-

Even though mortgage delinquencies increased on a quarter-to-quarter basis, strong overall metrics mitigate any concerns regarding future loan performance, according to the Mortgage Bankers Association.

May 14 -

As home price appreciation levels off, the amount of underwater loans rose in the first quarter while equity-rich properties continued adding value, according to Attom Data Solutions.

May 9 -

Private-label mortgage securitizations with variable servicing fee arrangements could become more common going forward as issuers look to increase investor cash flow while reducing the loan servicer's economic exposure, Fitch said.

May 6 -

With nearly $90 million added in the past two months, Goldman Sachs marched closer to its $1.8 billion consumer-relief mortgage settlement with the U.S. Department of Justice.

May 2 -

Mortgage prepayments came gushing in at the start of the spring home buying season as delinquencies also improved, according to Black Knight.

April 23 -

As the dangers of global warming lead to heightened natural disasters, those disasters result, at least temporarily, in a higher amount of mortgage defaults. From Texas to the nation's capital, these are the 12 most hazard-prone housing markets, according to Redfin.

April 15 -

Freddie Mac's latest nonperforming mortgage auction will include one pool targeted to smaller investors like nonprofit organizations.

April 12 -

Caliber Home Loans settled a grievance with the Massachusetts attorney general over allegations of providing distressed borrowers with unaffordable loan modifications.

April 11 -

The number of properties with foreclosure filings dropped to the lowest quarterly amount since the Great Recession, according to Attom Data Solutions.

April 11 -

With a strong job market and low interest rates, the mortgage delinquency rate fell to its lowest January level in at least 20 years.

April 9 -

The commercial mortgage-backed securities delinquency rate increased for the first time since October lead by a 31-basis-point rise in late payments for loans secured by retail properties, Fitch Ratings said.

April 8 -

Controlling classes of investors in commercial mortgage-backed securitizations can replace a special servicer, but before they do, they should make sure the long and potentially expensive process is worth it.

April 3 Alston & Bird

Alston & Bird -

Home retention actions for loans owned by Fannie Mae and Freddie Mac declined in the fourth quarter and that trend is likely to continue given the strong economy.

March 26 -

While fading 9.53% annually, February mortgage delinquencies posted a month-over-month increase for the first time in 12 years, according to Black Knight.

March 21 -

The money for a proposed $300 million sports complex at a foreclosed famed New York Catskills Mountain hotel was not produced by a March 22 deadline.

March 21 -

Mortgage foreclosure filings across New York dropped 46% between 2013 and 2018, from 46,696 to 25,334, according to a report issued by New York State Comptroller Thomas DiNapoli.

March 11 -

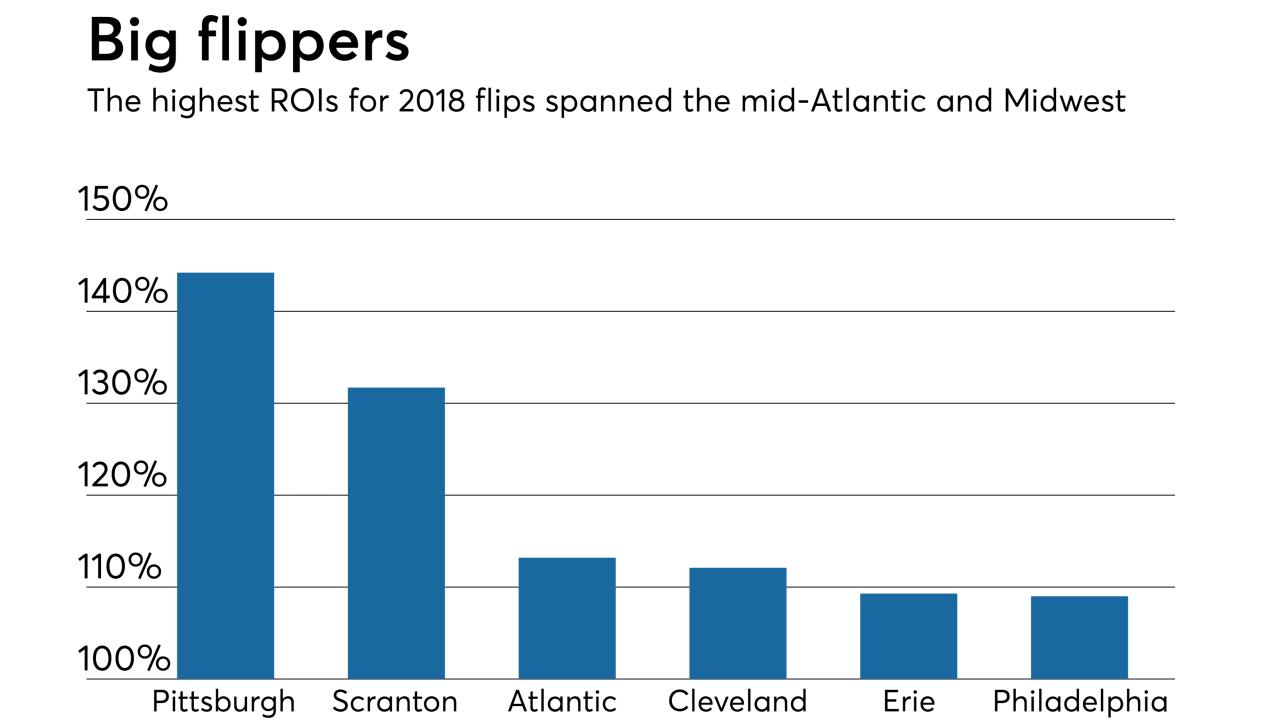

Financing poured into purchasing homes to flip in 2018, reaching the highest total since 2007, according to Attom Data Solutions.

February 28 -

In what some real estate professionals are referring to as part of the "after-effects" of the recession, is a spike in the sale of foreclosures across Staten Island.

February 20 -

The funds the bank promised to spend on consumer relief will instead be used to make new home loans, according to a report by the monitor of its 2017 settlement with the U.S. Justice Department.

February 15 -

Mortgage delinquencies in the fourth quarter were at their lowest level in nearly 19 years, helped by wage growth, low household debt and low unemployment, the Mortgage Bankers Association said.

February 15