-

By replicating human tasks, robotic process automation technology is driving scale and efficiency in loan manufacturing.

April 11 -

Embrace Home Loans created a digital marketing division as more potential customers are researching their lending options online.

April 10 -

Large banks will gain the advantage in offering online mortgages because of their greater financial resources, pricing capabilities and cross-selling ability, Fitch Ratings said.

April 6 -

loanDepot has invested $80 million in a three-part digital lending platform called mello and is opening a 65,000-square-foot technology campus in Irvine, Calif.

March 31 -

Lenders can track the effectiveness of product pricing changes on a real-time basis using a new market share analytics tool from Optimal Blue.

March 30 -

Fintech could cut the closing times on the simplest home loans by more than 50%, but the mortgage business' complexity means there are limits to how much time and money can be saved.

March 28 -

Fannie Mae has selected electronic document management vendor eOriginal to host the government-sponsored enterprise's new electronic vault.

March 6 -

The reduction in refinance activity as the mortgage industry pivots toward purchase transactions amid higher interest rates has caused loan defect and fraud risk to rise, according to First American Financial Corp.

February 24 -

CoreLogic has released a new platform that provides information on lien and equity positions for whole loan traders and servicers.

February 24 -

The monthly prepayment rate declined in January, an indication of the effects of higher interest rates.

February 23 -

Nationstar Mortgage Holdings reported significantly higher net income for the fourth quarter, due to improved revenue in its servicing segment.

February 22 -

International Document Services has updated its idsDoc technology to support upcoming changes to Home Mortgage Disclosure Act reporting.

February 17 -

Black Knight Financial Services has launched a new tool that identifies potential liabilities to reduce title insurers' claims.

February 15 -

Ellie Mae has launched a new version of its Encompass mortgage management product, which features expanded support for construction loans and streamlined integrations with Fannie Mae and Freddie Mac.

February 6 -

Fannie Mae and Freddie Mac have released the final specification update regarding the Uniform Closing Dataset, the digital file format for the TRID Closing Disclosure form.

February 1 -

The Federal Emergency Management Agency has tapped Torrent Technologies as a direct service provider for the National Flood Insurance Program.

January 30 -

CoreLogic has released a new mobile application that provides access to property data and analytics.

January 24 -

The Mortgage Industry Standards Maintenance Organization has extended the comment period on its proposed standard regarding the maintenance and sharing of commercial and multifamily rent-roll information.

January 24 -

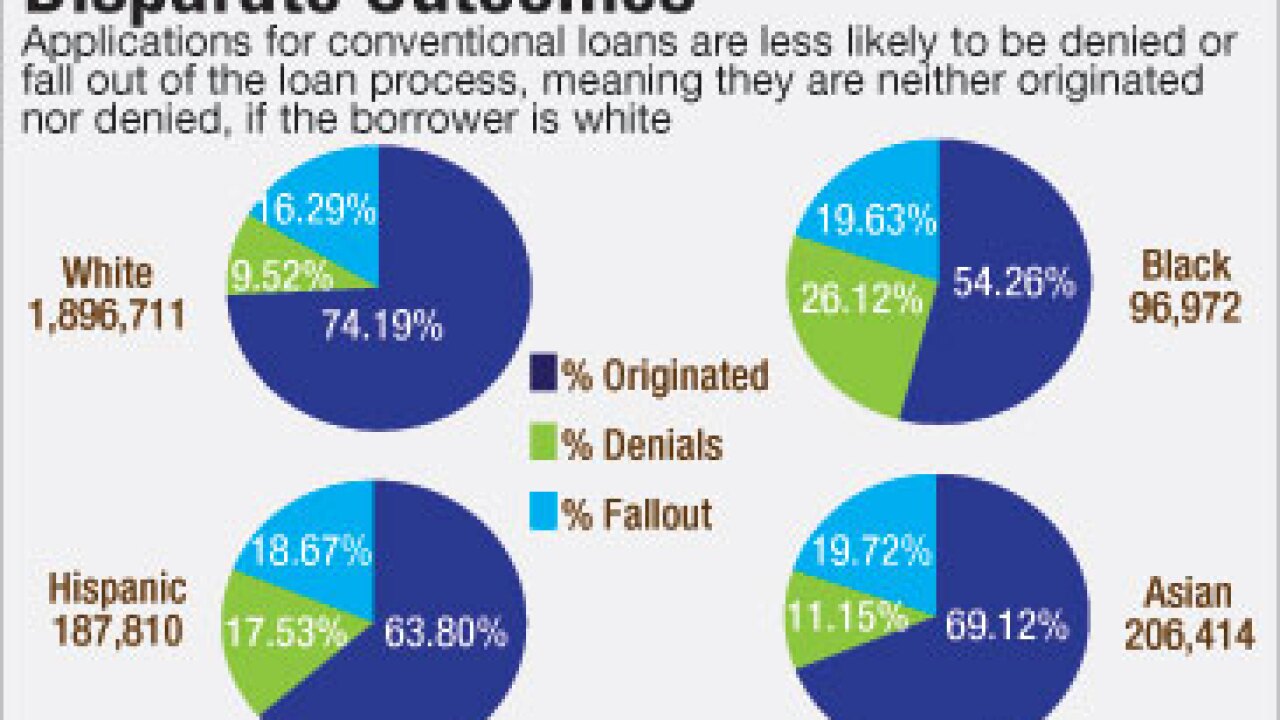

Initiatives aimed at a more inclusive credit box have long relied on costly approaches that are difficult to scale. Now, demographic shifts are intensifying industry demand for a more automated and efficient solution.

January 6 -

Demographics are shifting, creating more prospective minority homebuyers than ever before. But predominant underwriting processes and these would-be borrowers' financial backgrounds are holding them back.

January 5