-

Record originations helped Mr. Cooper Group generate its first full-quarter profit since its formation through a merger between WMIH and Nationstar last year.

October 31 -

The end of the qualified mortgage patch should further accelerate non-QM origination growth, but is the mortgage industry ready?

October 8 -

Angel Oak is now offering mortgage brokers and correspondent loan sellers a prequalification tool to determine borrower eligibility for non-qualified mortgages.

August 14 -

An $8 billion mortgage servicing rights package consisting of newly originated conforming loans is up for bid, according to broker Incenter Mortgage Advisors.

August 12 -

Steeper rate declines contributed to a deeper quarterly net loss at Ocwen Financial, forcing it to extend its timeline for returning to profitability.

August 6 -

Freedom Mortgage's planned purchase of J.G. Wentworth Home Lending would add 570 employees and 35 offices across 46 licensed states and increase the acquirer's servicing portfolio by $6 billion.

August 2 -

FB Financial is selling its correspondent lending channel to Rushmore Loan Management Services, which will complete the bank holding company's restructuring of its mortgage business.

June 27 -

Roughly 50 of the more than 100 staff members Live Well Financial let go after it stopped funding loans will join Open Mortgage, a multichannel lender in expansion mode.

June 5 -

Plaza Home Mortgage has improved its pricing for certain jumbo loans that Fannie Mae's automated underwriting system approves, but categorizes as ineligible due to loan size.

May 28 -

Freedom Mortgage's acquisition of RoundPoint Mortgage Servicing gives it a major subservicer and will increase the Mount Laurel N.J.-based company's mortgage servicing rights portfolio by nearly 44%.

May 24 -

Movement Mortgage purchased the two branches that comprise Huntsville, Ala.-based Platinum Mortgage's retail business just weeks after the latter company sold its wholesale division.

May 3 -

360 Mortgage is bringing back the no-income, no-asset loan, but says its $1 billion pilot's guidelines differ from those of the NINA loans that contributed to the financial crisis.

April 18 -

Plaza Home Mortgage has expanded the guidelines of its wholesale and correspondent non-qualified mortgage program to allow using bank statements for documenting income.

April 3 -

Impac Mortgage Holdings saw its shift to predominantly originate non-qualified mortgage loans reduce its fourth-quarter GAAP net loss along with increasing its gain-on-sale margins.

March 15 -

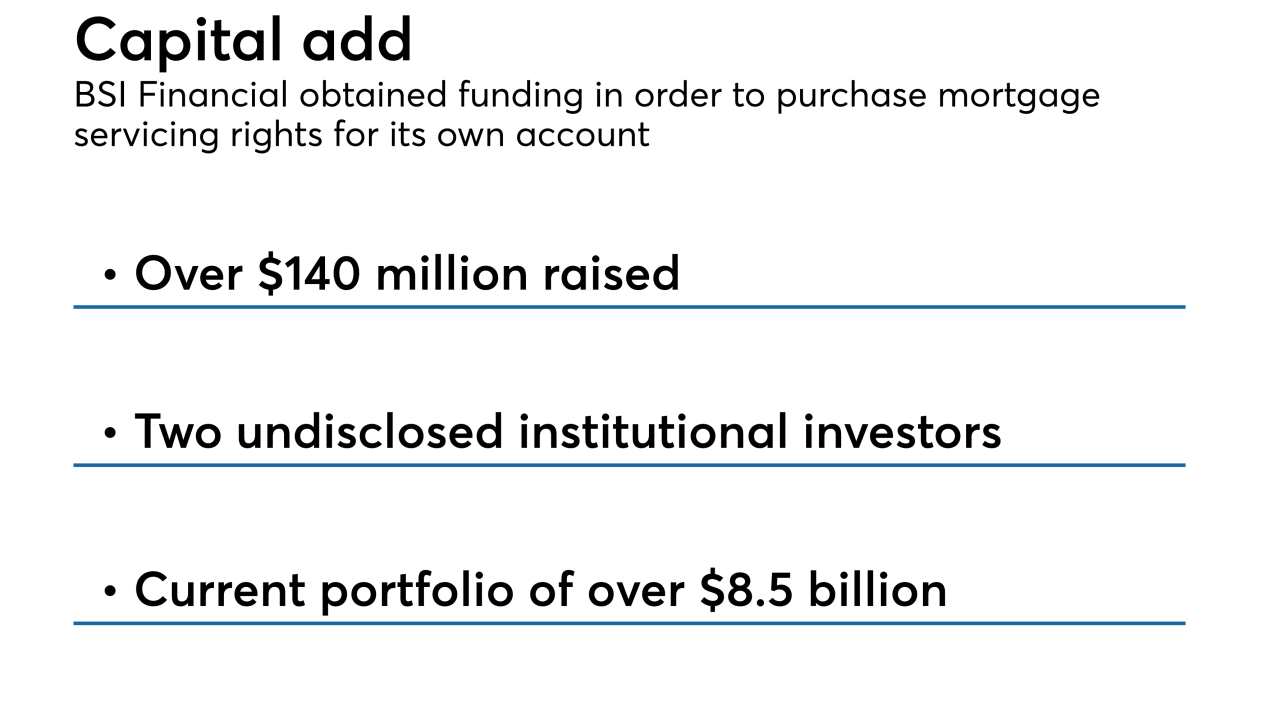

BSI Financial Services received a capital infusion for the subservicer to acquire mortgage servicing rights for its own account in order to offer its clients more liquidity for this asset.

February 22 -

Ellie Mae's latest update to the Encompass loan origination system includes templates to help mortgage lenders with Americans with Disabilities Act compliance.

February 11 -

Wells Fargo and JPMorgan Chase had reduced mortgage-related earnings in the fourth quarter as home loan activity continues to fall short of expectations.

January 15 -

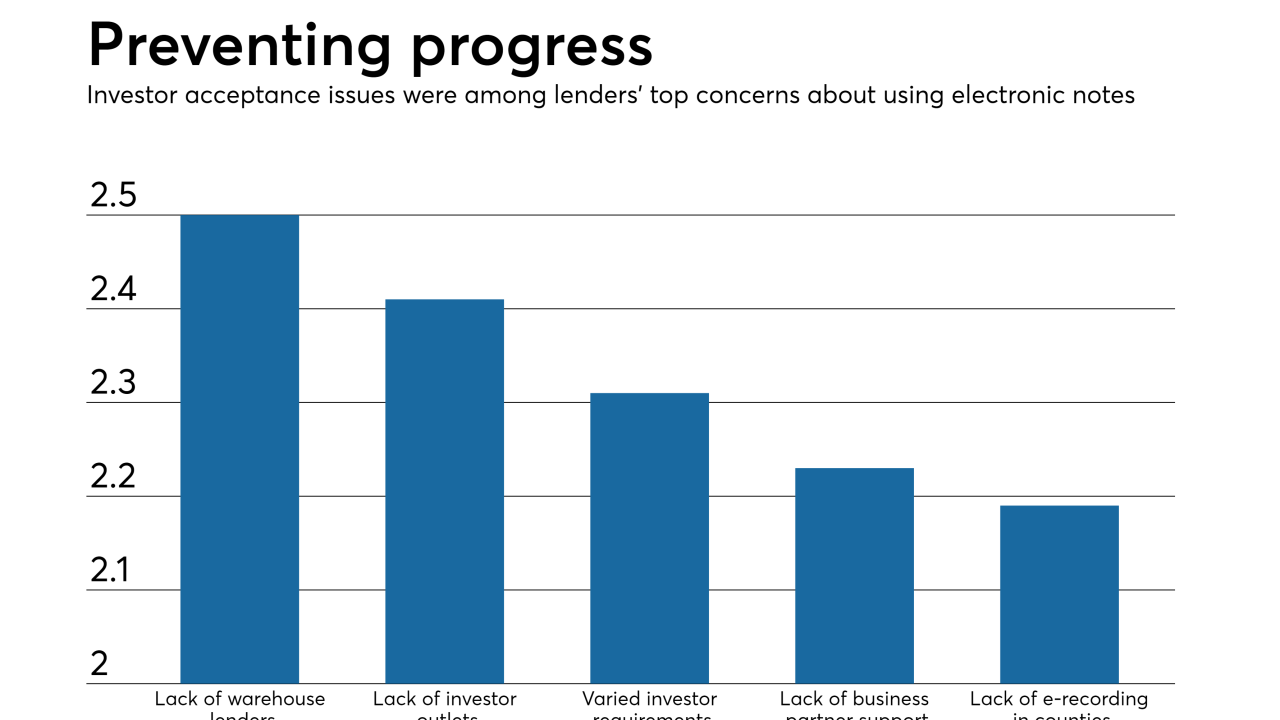

Texas Capital Bank, which already provides warehouse financing for e-mortgages, will now purchase these loans off those lines as it looks to increase liquidity for this product.

December 12 -

Carrington Mortgage Services has created a nondelegated correspondent channel, looking to build on relationships it has with originators that currently broker loans to the company.

November 20 -

QRL Financial Services, the mortgage outsourcing division of First Federal Bank of Florida, is the latest investor to seek out better secondary market execution by purchasing electronic notes from correspondents.

October 29