-

The money’s distribution is really the states’ responsibility and mortgage companies already have a lot to juggle, but their involvement is essential to forbearance outcomes, according to a former HUD official.

July 23 -

The relatively low share of borrowers who were distressed in June adds to signs that the offramp from government relief measures may not lead to an overwhelming wave of foreclosures.

July 22 -

As the distribution of at-risk housing markets spread across more states quarter-over-quarter, vulnerable clusters remained around Chicago, New York and Philadelphia, an Attom Data report finds.

July 22 -

The meager increase suggests the largest boost in inventory possible would likely still leave the backlog of homes on the market at historic lows.

July 21 -

The return of more normalized numbers for two key players in the home loan market could be the lead-up to a wave that’s been anticipated since the coronavirus arrived.

July 14 -

Those handling loan modifications anticipate a growing secondary market for loans in forbearance as they budget cautiously for additional alterations of regulations down the road.

July 14 -

Most troubled homeowners can avoid a long foreclosure process by selling and exiting with clean credit or even a profit, but a little under 2% may not have enough value in their property.

July 13 -

The sharp decline suggests borrowers are recovering enough from pandemic-related hardships to leave forbearance plans even before a key expiration date arrives this fall.

July 9 -

Identifying where payment stress is concentrated could help mortgage servicers and federal policymakers prepare for the broader range of loan workouts that will resume this summer.

July 8 -

It will be several years before business and group travel return to normal levels, according to an estimate from the American Hotel & Lodging Association.

July 7 -

Rebounding employment brought total forborne mortgages under 2 million, according to the Mortgage Bankers Association.

July 6 -

The lack of a stabilizing force in the commercial real estate mortgage business is creating one of the most significant threats the lending industry faces, writes the CEO of Cirrus.

July 5 Cirrus

Cirrus -

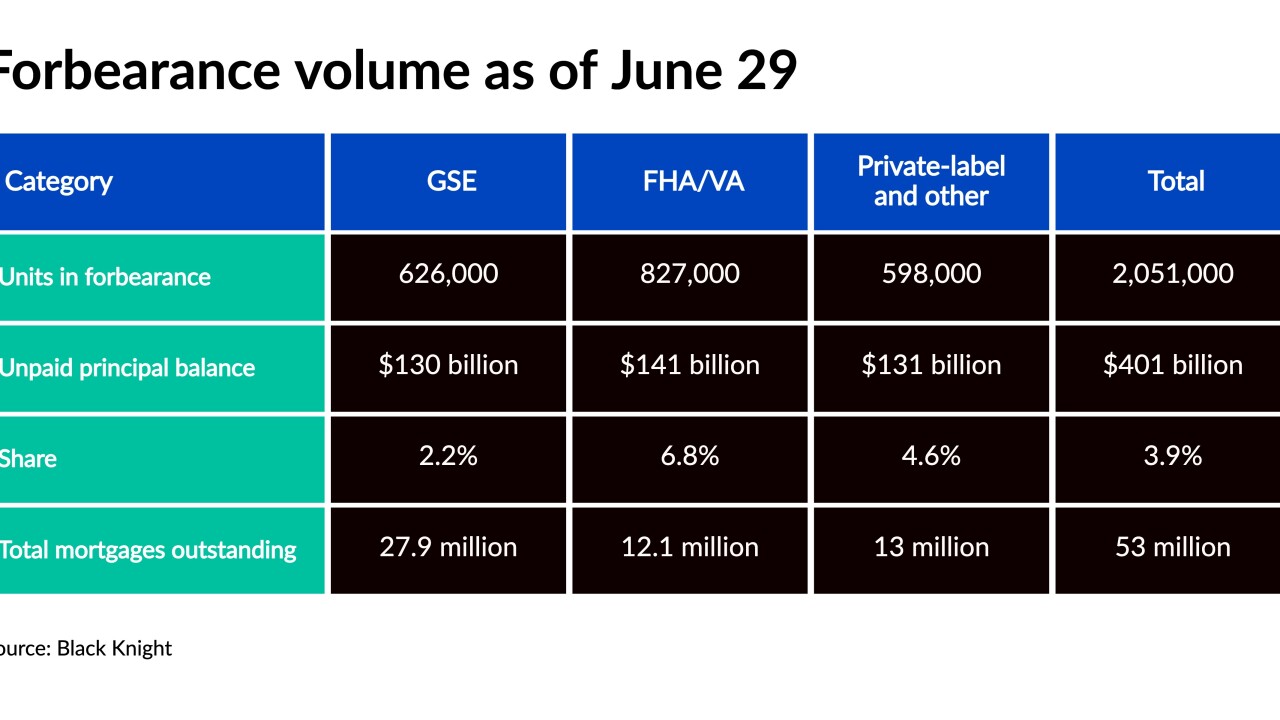

The number of GSE-backed and government sponsored loans in forbearance declined, while portfolio and private-label loans increased.

July 2 -

Private mortgage insurers can continue to hold less capital for forborne delinquent loans, which helps them potentially upstream payments to parent companies in the third and fourth quarters.

July 1 -

The change makes it easier for borrowers exiting forbearance to get access to home retention options that might otherwise be out of reach due to skyrocketing home prices.

June 30 -

The Federal Housing Finance Agency addressed the period between the end of the federal foreclosure moratorium and the beginning of new Consumer Financial Protection Bureau directives as home loan companies expressed relief that requested exemptions from some foreclosure waiting periods were included.

June 29 -

Fewer borrowers are suspending payments for pandemic hardships but some who got back on track are having trouble again, and deadlines could spur a final round of new requests.

June 28 -

The White House extended the foreclosure moratorium for federally-backed home loans a final month, and government agencies plan to roll out additional measures in July.

June 24 -

The numbers, which include payments suspended for pandemic-related hardships, could be a consideration in the possible further extension of moratoria federal regulators are close to making a call on.

June 23 -

Growing CRE mortgage volumes raised the bar for the coming year despite lingering concerns, according to the CRE Finance Council.

June 23