-

Those handling loan modifications anticipate a growing secondary market for loans in forbearance as they budget cautiously for additional alterations of regulations down the road.

July 14 -

Most troubled homeowners can avoid a long foreclosure process by selling and exiting with clean credit or even a profit, but a little under 2% may not have enough value in their property.

July 13 -

The sharp decline suggests borrowers are recovering enough from pandemic-related hardships to leave forbearance plans even before a key expiration date arrives this fall.

July 9 -

Identifying where payment stress is concentrated could help mortgage servicers and federal policymakers prepare for the broader range of loan workouts that will resume this summer.

July 8 -

It will be several years before business and group travel return to normal levels, according to an estimate from the American Hotel & Lodging Association.

July 7 -

Rebounding employment brought total forborne mortgages under 2 million, according to the Mortgage Bankers Association.

July 6 -

The lack of a stabilizing force in the commercial real estate mortgage business is creating one of the most significant threats the lending industry faces, writes the CEO of Cirrus.

July 5 Cirrus

Cirrus -

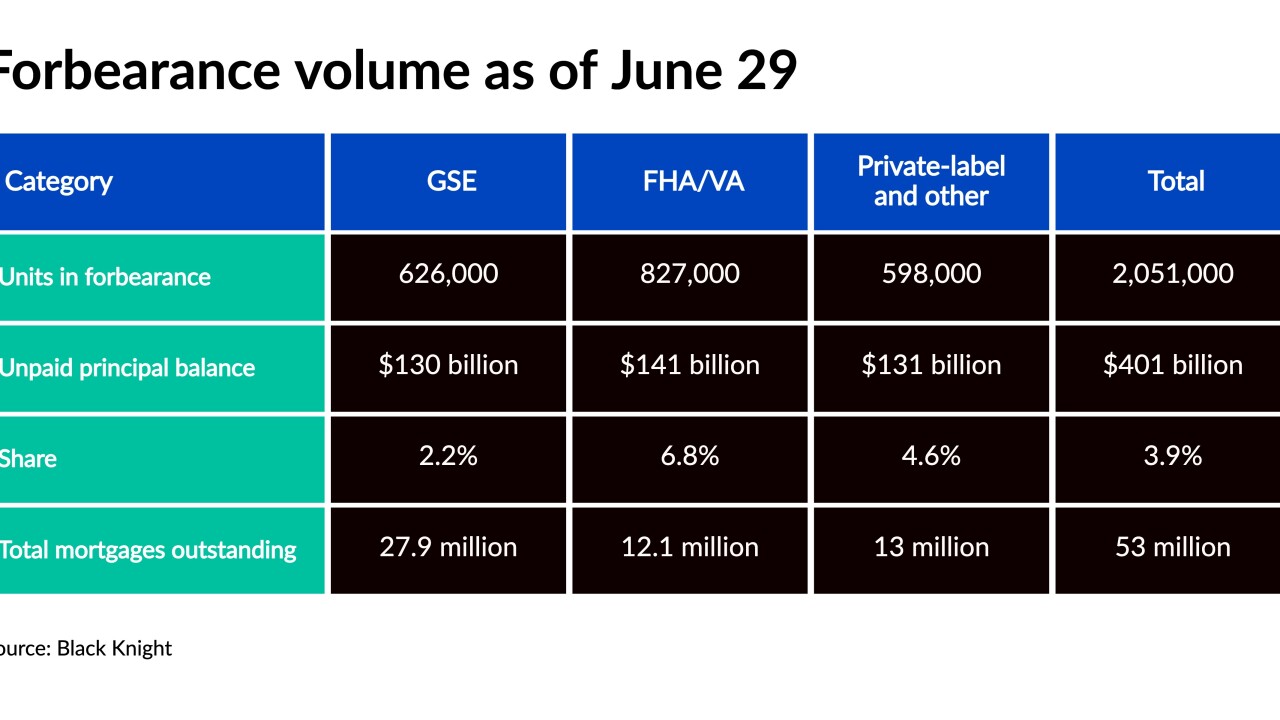

The number of GSE-backed and government sponsored loans in forbearance declined, while portfolio and private-label loans increased.

July 2 -

Private mortgage insurers can continue to hold less capital for forborne delinquent loans, which helps them potentially upstream payments to parent companies in the third and fourth quarters.

July 1 -

The change makes it easier for borrowers exiting forbearance to get access to home retention options that might otherwise be out of reach due to skyrocketing home prices.

June 30