-

The Trump administration is not backing down even after a federal court blocked guidance that would have limited the operations of national housing funds.

September 4 -

From the Lone Star State to the beaches of Florida, here's a look at the top 15 housing markets with the largest influx of VA purchase loans between 2015 and 2018, according to Veterans United.

August 9 -

The Federal Housing Administration program insured three-quarters of the mortgages obtained by millennial homebuyers as most had trouble saving up for a 20% down payment, a LendEDU study found.

August 6 -

Essent Group continued to benefit from the volatility in private mortgage insurers' market share, remaining in second place among the six active underwriters at the end of the recent quarter.

August 2 -

Through the first half of the year, there have has been 2,000 single-family homes sold countywide, a 6.45% decline from the comparable period last year when 2,138 homes were sold.

July 22 -

The ruling deals a blow to efforts by the Department of Housing and Urban Development to restrict nonprofit housing funds from operating on a national scale.

July 17 -

An expanding gap between sharp home price appreciation and relatively feeble income growth dating back to 1960 brewed America's affordability crisis, according to Clever Real Estate.

July 17 -

Taking aim at the racial wealth gap in the U.S., Democratic presidential candidate Kamala Harris proposed a $100 billion program to help black families and individuals buy homes.

July 8 -

A Bay Area real estate agent has been indicted on charges of fraud and money laundering after allegedly promising home loans to clients then taking their money.

July 5 -

A handful of institutions in the last year have rolled out loan programs targeting members of the military and first responders, but there could be risks associated with these mortgages if the economy takes a nosedive.

July 4 -

The California Housing Finance Agency helped a record number of low- and moderate-income residents purchase their first homes with help from its down payment assistance program.

July 3 -

Housing finance agencies reported increased demand for their loan products, but at the same time the inventory shortage constrains activity and drives them to work with other public entities to find solutions, Moody's said.

June 17 -

A new startup launched in the Bay Area says it can help buyers survive the region's cutthroat housing market by doing away with one of its biggest hurdles — a massive down payment.

June 12 -

Consumers' knowledge of the mortgage process and what it takes to purchase a home has not improved from four years ago and lenders have an opportunity to fill that need, Fannie Mae said.

June 5 -

With Sen. Elizabeth Warren's cancellation plan to alleviate student debt, millennials would save up for mortgage down payments three years sooner, according to Redfin.

May 31 -

Investors shouldn't overreact to the first-quarter shift in private mortgage insurer market share, said the CEO of the company that benefited most from the change.

May 31 -

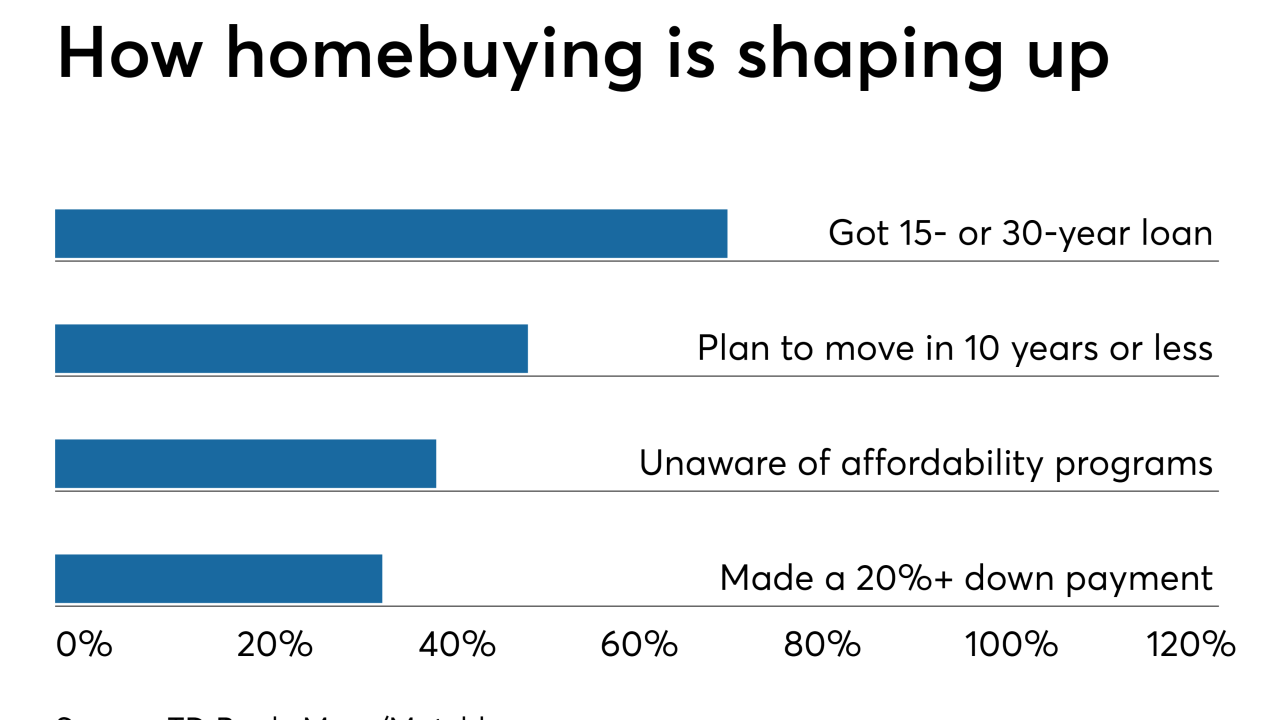

Increased use of the digital mortgage process contributes to improved closing times, but falls short when it comes to borrower education, according to a TD Bank survey.

May 30 -

Delinquencies associated with the government-sponsored enterprises high loan-to-value ratio programs that target low-to-moderate income homebuyers are slightly better than expected, at least early on, according to Fitch.

May 23 -

In a weak first quarter, housing activity held up better for first-time homebuyers than others, according to a new Genworth Mortgage Insurance report.

May 23 -

One of the hardest financial parts of buying a new home is coming up with the initial down payment on the mortgage loan.

May 20