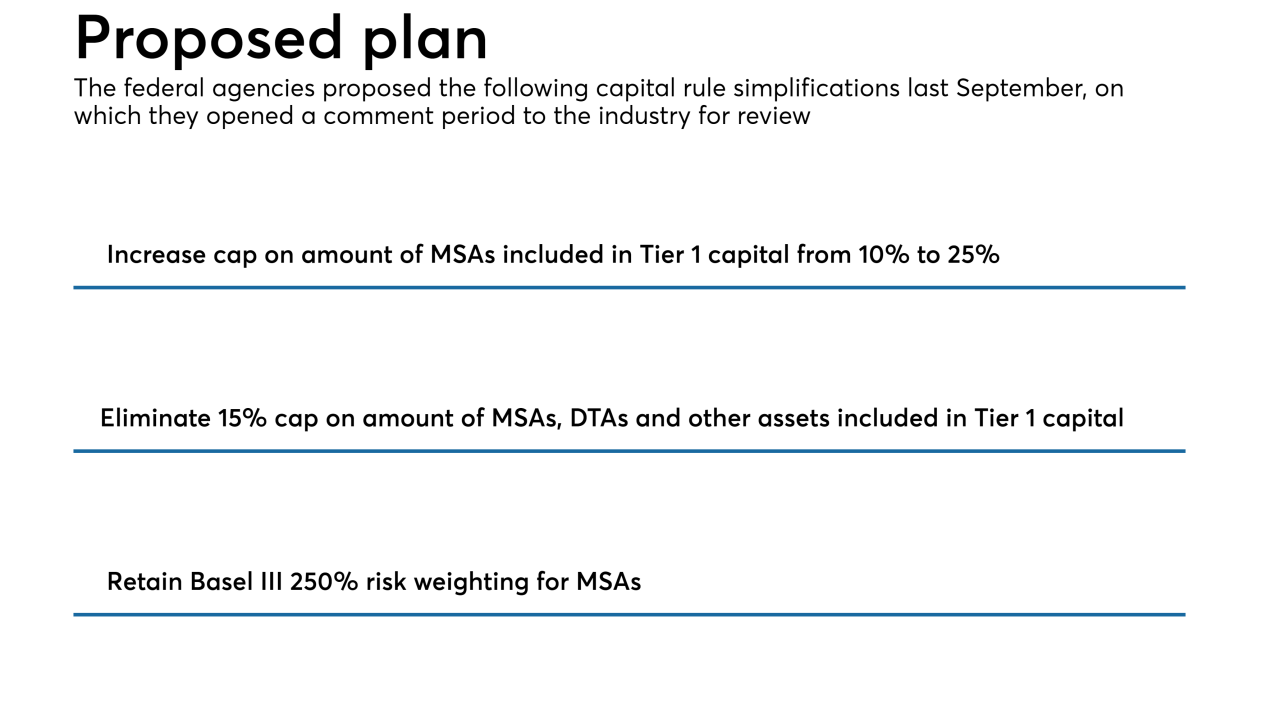

A proposal issued over a year ago by federal banking agencies to simplify risk-based capital rules and ease compliance burdens for community banks has still not been finalized, and mortgage brokers and bankers are calling on them to do just that.

December 18 -

While the foreclosure crisis is over and federal regulators are being less assertive on enforcement actions, mortgage servicers must remain vigilant about compliance, as state agencies are stepping up their own oversight, according to Standard & Poor's.

November 6 -

New York's Department of Housing Preservation and Development has released a "Speculation Watch List" of rent-regulated homes sold that the agency said could potentially put tenants at risk.

November 1 -

Under the Federal Housing Finance Agency's plan, small Home Loan banks would face a new housing benchmark and a volume threshold for meeting the goals would be eliminated.

October 29 -

Lennar's mortgage banking unit agreed to settle False Claims Act allegations for $13.2 million, a smaller amount than other lenders paid to the government prior to the end of fiscal year 2017.

October 22 -

The Office of the Comptroller of the Currency lowered the $14 billion-asset thrift in Cleveland to “needs to improve” from "satisfactory."

October 3 -

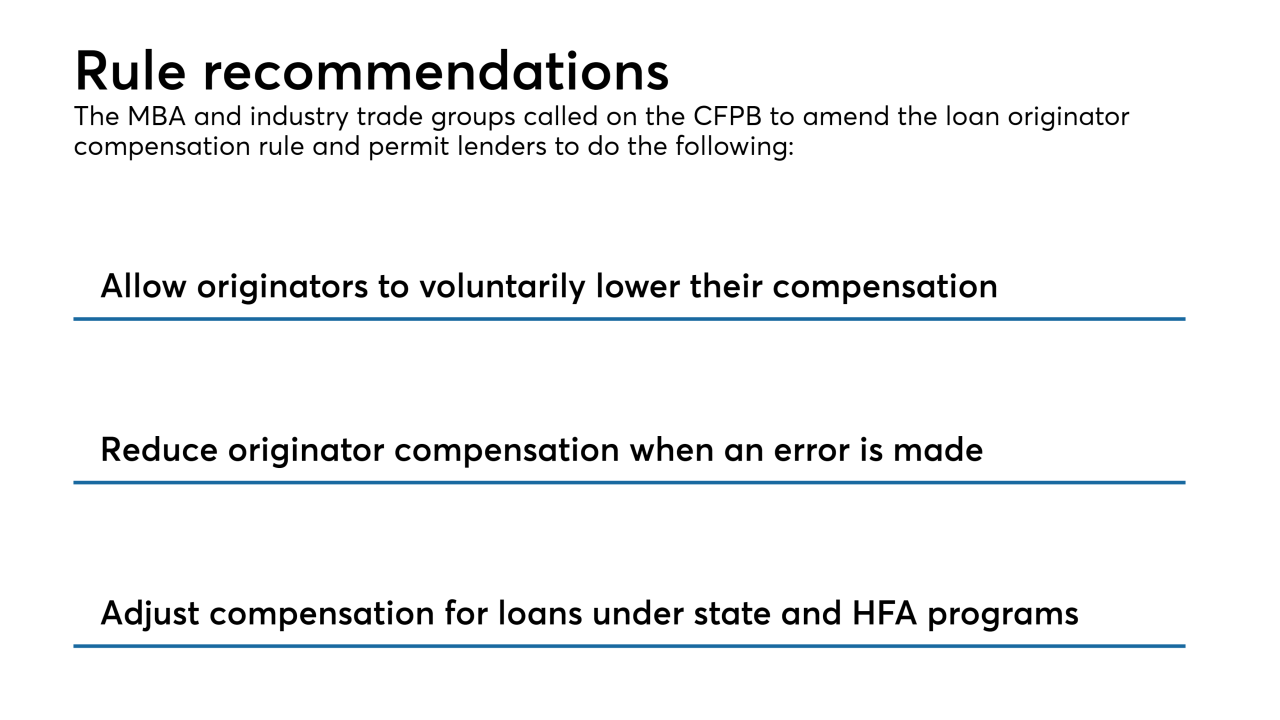

The mortgage industry is calling on the Consumer Financial Protection Bureau to revise its Loan Originator Compensation rule in favor of better protection for consumers and lesser regulatory burdens for lenders.

October 1 -

Gov. Jerry Brown signed a bill Sunday to streamline housing development around BART stations and ease the Bay Area's epic affordable housing problem at the expense of local officials' decision-making powers over land use.

October 1 -

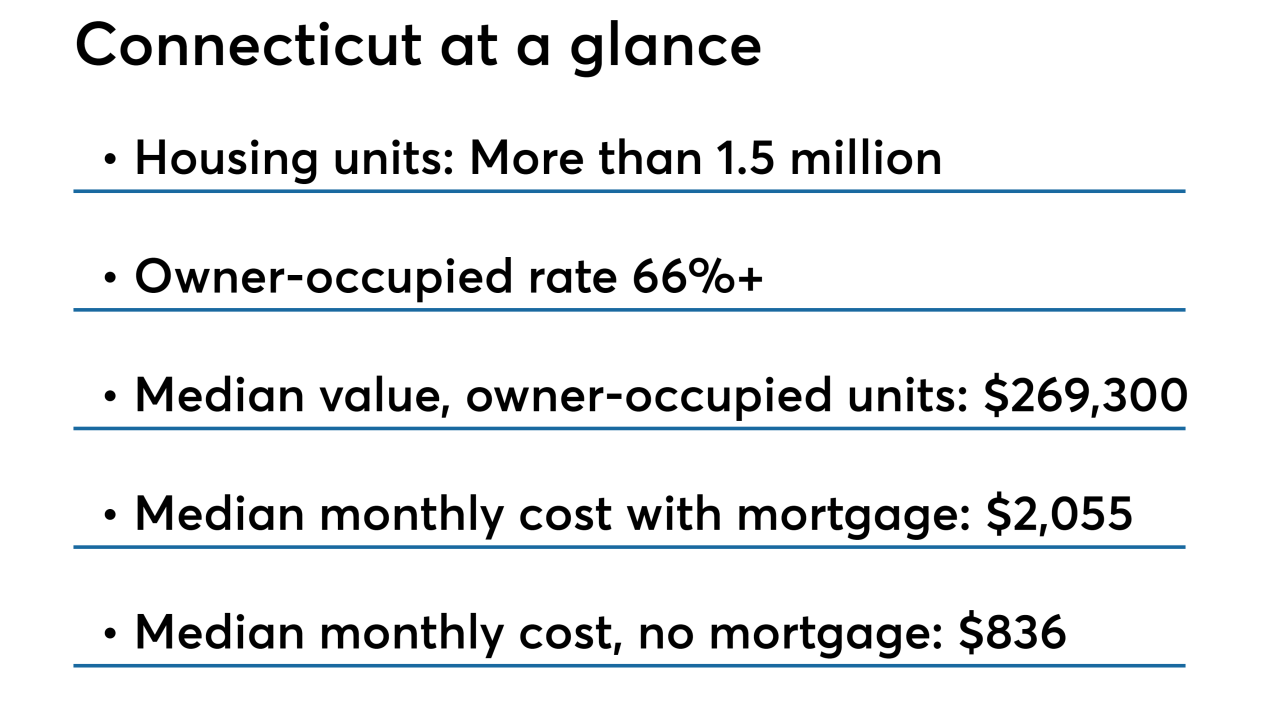

1st Alliance Lending plans to cut up to 35 employees in Connecticut and terminate efforts to expand its East Hartford headquarters in order to prepare for an expected increase in regulatory costs.

September 19 -

Early adopters took digital mortgages from concept to reality. What will it take for everyone else to catch up?

September 10