-

Default rates for prime jumbo mortgages will increase, but a strong economy and rising home prices will bail most borrowers and lenders out, Moody's said.

February 3 -

Non-QM lending is expected to grow again in 2020, but it has some obstacles to navigate. Altisource CRO John Vella shares his insight into the sector and other hot topics.

January 23 -

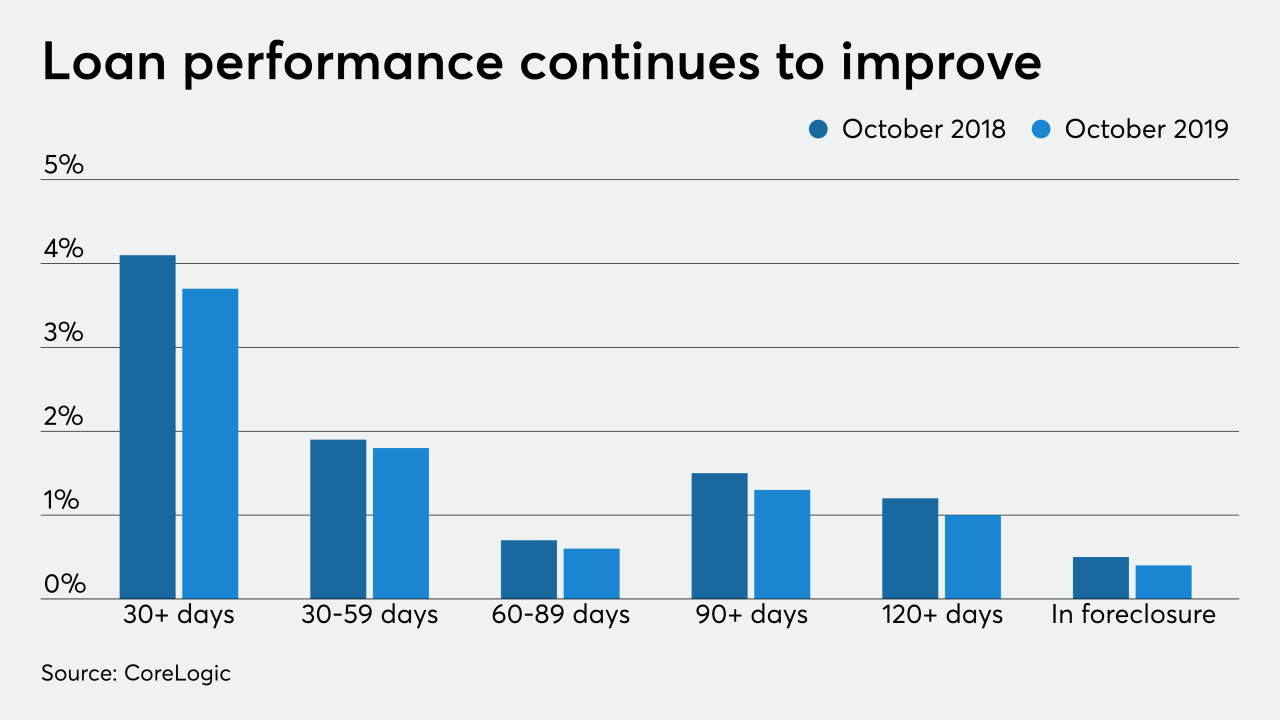

The nationwide mortgage delinquency rate had its best October in at least two decades, while the foreclosure rate remained at a 20-year for the twelfth straight month, according to CoreLogic.

January 14 -

The percentage of home loans with late payments is unlikely to fall much further in 2020 when mortgages made to lower credit-score borrowers could rise slightly, according to TransUnion.

December 12 -

Most commercial and multifamily loan delinquency rates remained near record lows in the third quarter extending a long run of declines in the securitized market, according to the Mortgage Bankers Association.

December 6 -

The third-quarter delinquency rate fell to its lowest point since 1995, according to the MBA. However, Attom Data Solutions' numbers show foreclosure filings experienced a near-term growth spurt in October.

November 14 -

Overall home-loan delinquencies remain near 20-year lows, but in Iowa, Minnesota, Nebraska, Rhode Island and Wisconsin, they are inching up in moves that may be tied to local economic concerns.

November 12 -

There are many ways to mark the economic progress since the Great Recession: over 100 months of job gains, record low unemployment and a long bull run on Wall Street.

October 29 -

The commercial mortgage-backed securities sector will weather the fourth quarter's slowing but steady growth in the U.S. economy, as better loan performance counters a continued decline in volume, Morningstar said.

October 2 -

Commercial and multifamily mortgage delinquency rates should stay at historically low levels in the near future even as economic uncertainty over trade affects U.S. businesses, according to the Mortgage Bankers Association.

September 24 -

Foreclosure starts dropped to their lowest level in 18 years, and properties foreclosed on but not yet sold fell to a 14-year low in August, according to Black Knight.

September 23 -

The percentage of Tampa Bay homeowners late on their mortgage payments continues to fall.

September 23 -

Removing Federal Housing Administration-insured mortgages with natural-disaster forbearance from the agency's delinquency tracking database would give investors a less-distorted view of loan performance, according to the Community Home Lenders Association.

July 29 -

Economic strength bolstered the performance of loans included in commercial mortgage-backed securities with delinquencies improving for the seventh consecutive quarter, according to the Mortgage Bankers Association.

June 10 -

An institution that services housing finance authority loans is putting $2.65 billion in servicing rights from Washington state up for bid through the Mortgage Industry Advisory Corp.

May 16 -

Freddie Mac's latest nonperforming mortgage auction will include one pool targeted to smaller investors like nonprofit organizations.

April 12 -

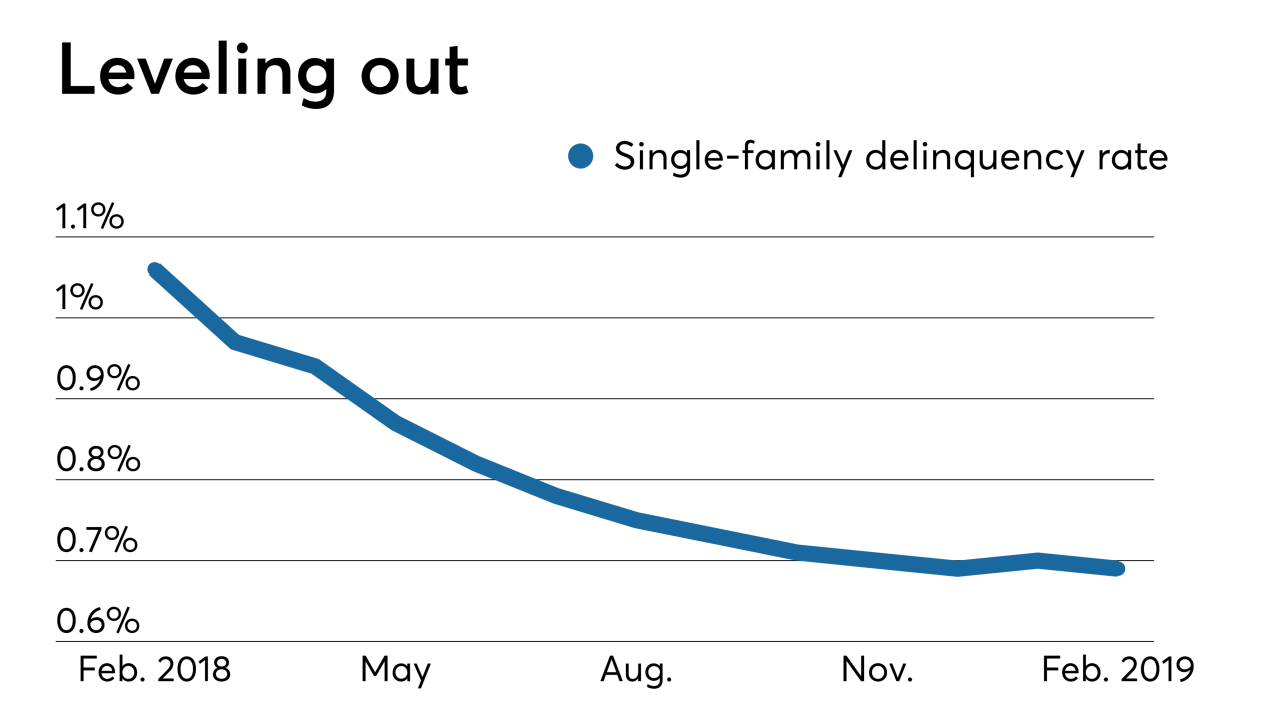

Late payments on single-family home mortgages changed direction and started falling again in Freddie Mac's latest monthly report.

March 26 -

Servicers that fail to give borrowers access to digital collection methods are missing out on a chance to improve delinquency rates and lower costs.

March 19 Visa Inc.

Visa Inc. -

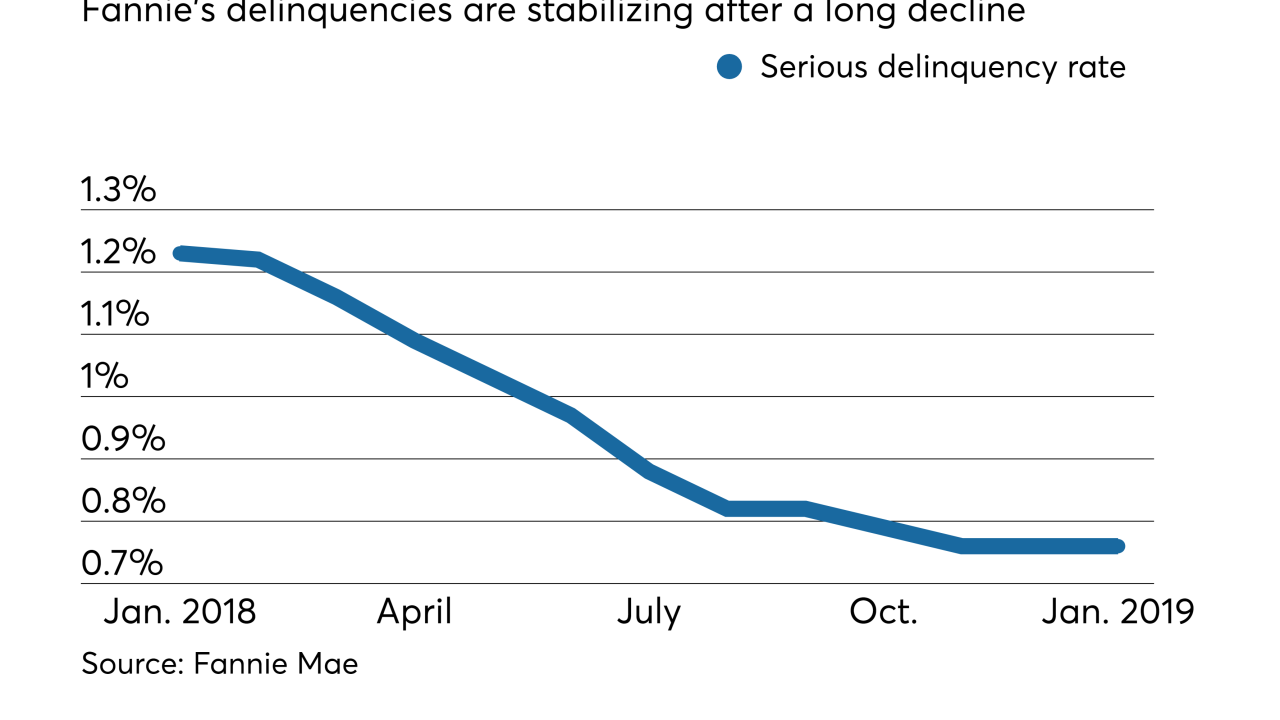

Fannie Mae's serious delinquency rate stood firm for the third month running, adding to evidence that it has hit a floor after dropping for most of the past year.

March 1 -

Recent data from the Federal Reserve suggests lenders are growing pessimistic about the credit environment. But is that a sign of trouble ahead, or just sound risk management?

February 18