-

Non-QM lending is expected to grow again in 2020, but it has some obstacles to navigate. Altisource CRO John Vella shares his insight into the sector and other hot topics.

January 23 -

With most U.S. households spending more and paying their bills on time, their creditors are feeling more confident than ever.

January 17 -

In another sign of state officials trying to outdo the Consumer Financial Protection Bureau, governors in California and New York want greater authority to license and oversee the debt collection industry.

January 16 -

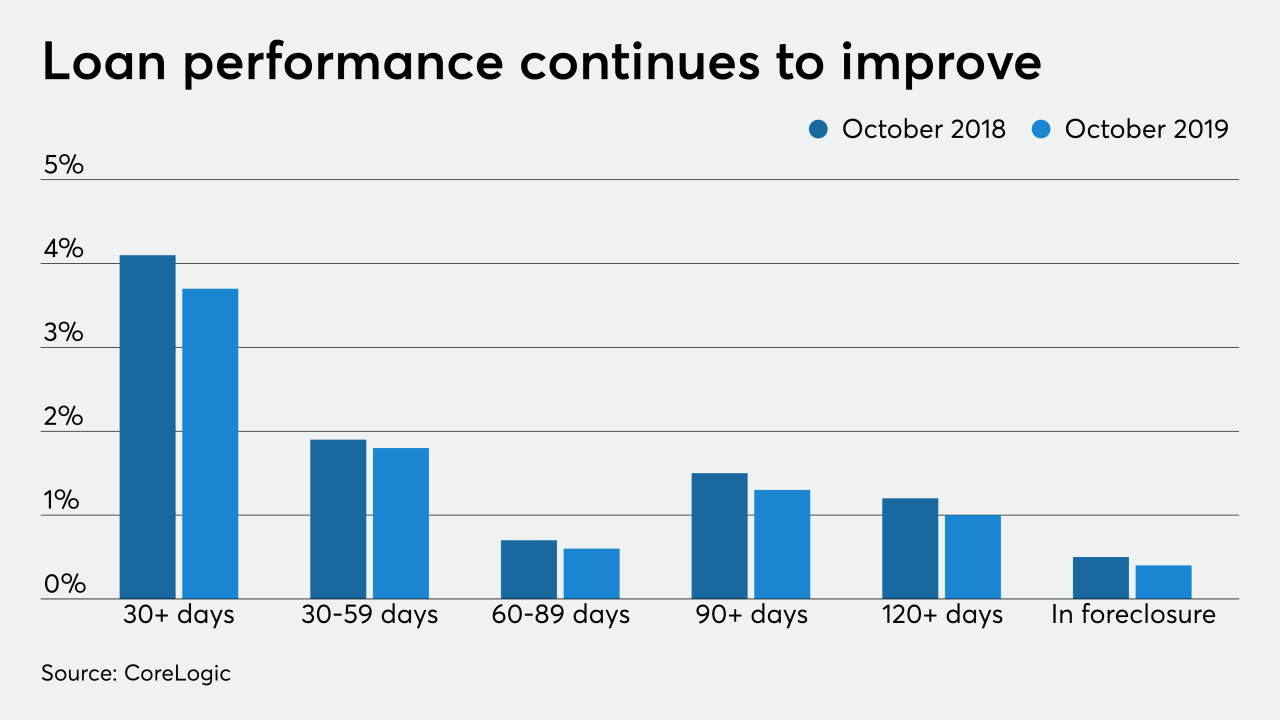

The nationwide mortgage delinquency rate had its best October in at least two decades, while the foreclosure rate remained at a 20-year for the twelfth straight month, according to CoreLogic.

January 14 -

Former CFPB Director Richard Cordray and consumer advocates have designed a proposed state consumer agency that would subject more financial firms and fintechs to state oversight.

January 10 -

In a case highlighting a fraud risk for mortgage companies and other financial institutions, two Garden State residents were sentenced for using fake money orders attempting to fraudulently discharge debts.

January 9 -

The Consumer Financial Protection Bureau faces a busy policy agenda heading into the new year, as well as strong external forces that are beyond its control.

December 24 -

The proposed changes laid out by banking regulators would clear up confusion about what qualifies for CRA credit within so-called Opportunity Zones. But not all community development advocates are convinced that the changes are for the better.

December 17 -

The city of Philadelphia and Wells Fargo have agreed to resolve a 2017 lawsuit in which the city accused the bank of violating the Fair Housing Act by steering minority borrowers into risky, high-cost loans.

December 16 -

Without admitting wrongdoing, the bank has agreed to contribute $10 million to city programs promoting homeownership for low- and moderate-income residents.

December 16 -

The percentage of home loans with late payments is unlikely to fall much further in 2020 when mortgages made to lower credit-score borrowers could rise slightly, according to TransUnion.

December 12 -

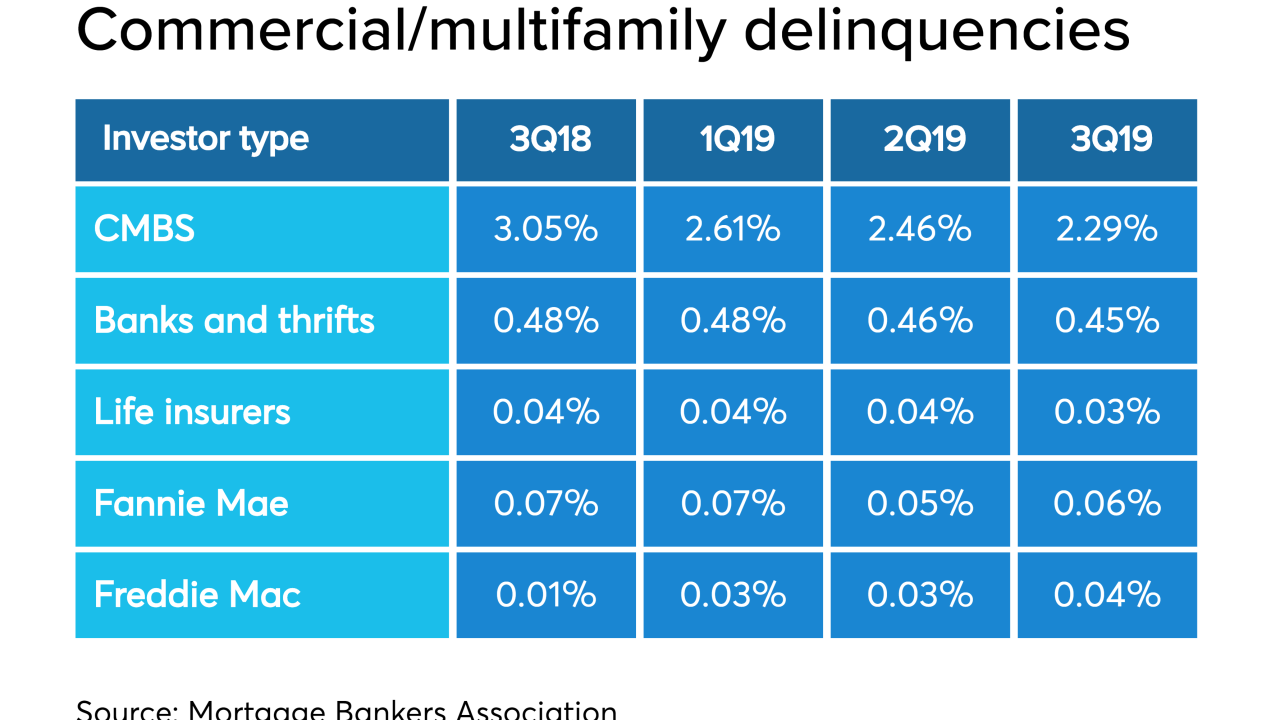

Most commercial and multifamily loan delinquency rates remained near record lows in the third quarter extending a long run of declines in the securitized market, according to the Mortgage Bankers Association.

December 6 -

Lenders contend the proposal goes beyond policing third-party debt collectors and could expose banks to enforcement actions and lawsuits.

November 25 -

Lenders have bundled more than $18 billion worth of non-QM, private-label loans into bonds this year that they then sold to investors, a 44% increase from 2018 and the most for any year since the securities became common post-crisis.

November 18 -

The third-quarter delinquency rate fell to its lowest point since 1995, according to the MBA. However, Attom Data Solutions' numbers show foreclosure filings experienced a near-term growth spurt in October.

November 14 -

The percentage of recent mortgage borrowers with subprime credit scores still resides in the single digits, but nearly doubled what is was in 2013, according to TransUnion.

November 13 -

Home loan originations rose by double digits in the third quarter while auto loan originations approached an all-time high, according to new household credit data from the New York Fed.

November 13 -

Overall home-loan delinquencies remain near 20-year lows, but in Iowa, Minnesota, Nebraska, Rhode Island and Wisconsin, they are inching up in moves that may be tied to local economic concerns.

November 12 -

Tom Marano, a former Bear Stearns banker, was apparently well compensated following the housing crisis for heading up ResCap and Ditech, both of which went into bankruptcy.

November 11 -

There are many ways to mark the economic progress since the Great Recession: over 100 months of job gains, record low unemployment and a long bull run on Wall Street.

October 29