-

The Consumer Financial Protection Bureau's indirect response to Quicken Loans' Super Bowl 50 commercial implicitly warns consumers to be wary of technology, which points to a bigger problem: does the CFPB even know what it wants from the mortgage industry?

February 8

-

Mortgage startup Nexera Holding has reached $100 million in fundings just six months after it began operations.

January 29 -

Lenders must treat self-service technology as a tool that facilitates, rather than defines, the mortgage borrowing experience.

January 20 Roostify

Roostify -

Social media offers a unique opportunity to make personal connections online, but mortgage lenders should tread lightly when using this channel as a lead source for new borrower prospects.

January 13 -

Ditech Financial, a subsidiary of Walter Investment Management, is exiting the distributed retail mortgage production channel.

January 7 -

Ditech has renewed its sponsorship of Kevin Harvick's No. 4 car which races for the Stewart-Has Racing team on the NASCAR Sprint Cup circuit.

December 11 -

Quicken Loans will be the primary sponsor for Kasey Kahne of Hendrick Motorsports for three races during the 2016 NASCAR season.

December 1 -

Quicken Loans, the company that showed a mortgage business can operate successfully without face-to-face interaction with borrowers, is now giving customers the option to work without human loan officers.

November 24 -

Quicken Loans CEO Bill Emerson's term as chairman of the MBA underscores how the consumer-direct mortgage channel has grown from a quirky novelty to the force leading a technology revolution.

October 26 -

Guaranteed Rate has added 75 former Discover Home Loans employees as well as the Irvine, Calif., call center facility that they worked at.

September 4 -

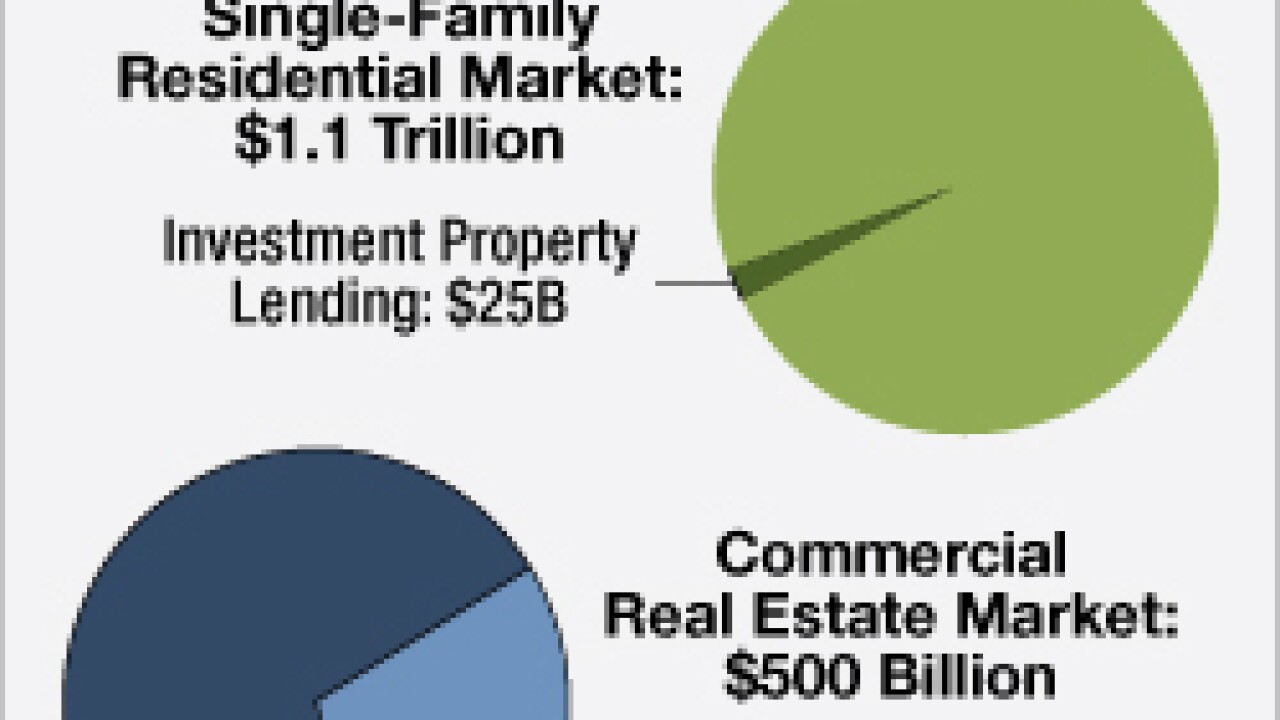

Marketplace lenders seek to disrupt traditional financial services with online platforms that connect borrowers to investors. But in real estate, this burgeoning sector has taken an approach that seeks to co-exist with, rather than supplant, the traditional mortgage market.

August 31 -

DotLoop, the tech startup Zillow just bought, takes the headaches and duplication out of managing real estate documents up until the hardest part of the transaction, the mortgage. Expanding into mortgages is possible, but would be tricky.

August 20 -

J.G. Wentworth Co. has begun a marketing campaign to call attention to its new home-lending business.

August 17 -

Prospect Mortgage will end any activities being undertaken as part of marketing services agreements because of regulatory risk.

July 30 -

From CFPB and TRID to QM and ATR, the barrage of new abbreviations emanating from the Dodd-Frank Act has only been matched by the enormity of the changes it made to the mortgage industry. Here are 10 ways that the landmark financial reform legislation has reshaped the mortgage industry since becoming law five years ago.

July 21 -

A new platform developed by Overture Technologies seeks to pair consumers and lenders online without charging for advertising by the number of clicks or leads generated.

July 10 -

BOK Financial has hired Glenn Brunker to oversee mortgage operations and manage the bank's transition to a new federally required consolidated mortgage disclosure regime.

July 2 -

Stonegate Mortgage will expand its consumer-direct operations in Scottsdale, Ariz., with plans to add about 50 employees.

July 1 -

Mortgage originators willing to help consumers overcome traditional financing hurdles can add more emerging segments of home buyers as clients.

June 29 -

Farmers Bank & Trust in Great Bend, Kan., has agreed to sell certain assets of its mortgage division to Prospect Mortgage in Sherman Oaks, Calif.

June 29