-

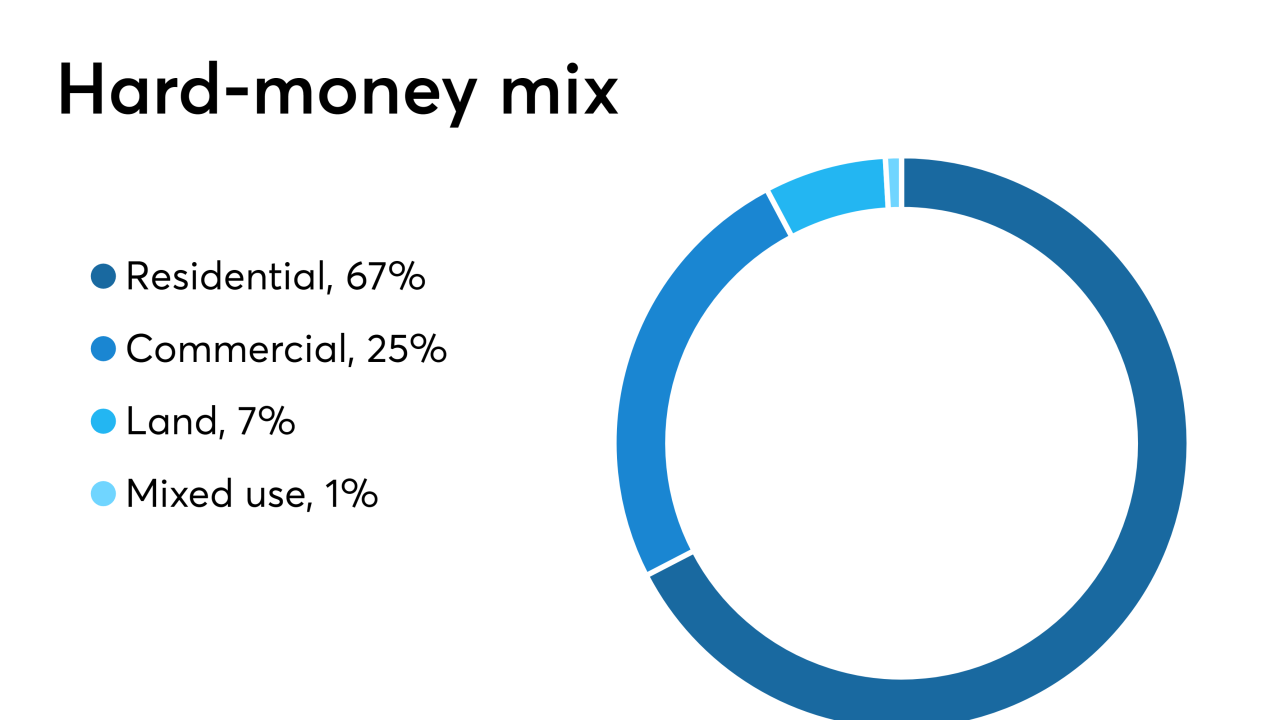

Sachem Capital Corp., a hard-money mortgage lender that makes short-term loans to investors, has raised $10 million in gross proceeds from a public offering of 2 million common shares.

July 29 -

The National Credit Union Administration caught flak after it approved raising the threshold for appraisals on commercial real estate loans to $1 million.

July 18 -

A developer behind projects in the Maine cities of Portland and Saco was sued by a business partner as properties there are scheduled to be sold at foreclosure auctions.

July 8 -

The value of construction projects started in the greater Houston area fell sharply across both the residential and nonresidential sectors in May, according to a new Dodge Data & Analytics report.

July 5 -

On sunny days, the Grand Venezia at Baywatch condominiums in Clearwater, Fla., offer a view of Old Tampa Bay that calms the mind.

June 28 -

EF Hutton admitted in a court filing that it has defaulted under the terms of its contract with a real estate company and that the company has rightfully accelerated the debt.

June 27 -

First National Bank of Pennsylvania has filed a commercial mortgage foreclosure action against Conneaut Lake Park Volunteer Fire Department to collect more than $400,000 in outstanding loan debt, interest and penalties.

June 25 -

Presidential candidate Sen. Elizabeth Warren, D-Mass., and another Democratic senator are asking whether Kushner Cos. "may have received special treatment" on a U.S.-government-backed loan of about $800 million.

June 13 -

Commercial and multifamily mortgage debt outstanding continued rising, aided by low mortgage rates and the steady incline of property values, according to the Mortgage Bankers Association.

June 12 -

The large number of overleveraged commercial mortgage-backed securities loans coming due in 2019 is likely to cause the payoff rate to drop an additional 9 percentage points by December, a Morningstar report said.

May 29 -

Kushner Cos., the real estate firm owned by the family of President Donald Trump's son-in-law Jared Kushner, has received about $800 million in federally backed debt to buy apartments in Maryland and Virginia.

May 24 -

BB&T's acquisition of SunTrust may make the combined company more of a contender in regional metro-area commercial mortgage lending, according to data provider CrediFi.

May 17 -

Payoffs of maturing office loans in securitizations may be delayed more often in the next few years if increasing inventory constrains occupancy and rent growth, according to Morningstar.

May 8 -

A drop in property sales in San Francisco suggests a housing slowdown despite a booming economy, according to city Assessor-Recorder Carmen Chu.

April 29 -

Property valuation notices are going out, and most homeowners in metro Denver should see tamer increases than the big shocking ones that hit them this time in 2017, according to county assessors.

April 26 -

The trio of malls collateralizing the new mortgage include two well-performing mall as well as a troubled Florida super-regional shopping center.

April 23 -

Destiny USA, one of the largest malls in the nation, is struggling to pay its mortgage, according to a published report.

April 17 -

Sheldon Oak Central, a Connecticut affordable housing developer, is at risk of losing half a million dollars in federal subsidies if it can't come up with cash to rehab one of its aging properties.

April 15 -

A strong real estate market is helping drive up residential property values across Scott County, Iowa, as many homeowners are seeing in assessment notices from the assessor's office.

April 12 -

Multifamily and commercial lenders had another banner year in 2018, when closed-loan originations rose 8% to a high of $574 billion.

April 11