-

Evaluations for payment reduction still represent a relatively small share of home retention actions but their uptick could add incrementally to servicers’ workloads.

June 22 -

The strength of the housing market helped to increase forbearance exits while minimizing new requests, according to the Mortgage Bankers Association.

June 22 -

So far companies plan on using roughly the same number of employees as they shift from handling payment suspensions to assessing borrowers who have seen long-term declines in their incomes.

June 21 -

Experts expect only a small uptick in distressed mortgages, either through default or inability to refinance, which will create some opportunity for debt buyers

June 21 -

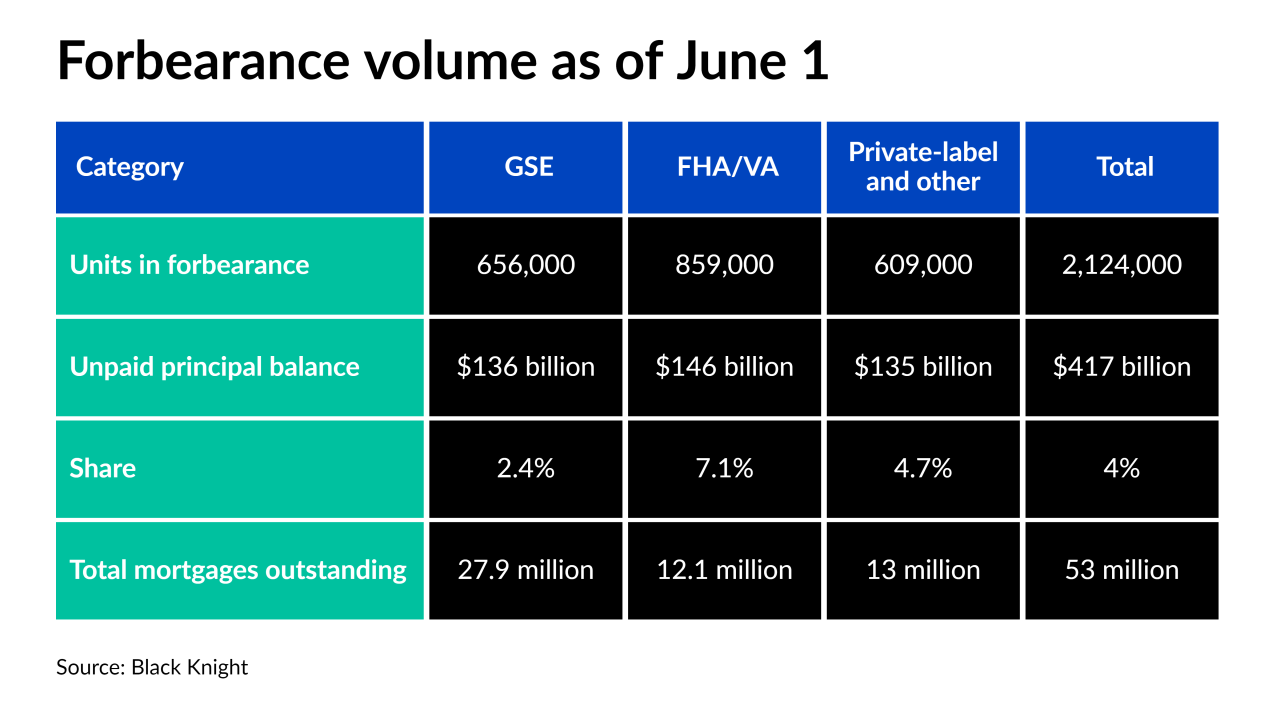

About 20% of the pandemic-related delinquent borrowers are up for review by the end of June, which could lead to vast improvement or deeper financial strife, according to Black Knight.

June 18 -

Consumer-permissioned access to bank or payroll information could be used to evaluate borrowers who still need relief after payment suspensions for pandemic-related hardships end.

June 16 -

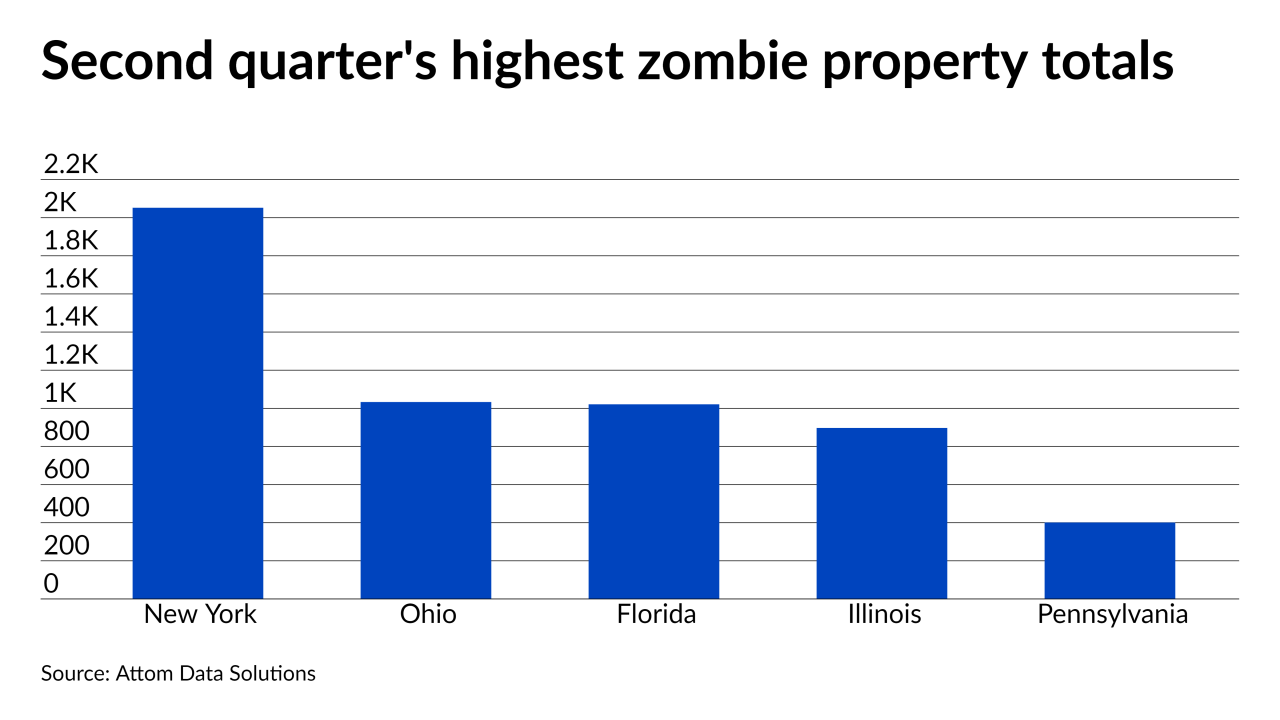

Although activity crept down in May from April, it posted “dramatic” increases from the year before, according to Attom Data Solutions.

June 15 -

The guidance addresses confusion related to how lenders should handle situations in which borrowers have not paid for a year and need additional help due to a natural disaster.

June 11 -

Meanwhile, National MI has been increasing its new insurance written by slightly widening its credit standards.

June 11 -

But March's overall late payment rate was 1.3 percentage points higher than one year ago, while the 90-day-plus rate was 2.3 percentage points higher.

June 8 -

The four-week high in forbearance exits also helped drive the considerable drop in plans, according to Black Knight.

June 4 -

While there was a small uptick in missed payments for multifamily loans, the rate remained in the same area it's been at for the last year, according to the Mortgage Bankers Association.

June 3 -

The ongoing CARES Act foreclosure moratoria may have led to distressed borrowers abandoning their homes, according to Attom Data Solutions.

May 27 -

Mortgage forbearances rose for only the second week in the past three months but big drops in numbers could be on the horizon, according to Black Knight.

May 21 -

For the first time since the pandemic began, the share of borrowers who are 30 days or more late on their payment is below 5%, Black Knight found.

May 20 -

Issuance of capital market instruments aimed at protecting one government-sponsored enterprise from distressed mortgage credit events staged a relatively quick rebound in 2020, a new Federal Housing Finance Agency report shows.

May 18 -

The rate of new forbearance requests as a share of portfolio volume also dropped to its lowest point since March, the Mortgage Bankers Association reported.

May 18 -

Most of the activity covered vacant and abandoned properties or commercial loans, according to Attom Data Solutions.

May 12 -

Altisource Portfolio Solutions’ bottom line took a larger hit in the first quarter compared to Q4 2020, causing the company to cut costs.

May 10 -

Rents are soaring in many U.S. cities as the economy rebounds, squeezing the budgets of tenants who also face increased risk of eviction after courts overturned a pandemic-era ban from the Center for Disease Control.

May 5