-

The number of consumers being pursued by debt-collection agencies fell dramatically in the past year, but it's as much technicality as achievement, and bankers need to keep that in mind when reviewing the credit scores of millions of Americans.

August 14 -

A ruling involving a Cleveland law firm casts doubt on CFPB claims that attorneys misrepresent their role to consumers.

July 27 -

Debates on the issue often focus on how lending decisions affect certain demographic groups, but those analyses tend to ignore an important factor: default rates.

July 23

-

Servicers and MSR investors face increased regulation and oversight as nearly all states now require some form of licensing for firms responsible for mortgage collections.

July 23 -

The nominee to run the consumer bureau endured tough questioning over the administration’s family-separation policy but appeared to weather the barrage.

July 19 -

Bank of America's residential mortgage origination volume fell short of last year's in its second-quarter earnings despite gains from digital sales and seasonal home buying, and broader consumer lending strength.

July 16 -

The U.S. Supreme Court agreed to decide whether thousands of borrowers can invoke a federal debt-collection law when they are facing foreclosure.

June 28 -

Lauren Hedvat, Angel Oak's managing director of capital markets, said that the rising non-qualified mortgage volume in the market has expanded the number of third-party origination loan packages for purchase.

June 27 -

The borrowers behind the $401.6 million COLT 2018-2 have weighted average liquid reserves of $426,633, or nearly twice the level of borrowers backing a deal completed in January.

May 29 -

Although mortgage default risk remains very low, it was the only category of consumer lending to experience increases both sequentially and year-to-year in VantageScore's latest update to its index.

May 29 -

The post-recession boom in auto loans and credit cards for borrowers with marred credit histories has been winding down in recent months.

May 17 -

Acting CFPB Director Mick Mulvaney has dropped agency plans to crack down on overdraft programs and large marketplace lenders. Here's what else he's changing.

May 16 -

Late payments on single-family home mortgages improved on a consecutive quarter basis as more recovery from Hurricanes Harvey and Irma took hold, but more potential loan performance concerns lie ahead.

May 16 -

The public face of the Trump administration's revamp of the Consumer Financial Protection Bureau is by no means working alone.

May 7 -

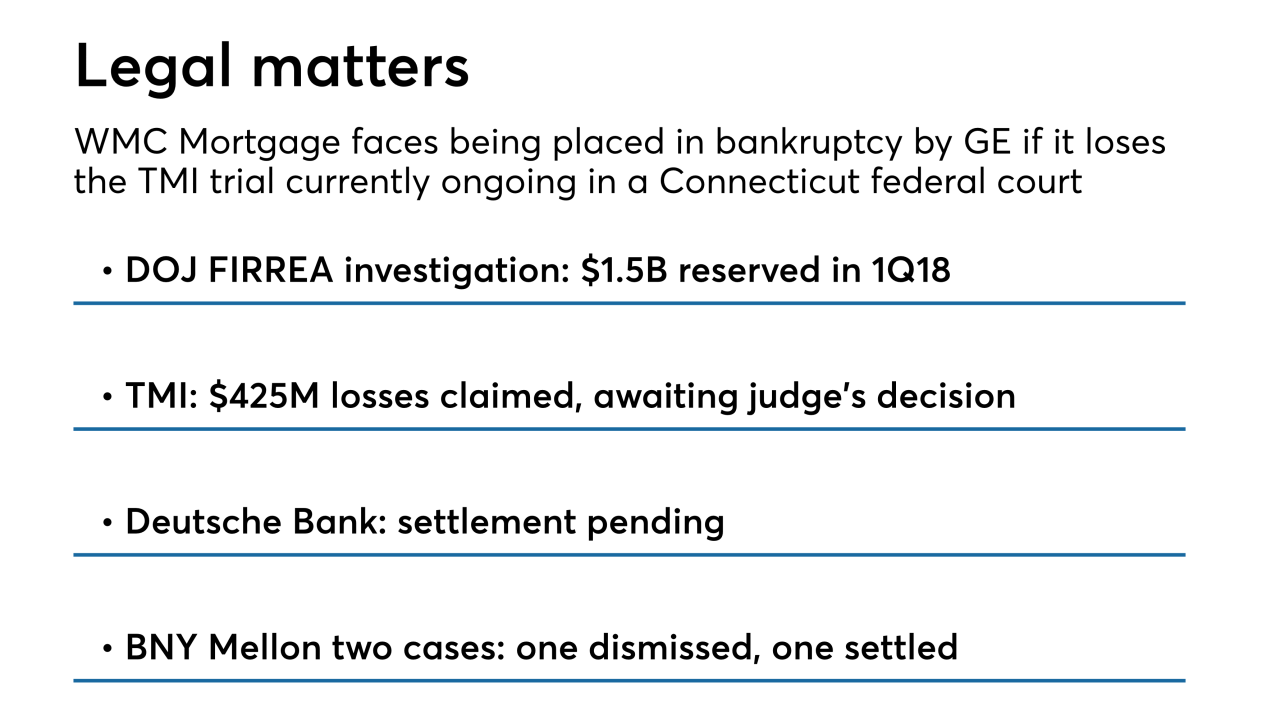

WMC Mortgage, a leading subprime originator during the boom era, could file for bankruptcy by parent company General Electric if it loses a legal proceeding regarding indemnifications on mortgage-backed securities.

May 3 -

Since taking office in November of last year, acting Consumer Financial Protection Bureau Director Mick Mulvaney's actions have sparked outrage from his critics seemingly at every turn, including several times just last week.

April 29 -

Acting Consumer Financial Protection Bureau Director Mick Mulvaney announced a trio of significant changes to the CFPB.

April 24 -

No individuals have been named in connection with the bank’s recent misdeeds, which resulted in a $1 billion fine, even as some senior leaders stand to gain from the government’s tax cut.

April 24 Public Citizen

Public Citizen -

The legislation would prohibit the CFPB from penalizing institutions that rely in good faith on guidance from the bureau.

April 23 -

The Providence, R.I., company reported a double-digit increase in quarterly profits despite a year-over-year decline in fee-based revenue.

April 20