-

The House of Representatives passed two bills that would tie appraisal waivers for Small Business Administration loans to bank rules for commercial real estate loans, despite objections from the Appraisal Institute about its members being cut out of transactions.

September 26 -

Lower corporate tax rates weakened the incentive for developers to use the Low-Income Housing Tax Credit program, which could prompt affordable housing construction to fall by as much as 40% by 2022, according to data aggregator Reis.

September 25 -

A Jacksonville, Ill., church facing foreclosure has a new lease on life after months of fundraising.

September 20 -

Commercial mortgage-backed securities delinquency rates are likely to continue to decrease for the rest of the year, as new issuances outpace maturing loans and precrisis loans continued to get resolved by special servicers, Fitch Ratings said.

September 17 -

Delinquencies for loans securing commercial mortgage-backed securities continued to decline, although they are still well above rates for other types of investors, according to the Mortgage Bankers Association.

September 4 -

A 75-year-old Florida real estate developer was sentenced to six months in prison after admitting he lied to banks to keep money flowing so he wasn't forced to scuttle an oceanfront hotel and condominium in Vero Beach.

August 29 -

Mortgages originated to finance apartments and other income-producing properties managed to generate an overall year-to-year increase in the first half, even though there are declines in some parts of the market.

August 21 -

Wells Fargo is considering a sale of commercial real estate broker Eastdil Secured, according to a person briefed on the matter.

July 26 -

Unusually for a debut transaction, the $329.7 million M360 2018-CRE1 will be actively managed: For the first 12 months after the closing date, funds from repaid principal can be used to purchase new loans, subject to eligibility criteria.

July 17 -

The $109.3 million CLEAN 2018-1 is also the first deal to be marketed as a Rule 144A transaction under securities regulation making it available to wide base of institutional investors.

July 10 -

Banks could shed as much as 20 million square feet of office space over the next five years as they shift many functions to high-tech operations centers in markets with cheaper rents.

July 6 -

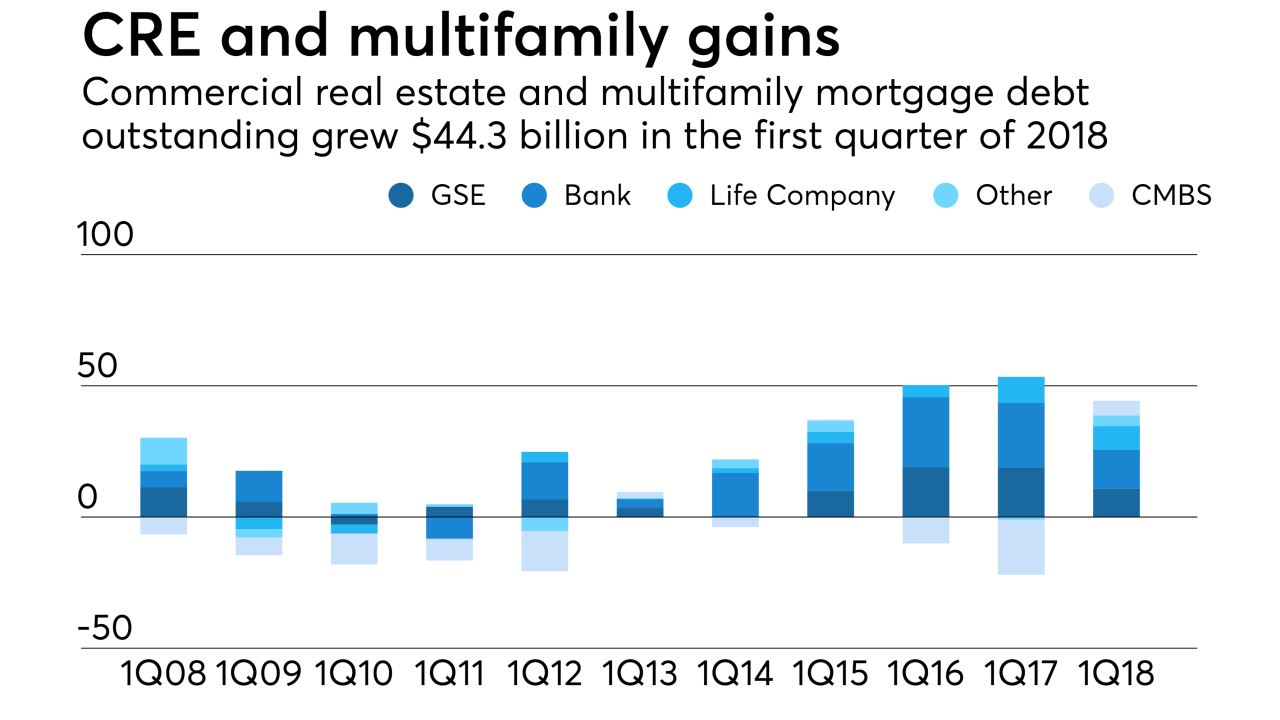

Commercial and multifamily mortgage debt outstanding grew $44.3 billion during the first three months of 2018, the largest first-quarter gain since before the Great Recession, according to the Mortgage Bankers Association.

July 2 -

Commercial real estate is their bread and butter, but many banks are scaling back in this vital loan category. Here’s why.

June 29 -

Angel Oak Commercial Lending has acquired a controlling interest in lender Cherrywood Mortgage in order to strengthen its focus on small-balance commercial lending.

June 5 -

Commercial mortgage bonds are getting stuffed with the lowest-quality loans since the financial crisis by one measure, according to Moody's Investors Service.

June 1 -

As President Trump signed the regulatory relief bill into law on Thursday, most of the attention was on a provision to help regional banks with more than $50 billion of assets. But a majority of the new law is aimed at helping institutions below $10 billion. Here's how.

May 24 -

Commercial and multifamily loan originations may not be up by much from a year ago, but borrowing and lending behaviors were drastically different in the first quarter.

May 17 -

Blackstone Group is doubling down on industrial real estate by buying Gramercy Property Trust, the second multibillion-dollar takeover of a warehouse company in as many weeks with the growth in e-commerce raising demand.

May 7 -

Leader Bank says it can land property managers as commercial clients by helping them handle tenant deposits — and possibly create opportunities to boost CRE lending.

May 3 -

The increase in the delinquency rate for securitized CRE loans for March ended an eight-month streak of declines.

April 3