-

The credit could cover the minimum down payment for the average Federal Housing Administration-insured mortgage in most large metropolitan areas.

March 16 -

The American Dream Down Payment Act would let states establish and manage accounts, which would be similar in structure to 529 college savings plans.

August 6 -

Down payment assistance programs remain an important tool for increasing minority homeownership, but especially more so because of the pandemic.

July 14 Mountain Lake Consulting

Mountain Lake Consulting -

With the average borrower needing over two decades to save a 20% down payment for the median-priced home, private-mortgage-insured loans experienced major growth in 2019.

June 22 -

How the mortgage and housing industries react to the current civil rights moment could shape policies and bridge the homeownership divide for the Black community.

June 19 -

We need to be doing everything possible to ensure those that needed down payment assistance are able to keep their homes during this crisis and beyond.

April 15 CBC Mortgage Agency

CBC Mortgage Agency -

A city agency that in recent years lost its luster as a place where low-income New Orleanians could go for low-interest mortgages is set to re-emerge as a key player in plans to develop more affordable housing in the city.

February 10 -

Mortgages guaranteed by the Department of Veterans Affairs may increase in certain regions due to a new option that can offset a broader fee increase.

February 6 -

Homeownership is one of the fastest ways for people to build wealth and giving down payment assistance provides creditworthy borrowers an opportunity to buy a house they otherwise wouldn't have, according to the CBC Mortgage Agency.

January 31 -

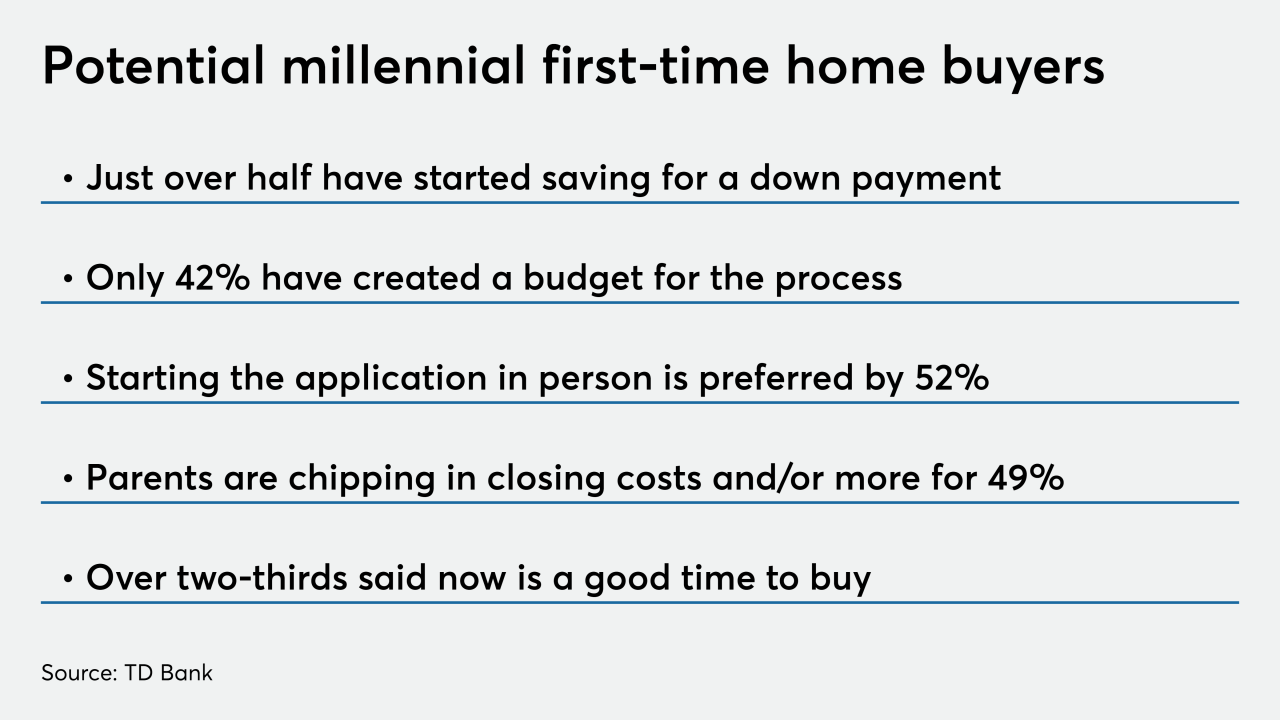

A significant number of millennials planning to purchase their first home during 2020 have not yet taken the financial steps necessary to successfully complete the process, a TD Bank survey found.

January 27 -

Now is not the time for the government to cut Federal Housing Administration premiums and enter new segments of the housing market.

December 24

-

In light of the Federal Housing Administration's strong financial performance, now is not the time to "reduce the FHA's footprint," but rather to broaden the critical access to credit role it plays.

December 3 Kellum Capital Group and Kellum Mortgage

Kellum Capital Group and Kellum Mortgage -

Private mortgage insurance now has almost matched the government's Federal Housing Administration program in market share, having gained approximately eight percentage points in the past five years, Keefe, Bruyette & Woods found.

November 26 -

It was long believed down payment assistant programs were recipes for poor loan performance and future delinquencies, but that's not the case, according to a new report.

November 12 -

Faced with higher property prices and piles of student debt, Americans are getting older and older before they buy a home.

November 8 -

Gentrification and rapid home price growth have intensified the loss of wealth the African-American community experienced post-crisis, widening the chasm between what white and black borrowers can afford, Redfin found.

October 17 -

Home prices have more than recovered since the recession, but higher-than-ever medical and student debt is robbing many homeowners from realizing the benefits, while keeping others away from the market, according to Zillow.

October 1 -

With the ongoing issue of the affordable housing crisis, the Mortgage Bankers Association got behind the Build More Housing Near Transit Act, a bipartisan bill introduced in the House of Representatives.

September 16 -

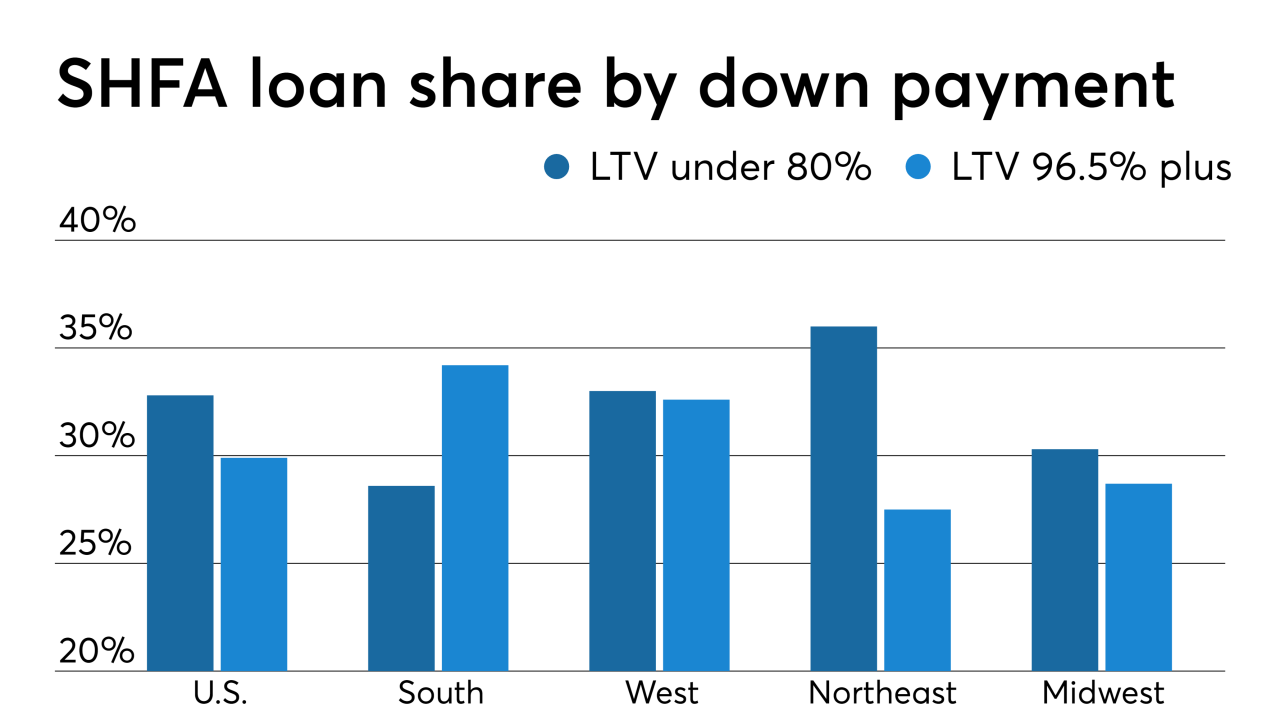

The use of state housing finance agency down payment assistance programs is part of the solution to address the growing affordable housing gap, a Fitch Ratings report said.

September 11 -

While millennials took advantage of mortgage rates falling to two-year lows, increasing their refinance share, teaching them about low down payment loan products would help grow homeownership for this group, according to Ellie Mae.

September 4