-

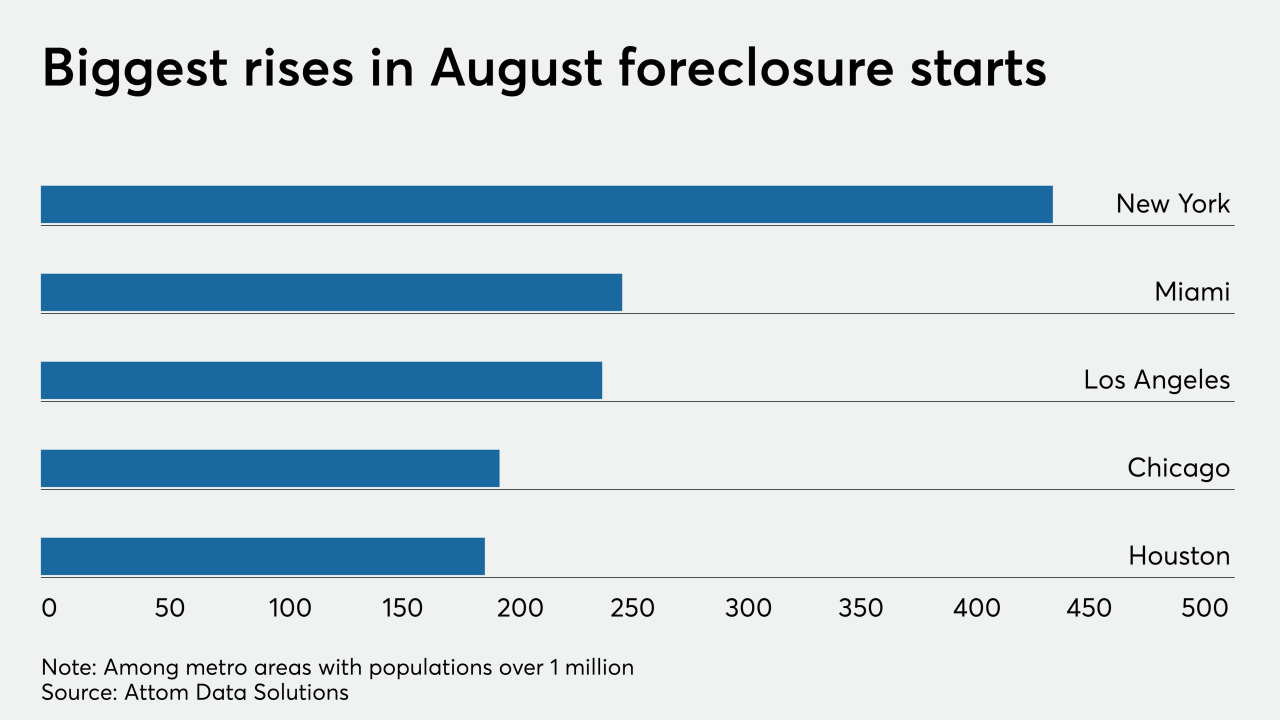

While still greatly trailing year-ago numbers, mortgage foreclosure activity jumped in August from July as moratorium restrictions started lifting and courthouses reopened, according to Attom Data Solutions.

September 11 -

Some of the cures were the result of short-term remedies and could reverse as relief measures end.

September 10 -

"The current economic crisis continues to disproportionately impact borrowers with FHA and VA loans," said Mike Fratantoni, the MBA's senior vice president and chief economist.

September 8 -

Without further government help, that rate could double again by 2022, CoreLogic said.

September 8 -

Today there are 1 million fewer Americans in forbearance than there were at the peak in May, according to Black Knight.

September 4 -

The lightning-ignited Hennessey Fire destroyed 254 single-family homes in Napa County, Calif., making it one of the most destructive in county history, Cal Fire reported.

September 2 -

Gov. Gavin Newsom late Monday signed a stopgap measure to rein in evictions, offering limited protections for tenants and aid to landlords hit financially by the coronavirus pandemic.

September 1 -

For the first time since June 7, the number of loans going into coronavirus-related forbearance didn't decrease from the week before, according to the Mortgage Bankers Association.

August 31 -

Blackstone Group, which led Wall Street's initial foray into the single-family rental business, is making a new investment in suburban houses at a time when the COVID-19 pandemic is pressuring traditional commercial real estate.

August 28 -

The new reality for investors and originators accounts for forbearances and ability-to-repay.

August 28 -

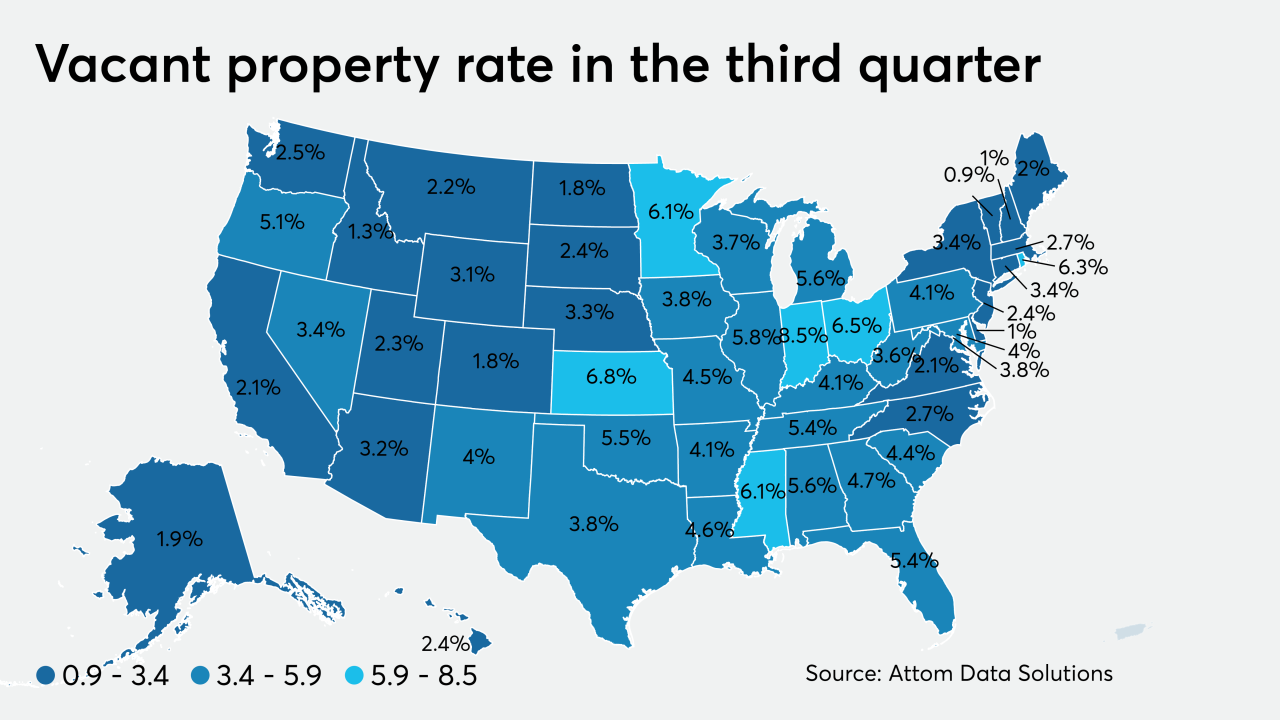

While the overall amount of foreclosures continued to decline due to the coronavirus moratorium, the share of zombie properties grew during the third quarter, according to Attom Data Solutions.

August 27 -

Many mortgage companies are hoping to operate remotely through year-end and are asking regulators for relief to that end.

August 27 -

With mortgage rates and housing inventory both at all-time lows, the majority of consumers would overshoot their budgets for the right home without accounting for future costs, according to LendingTree.

August 26 -

If it makes landfall as a Category 3 storm as was initially projected, damage from Hurricane Laura's surge could potentially devastate 432,810 residential properties in Texas and Louisiana, according to CoreLogic.

August 25 -

The number of loans going into coronavirus-related forbearance decreased for the tenth straight week, but to a lesser degree than in previous weeks, according to the Mortgage Bankers Association.

August 24 -

As interest rates tumbled throughout July, prepayments climbed to the highest monthly rate since 2004, but 90-days-or-more delinquencies were on the rise from June, according to Black Knight.

August 21 -

Rather than letting zombie properties sit vacant, selling them to new owners and getting them reoccupied, creates the desired outcome.

August 21 Auction.com

Auction.com -

Positive payment behaviors in conjunction with CARES Act measures kept mortgage delinquencies from rising, but the number of borrowers facing hardship grew exponentially from last year, according to TransUnion.

August 20 -

Travel restrictions have left hotels like Miami Beach's Fontainebleau struggling to repay their mortgage loans.

August 17 -

The Tri-COG Land Bank, a multicommunity effort to get abandoned and blighted properties back on the tax rolls, has sold its first property.

August 14