-

The government-sponsored enterprises set a Sept. 30 deadline for sellers to accept applications for Libor adjustable-rate mortgages.

October 8 -

If mortgage lenders need to learn anything from the pandemic, it is relying on a single source for any service could disrupt their activities.

October 7 Lereta

Lereta -

Three nonprofits look to create or preserve 10,000 units, vowing to fight off firms like Blackstone and Colony Capital, which bought up foreclosed homes after Great Recession.

October 6 -

When the economy inevitably slides, leaders with a culture based on the mantra, "Treat people like family, and the money will take care of itself," won't need a miracle to survive.

October 6 Incenter

Incenter -

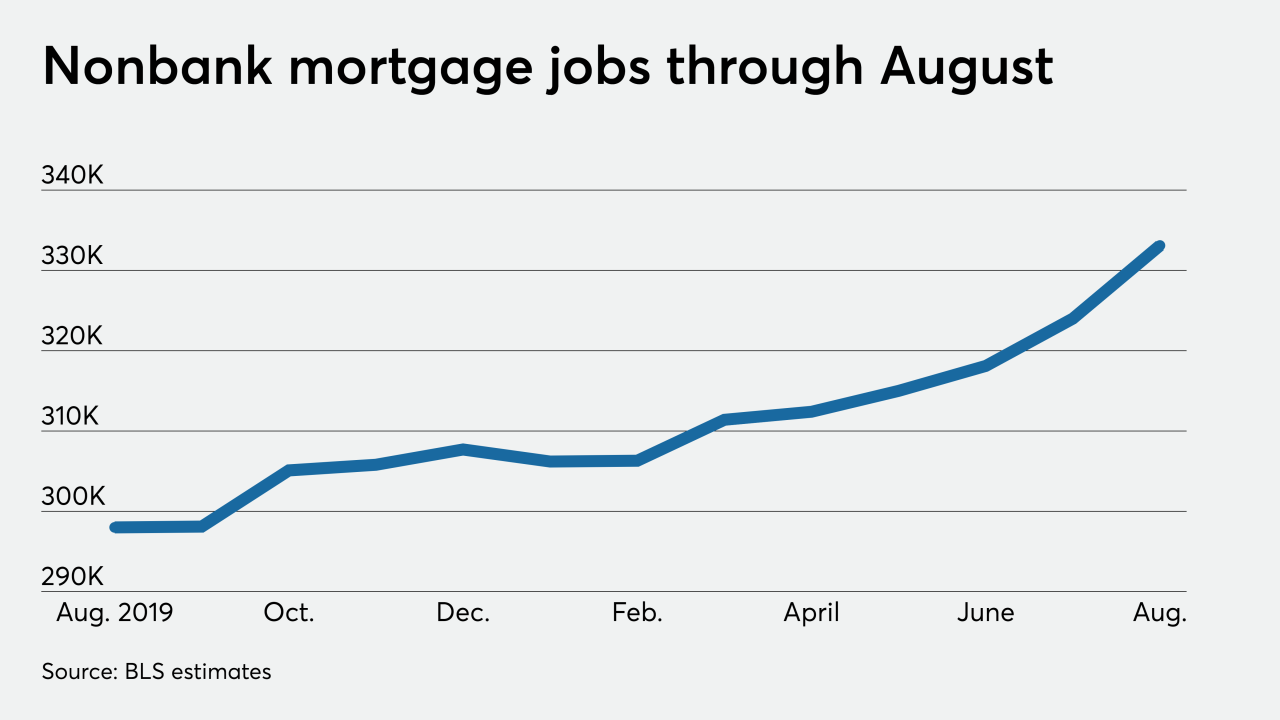

There was an estimated total of 333,100 people on nonbank mortgage banker and broker payrolls in August, and that's the highest recorded since at least 2010.

October 2 -

Over 3.6 million borrowers sit in coronavirus-related forbearance with portfolio and private-label securitized loans driving the week's increase, according to Black Knight.

October 2 -

The bar to prove discriminatory patterns is so high that plaintiffs would have slim odds of winning lawsuits against housing providers.

October 2 George Washington University

George Washington University -

The government-sponsored enterprise's first multifamily sustainability bond transaction, totaling $600 million, is part of Freddie's K-Deal program.

October 1 -

Student housing and assisted/independent living centers were small portions of Freddie's multifamily securitizations prior to COVID, but Kroll noticed they've been missing in most rated deals since spring.

September 30 -

Approximately 75% of the quarter-to-quarter growth came from multifamily mortgage originations.

September 29 -

The net share of mortgages in Ginnie Mae securitizations with suspended payments appears to be stabilizing, but the number of new requests creates doubt about whether it will subside.

September 29 -

-

Frank Pallotta sold Wall Street services to lenders and later helped create programs to help underwater borrowers. Now he's running to represent a district both parties fight hard over.

September 28 -

Sales of U.K. homes costing over 1 million pounds ($1.3 million) doubled last month, outperforming the rest of the market as wealthier buyers sought more space following the COVID-19 lockdown.

September 28 -

Wall Street won big buying up homes during the foreclosure crisis and renting them out. Now, it's headed back to the suburbs in hopes of scoring again.

September 25 -

The Financial Stability Oversight Council said the mortgage giants may need a bigger capital cushion than their regulator has proposed, but stopped short of designating them as “systemically important financial institutions.”

September 25 -

After an annual gain in July, newly constructed home listings tumbled in August as coronavirus complications caused the largest inventory drops on record, according to Redfin.

September 25 -

Twelve people were charged in a scheme regarding the creation of 100 fraudulent mortgages in Georgia, according to the HUD inspector general.

September 24 -

Home sales in Greater Hartford continued to surge in August with houses selling faster and at higher prices than the same month a year ago.

September 24 -

The Charlotte, N.C., company recently closed on a sale of its Cohen Financial platform to SitusAMC.

September 23