Digital banking

Digital banking

-

Customers' needs and expectations changed drastically in 2020, overturning conventional thinking about their experience in the process. How can we strike the right balance between embracing digital channels and recognizing the value of human touch?

October 15 -

The company's software can now be used to handle personal loans, credit cards and specialty-vehicle loans.

September 24 -

A historic charter award defines a new beginning for digital banking, Varo Money becomes the first consumer fintech in US history to gain full regulatory approval to become a national bank

-

An internally built system called Advanced Listening analyzes phone calls, emails, text messages and more, identifying possible compliance violations, systemic issues and opportunities to improve processes, products and customer service.

August 20 -

Built to respond to borrowers' questions about mortgage deferrals, the bot created by Salesforce is evolving and in the future could conduct transactions, handle a wide range of queries or help with emergencies.

August 12 -

KeyBank, Regions and others are using self-service portals, robotic processing automation and virtual assistants to digitize the collections process and make it more humane in anticipation of rising delinquencies.

August 4 -

Great leaders emerge from failure in the world of financial services and fintech is no exception. Moven founder Brett King shares his take on persistence and how it's worked for him.

-

The Minneapolis company said 75% transactions have been handled online since the pandemic hit.

July 15 -

Nationwide lockdowns forced banks to close brick and mortar outlets and rely heavily on drive up windows, mobile and online access. BBVA has proven that even in the middle of crisis and chaos, retail still fits into the banks overall strategy.

-

Digital banks outscored brick-and-mortar banks in a recent J.D. Power study of customer satisfaction. However, the survey pointed to shortcomings in call center services, which are in high demand during the COVID-19 pandemic.

April 2 -

David Becker, who founded First Internet Bank two decades ago, says traditional banks' digital-only ventures are only making his bank look more mainstream.

November 26 -

Prosper hopes to do for lines of credit what it did for unsecured personal loans, while BBVA hopes to provide a better experience for customers.

November 4 -

Startups are increasingly expanding into new areas with their bank partners in an effort to broaden their customer base and bring products to market faster.

October 29 -

The court passed up a recent opportunity to clarify confusion about Americans with Disabilities Act requirements for business websites, raising concerns among bankers that they could become an even more inviting litigation target.

October 9 -

Credible Labs, which lets consumers shop for the best rates on student loans, mortgages and other credits, would be part of an evolving digital strategy at Fox after the multibillion-dollar sale of many of its traditional media assets to Disney.

August 5 -

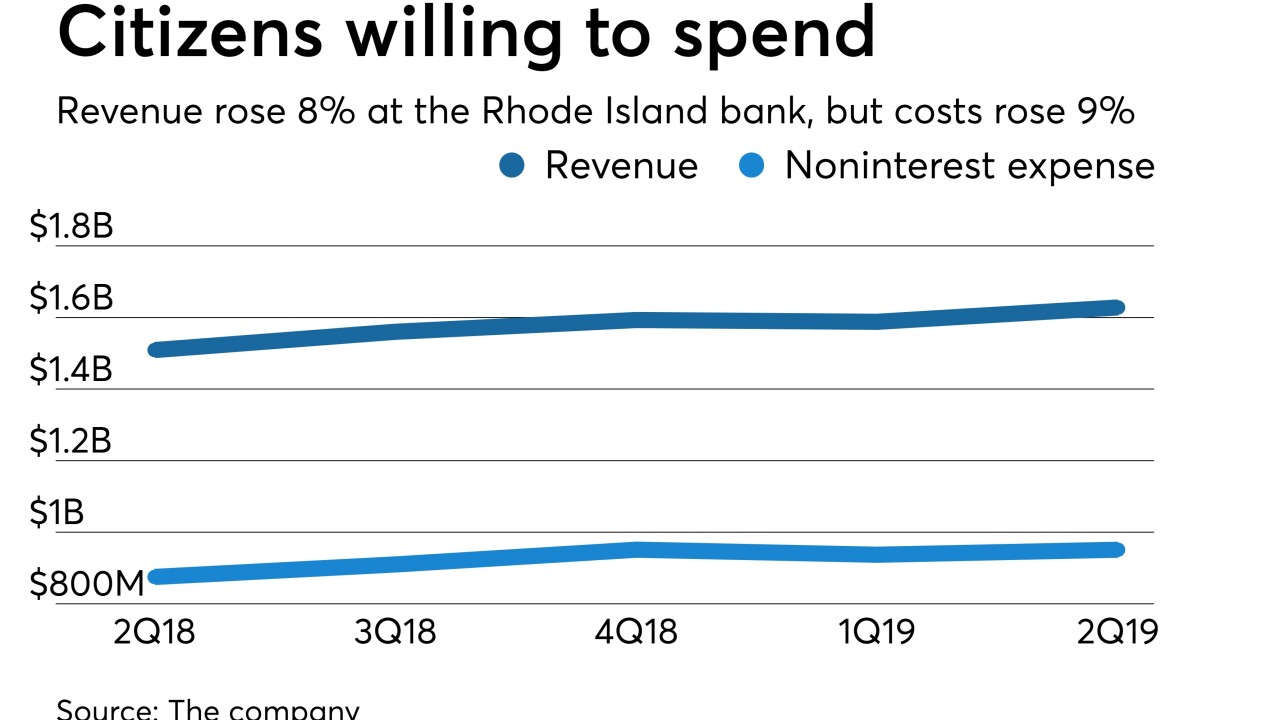

Weighing in on interest rate and other uncertainties facing all banks, Citizens Financial CEO Bruce Van Saun emphasized investments in point of sale, digital banking and other initiatives meant to enhance revenue down the road.

July 21 -

Bank of America says rate cuts could reinvigorate mortgages and that its digital and cards strategies will help it grab more market share to offset shrinking margins.

July 17 -

After years of largely standing on the sidelines, lawmakers are taking a closer look at whether algorithms used by banks and fintechs to make lending decisions could make discrimination worse instead of better.

June 26 -

Nearly half the nation's state regulators have agreed to a new multistate licensing business for money servicers, including fintechs.

June 24 -

House Financial Services Committee Chairwoman Maxine Waters and Rep. Patrick McHenry, the top GOP panel member, said Facebook must testify about Project Libra.

June 18