-

The Federal Reserve's $2.3 trillion loan stimulus includes plans for outstanding commercial mortgage-backed securities and newly issued collateralized loan obligations.

April 9 -

With the onset of the pandemic, real estate agents say deals that were in the works are encountering all types of problems, creating havoc in the market as buyers try to back out of contracts.

April 9 -

Social distancing, stay-home orders and a worsening economic crisis are upending Houston's housing market.

April 8 -

If rising flood waters were the right analogy last time around, this time a tsunami is probably a more accurate description of the wave of delinquencies about to come.

April 8 Mayer Brown LLP

Mayer Brown LLP -

The lender is one of many taking advantage of the disruption in the market to grow their businesses.

April 8 -

A bipartisan group of lawmakers wrote in a letter to the Treasury secretary that the Financial Stability Oversight Council should create a liquidity facility to deal with a flood of forbearance requests brought on by the coronavirus pandemic.

April 8 -

Bay Area real estate agents in February eagerly welcomed big crowds packing open houses — and the renewed bidding wars and growing sale prices.

April 8 -

Lenders and community groups say it's a mistake for the banking agencies to move forward during a national crisis. But Comptroller of the Currency Joseph Otting says updated Community Reinvestment Act rules would speed relief to neighborhoods and small businesses.

April 8 -

Mark Calabria needs to be working to secure a Fed facility for servicer advances and to support, not denigrate, smaller servicers, the Mortgage Bankers Association said.

April 8 -

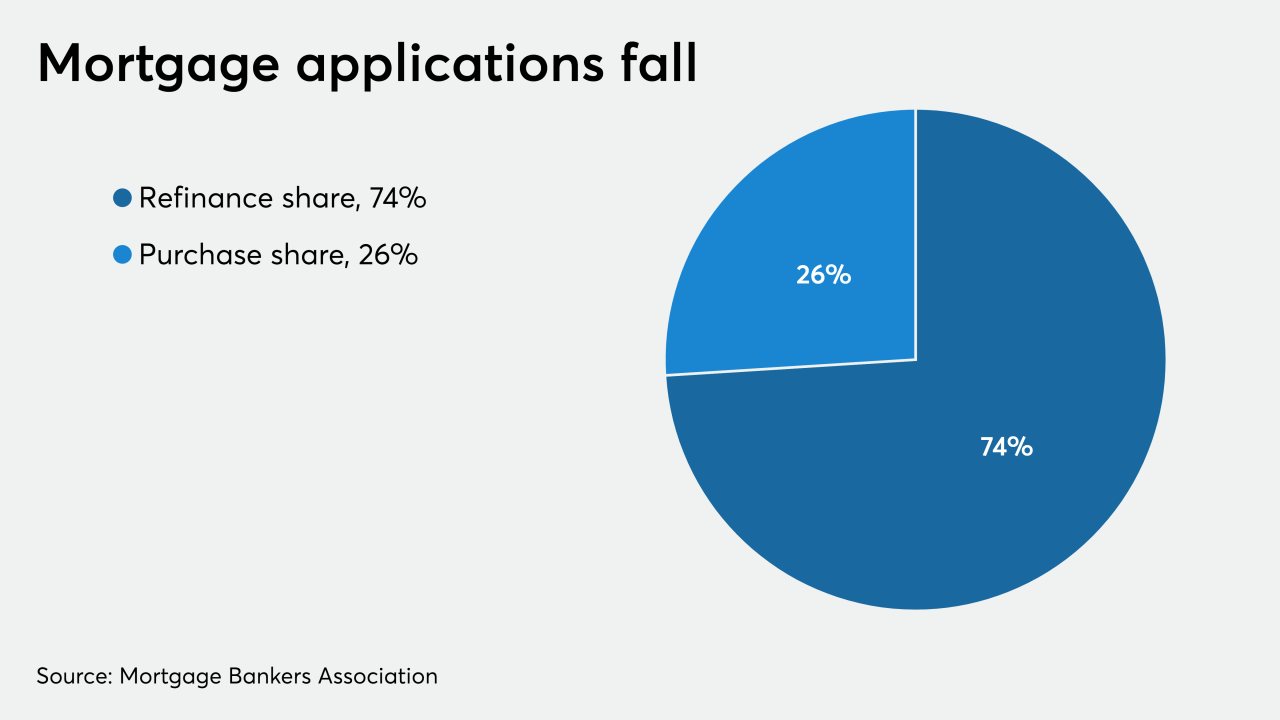

Mortgage applications decreased 17.9% from one week earlier, as coronavirus-related volatility affected consumer sentiment, according to the Mortgage Bankers Association.

April 8 -

A deadly pandemic seemingly did little to slow down Western Washington's real estate markets in March, according to data from the Northwest Multiple Listing Service.

April 8 -

Across metro Atlanta, the coronavirus pandemic has upended the process of buying and selling homes — a $95 billion industry that makes up 16.2% of Georgia's economy.

April 7 -

Consumer confidence for home buying fell to its lowest point since December 2016, according to Fannie Mae.

April 7 -

Attom ranked 483 counties across the country based on 4Q foreclosure notices, local wages and other factors.

April 7 -

Five Democrats on the Senate Banking Committee sent a letter to Director Kathy Kraninger calling the agency's response to COVID-19 “tepid and ineffectual at best.”

April 7 -

The share of borrowers seeking payment relief rose more than tenfold as COVID-19 concerns grew and authorities encouraged the practice, according to the Mortgage Bankers Association.

April 7 -

Almost all California foreclosures and evictions have been put on hold for the foreseeable future.

April 7 -

The CARES Act does not define what a covered period is when it comes to residential mortgage borrower requests for forbearance.

April 7 McCarter & English LLP

McCarter & English LLP -

Bucking the fears of industry experts about how the coronavirus would impact the housing market, median home prices in the Las Vegas Valley set an all-time high in March.

April 7 -

The Cincinnati company will hire about 950 workers to meet heightened demand for loan deferrals and other forms of relief clients are seeking to weather the economic fallout of the coronavirus outbreak.

April 7