-

The top executives at Bank of America, Citigroup and Wells Fargo all received less compensation during a year shaped by the pandemic, while several regional bank CEOs got large pay hikes.

May 19 -

There’s a 20 percentage-point gap between Black and white consumers who have the income necessary to qualify for a mortgage on a new median-priced home.

April 13 -

As more borrowers between 21 and 40 leveraged the historically low mortgage rates in January, the average age rose to a report high, according to ICE Mortgage Technology.

March 10 -

If you are underbanked you probably have limited access to mainstream financial services normally offered by retail banks. Many fintech startups offer alternative ways to measure credit risk, and assert that their products can help extend financial services to consumers who have not been well-served by traditional banks.

-

The multifamily lender named Michael Levine as board chairman, succeeding Dominick Ciampa, who held the role for 10 years. The move comes less than a week after longtime CEO Joseph Ficalora abruptly retired and was replaced by Thomas Cangemi.

January 6 -

Challenger banks aimed at Blacks, Hispanics, immigrants and other underserved groups are offering financial education and support for charities in addition to basic banking services.

December 31 -

Two reports reveal how borrowers prefer to engage with lenders, with younger customers preferring an efficient digital experience and most seeking some form of human interaction.

December 21 -

The head of the Federal Housing Administration said Congress should consider whether to continue allowing the loan floor and ceiling to remain tied to changes in the conforming mortgage limit.

December 2 -

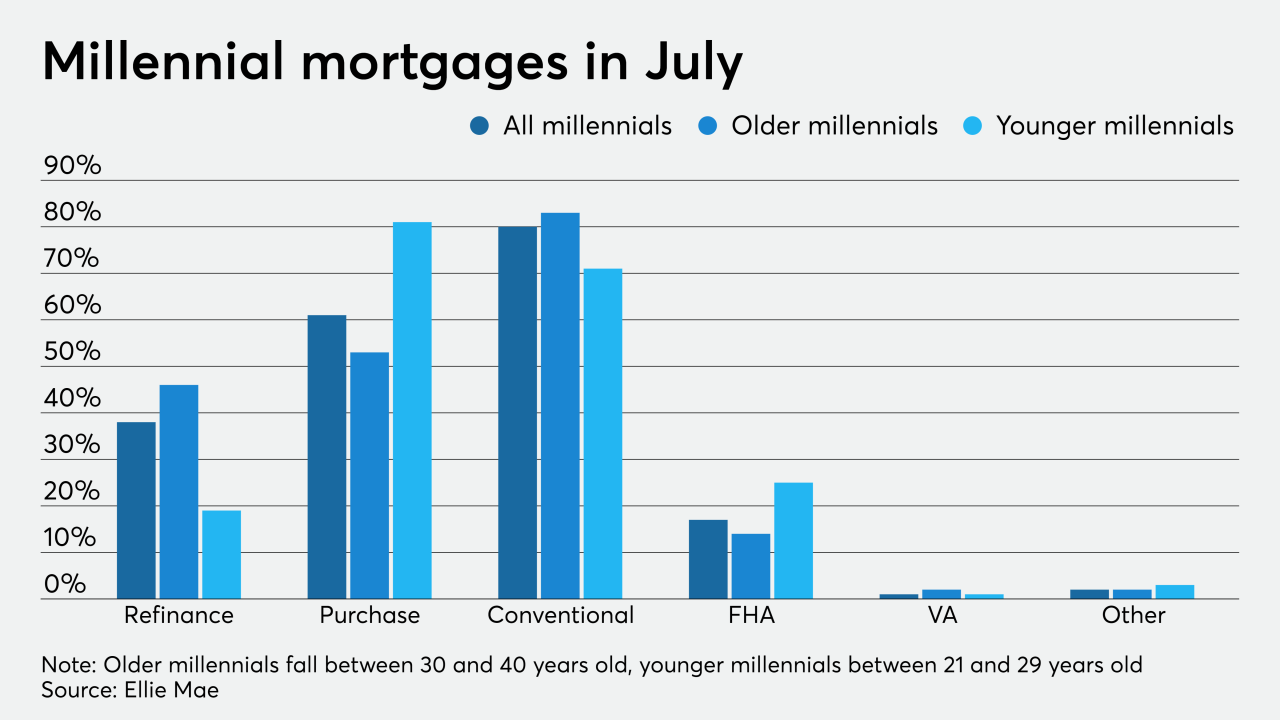

More borrowers between 21 and 40 are leveraging the historically low mortgage rates to either buy their first homes or slash their monthly payments, according to Ellie Mae.

November 4 -

The digital bank is on a larger mission to attract younger customers. It's inserting itself into the popular video game in the hope that game players will learn about its products and have fun at the same time.

October 30 -

Black borrowers locked in an average mortgage rate of 4.44% for conventional loans — 15 basis points higher than white borrowers, according to an analysis of HMDA data by the National Association of Real Estate Brokers.

October 28 -

But an expected drop in refinancings as mortgage rates rise should more than cancel that out, resulting in declining overall volume through 2023.

October 21 -

Millennials continue to lock in the lowest average mortgage rates on record, keeping lenders busy and the housing market churning, according to Ellie Mae.

October 7 -

Diversity initiatives for home appraisers would cut down the racism and bias within the valuation process.

October 7 -

Whether low rates will continue to outweigh health and employment concerns for millennials and Generation Z remains to be seen.

October 2 -

From an increased interest in outdoor space to a need for a dedicated home office, the pandemic has created new drivers for refinancing, moving and other housing decisions, TD Bank found.

September 11 -

More than half of listings underwent bidding wars in August with some housing markets peaking above 65%, according to Redfin.

September 4 -

Millennials locked in the lowest mortgage rates on record and kept the summer housing market hot, according to Ellie Mae.

September 2 -

Driven by robust purchase demand and tight housing supply, housing price growth reached a two-year high in July, according to CoreLogic.

September 1 -

Treasurer Ma has championed programs to give minority and women-owned businesses a seat at the table throughout her career. A mission of the Treasurer is increasing diversity to increase equitable outcomes.

August 20