-

The California Housing Finance Agency helped a record number of low- and moderate-income residents purchase their first homes with help from its down payment assistance program.

July 3 -

Housing finance agencies reported increased demand for their loan products, but at the same time the inventory shortage constrains activity and drives them to work with other public entities to find solutions, Moody's said.

June 17 -

A new startup launched in the Bay Area says it can help buyers survive the region's cutthroat housing market by doing away with one of its biggest hurdles — a massive down payment.

June 12 -

Consumers' knowledge of the mortgage process and what it takes to purchase a home has not improved from four years ago and lenders have an opportunity to fill that need, Fannie Mae said.

June 5 -

With Sen. Elizabeth Warren's cancellation plan to alleviate student debt, millennials would save up for mortgage down payments three years sooner, according to Redfin.

May 31 -

Investors shouldn't overreact to the first-quarter shift in private mortgage insurer market share, said the CEO of the company that benefited most from the change.

May 31 -

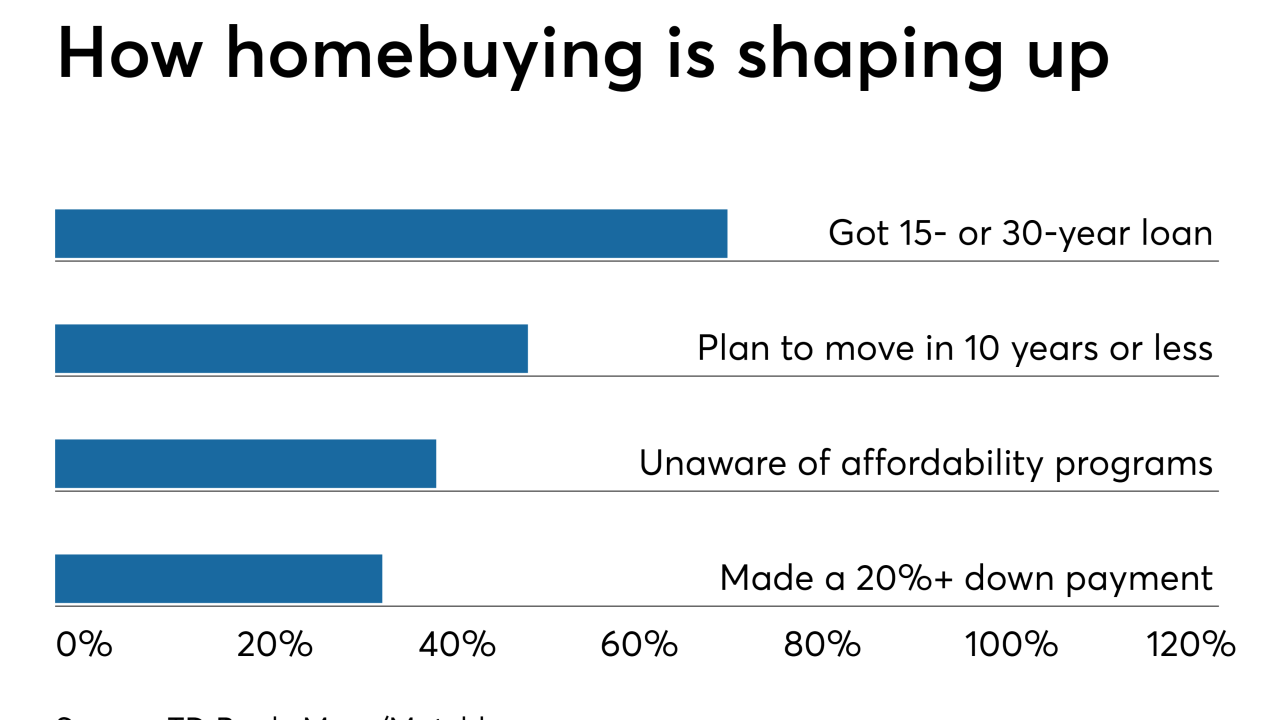

Increased use of the digital mortgage process contributes to improved closing times, but falls short when it comes to borrower education, according to a TD Bank survey.

May 30 -

Delinquencies associated with the government-sponsored enterprises high loan-to-value ratio programs that target low-to-moderate income homebuyers are slightly better than expected, at least early on, according to Fitch.

May 23 -

In a weak first quarter, housing activity held up better for first-time homebuyers than others, according to a new Genworth Mortgage Insurance report.

May 23 -

One of the hardest financial parts of buying a new home is coming up with the initial down payment on the mortgage loan.

May 20 -

Philadelphia officials have expanded a program that will give first-time homebuyers and other eligible city residents up to $10,000 when they purchase a home in the city.

May 13 -

The documents and other information needed for a loan application.

May 9 -

Whether online or advertised on a sign, very few consumers will qualify for that incredible low-rate deal. Here's why.

May 9 -

A larger share of Midwestern loan officers compared with their counterparts nationwide said working with first-time home buyers was extremely important for their success, the 2019 Top Producers Survey found.

May 8 -

Two nonprofits threatened by the effort say the Department of Housing and Urban Development tried to avoid scrutiny last month when it announced the new policy outside the formal rulemaking process.

May 6 -

Millennial homebuyers are increasingly using savings from their primary paychecks to put money down on a home, according to Redfin.

April 29 -

The Trump administration is cracking down on national affordable housing programs because of concern over growing risk to the government's almost $1.3 trillion portfolio of federally insured mortgages.

April 22 -

The Hispanic homeownership rate increased for the fourth consecutive year, despite the fact that the demographic remains more exposed to barriers to buying a house than the general population.

April 10 -

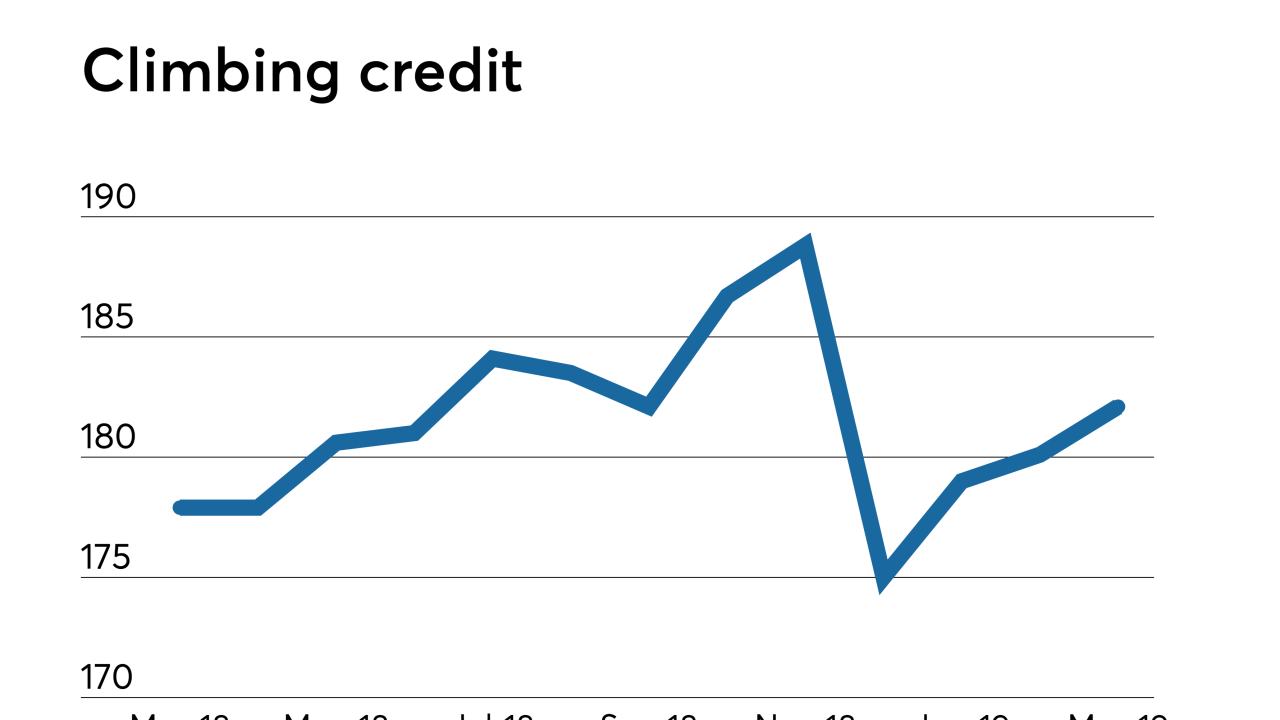

Mortgage lending standards loosened in March, as a swell in jumbo credit helped drive an expansion in availability for the third straight month, according to the Mortgage Bankers Association.

April 4 -

Bank of America is setting aim at low- to moderate-income and multicultural homebuyers and communities with the launch of its Neighborhood Solutions affordable homeownership initiative.

April 2