-

The number of loans going into coronavirus-related forbearance dropped for the third consecutive week, as the growth rate fell 8 basis points between June 22 and June 28, according to the Mortgage Bankers Association.

July 7 -

The court struck down a 2015 update to the Telephone Consumer Protection Act, which permitted robocalls to cellphones for government-related debt collection.

July 6 -

While the multifamily loan forbearance rate is lower than the most pessimistic projections, Pat Jackson says borrowers are hardly out of the woods yet.

July 6 -

The nonprofit, formed with the encouragement of government agencies to address borrower hardships in 2007, uses a model that has been challenged by the current crisis.

July 1 -

The number of loans going into coronavirus-related forbearance edged down slightly, with the growth rate dipping 1 basis point between June 15 and June 21, according to the Mortgage Bankers Association.

June 29 -

The company formally reported a nearly $65 million loss in the first quarter as the coronavirus affected its operations in March.

June 26 -

Compared with the week prior, approximately 83,000 more loans from all investor types became forborne.

June 26 -

The government-sponsored enterprises had been considering tightening counterparty requirements for nonbanks, but in light of COVID-19's spread, they've reconsidered that.

June 25 -

The mortgage company will provide up to $17 million in forgiveness to settle charges that modifications it applied to distressed government-related loans were not in keeping with state servicing regulations.

June 24 -

The number of loans going into coronavirus-related forbearance dropped, with the growth rate falling 7 basis points between June 8 and June 14, according to the Mortgage Bankers Association.

June 22 -

Compared with the week prior, approximately 57,000 fewer loans from all investor types were forborne.

June 19 -

Blackhawk Community Credit Union sold the buildings it acquired in lieu of foreclosure to Rock Renaissance Partnership for $165,000.

June 19 -

Starwood Capital Group missed two monthly payments on securitized debt tied to five shopping malls anchored by bankrupt department stores including Sears and J.C. Penney.

June 18 -

The number of loans going into coronavirus-related forbearance ground down to a growth rate of 2 basis points between June 1 and June 7, according to the Mortgage Bankers Association.

June 15 -

A Clever Real Estate survey found a significant share of new borrowers are not making their full payment.

June 15 -

As brick-and-mortar shopping centers steadily lost market share to online competitors, the family behind three of the four biggest malls in North America built a thriving business by infusing their properties with heavy doses of entertainment.

June 9 -

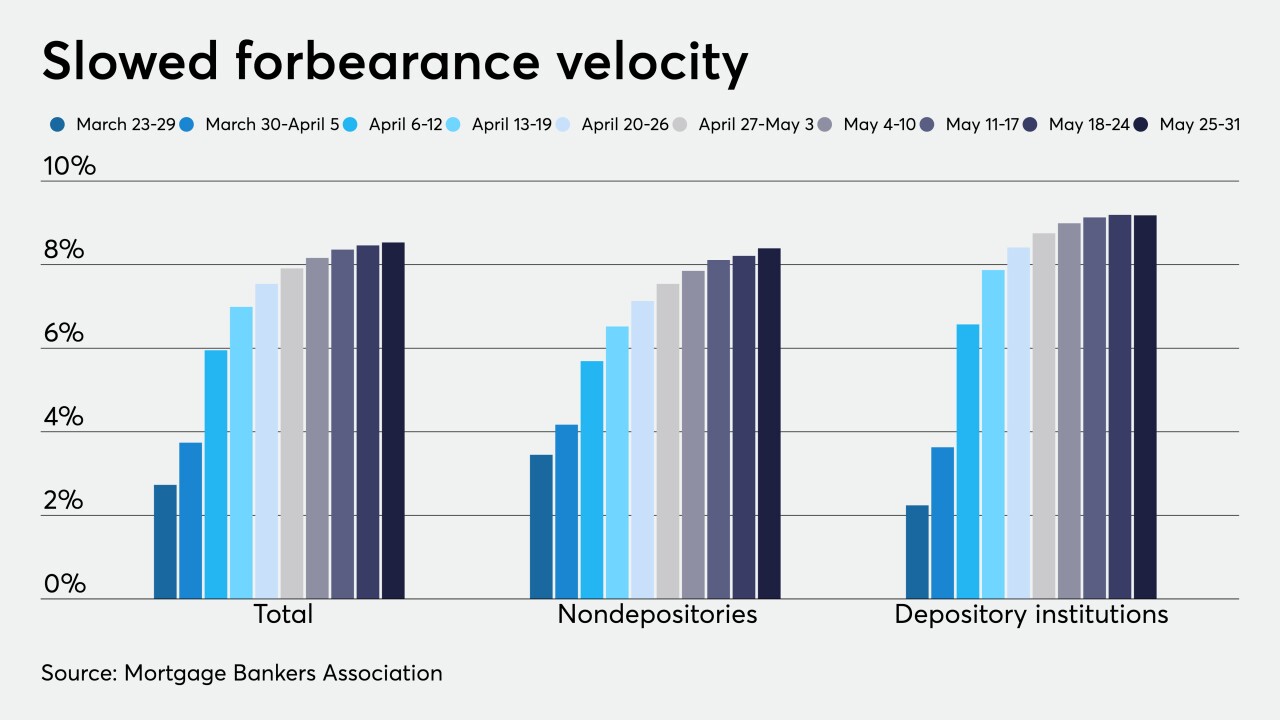

The number of loans going into coronavirus-related forbearance slowed to a rate of 7 basis points between May 25 and May 31, according to the Mortgage Bankers Association.

June 8 -

About 9% of government-insured loans in forbearance have low equity, which could hamper post-forbearance servicing.

June 8 -

But there was an increase in private-label mortgages in forbearance.

June 5 -

The company's pricing of its secondary stock option partially alleviated worries about the need to obtain new funds and the risk of dilution for existing shareholders.

June 1