-

FHFA head Mark Calabria and his FSOC counterparts need to sit down with the Treasury and fashion an emergency capital plan for the GSEs.

April 13 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

The Rhode Island Association of Realtors reports that single-family home sales in the state actually rose slightly year-after-year in March, despite the onset of the coronavirus crisis.

April 13 -

Forbearance requirements under the CARES Act raised immediate concerns about servicing advances and performance, but experts suggest there are other outcomes to brace for, too.

April 9 -

With the onset of the pandemic, real estate agents say deals that were in the works are encountering all types of problems, creating havoc in the market as buyers try to back out of contracts.

April 9 -

If rising flood waters were the right analogy last time around, this time a tsunami is probably a more accurate description of the wave of delinquencies about to come.

April 8 Mayer Brown LLP

Mayer Brown LLP -

The lender is one of many taking advantage of the disruption in the market to grow their businesses.

April 8 -

A bipartisan group of lawmakers wrote in a letter to the Treasury secretary that the Financial Stability Oversight Council should create a liquidity facility to deal with a flood of forbearance requests brought on by the coronavirus pandemic.

April 8 -

Mark Calabria needs to be working to secure a Fed facility for servicer advances and to support, not denigrate, smaller servicers, the Mortgage Bankers Association said.

April 8 -

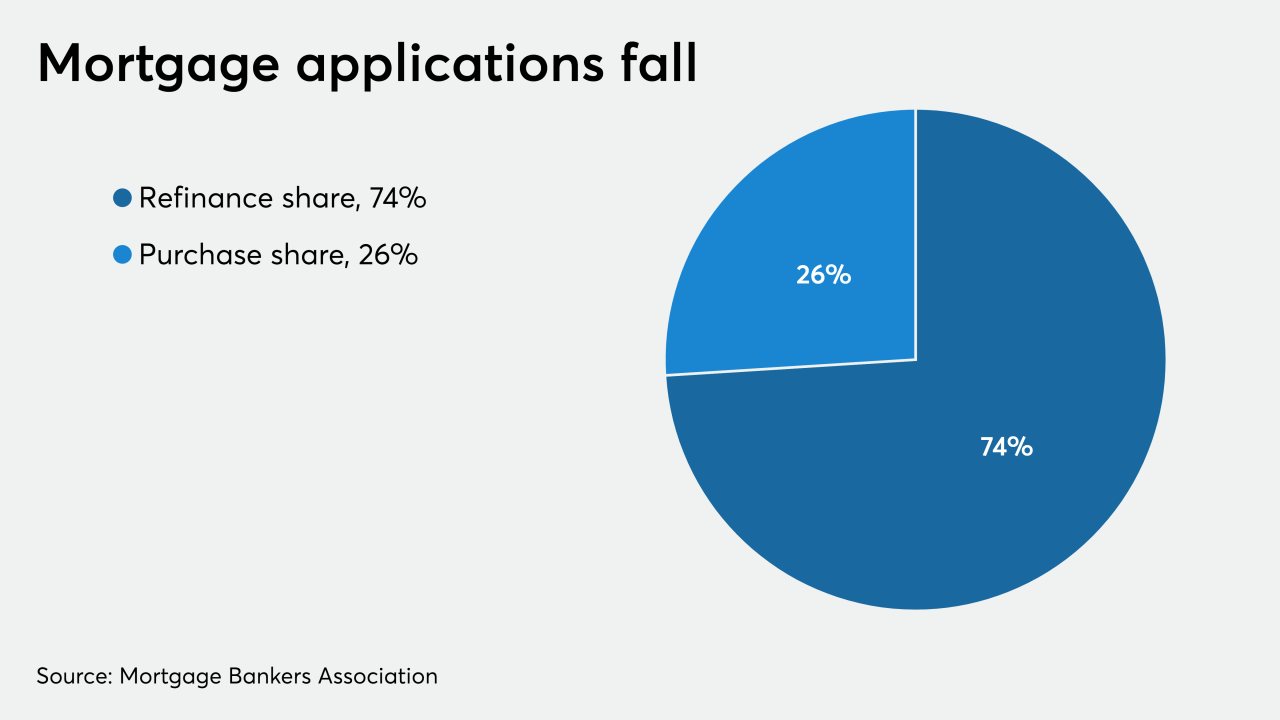

Mortgage applications decreased 17.9% from one week earlier, as coronavirus-related volatility affected consumer sentiment, according to the Mortgage Bankers Association.

April 8 -

Consumer confidence for home buying fell to its lowest point since December 2016, according to Fannie Mae.

April 7 -

The CARES Act does not define what a covered period is when it comes to residential mortgage borrower requests for forbearance.

April 7 McCarter & English LLP

McCarter & English LLP -

Prices on average are expected to grow at nearly half the rate they were expected to rise before the pandemic hit, according to Veros Real Estate Solutions.

April 6 -

The government lock-down on real estate sales loosened last week — agents and other professionals were deemed essential workers — but strict Bay Area guidelines banned open houses and close contact.

April 6 -

The coronavirus relief legislation could result in private mortgage insurers having to hold more capital, a B. Riley FBR analyst report said.

April 6 -

Ocwen Financial has approximately $749 million of liquidity from various sources to deal with servicing issues arising from the coronavirus, a company press release said.

April 3 -

Nonbank mortgage employment estimates show payrolls in February leveled off after an unusually strong winter, but anecdotal reports of selective hiring persisted through March amid a broader coronavirus-related drop in U.S. jobs.

April 3 -

One day after the rent was due, all evictions and foreclosures in Florida were suspended for 45 days under a statewide order issued Thursday.

April 2 -

New York's Real estate agents, home inspectors and residential appraisers are now considered "essential employees," according to the Empire State Development agency.

April 2 -

Real estate listings are drying up, open houses have been canceled, and buyers are staying home. One more pillar of the Canadian economy is under threat from the coronavirus pandemic.

April 2 -

Bank employment of mortgage loan officers rose slightly last year, but that was before the coronavirus spread and resulted in social distancing measures that raised questions about broader employment prospects.

April 2