-

Simply stated, the federal forbearance of mortgage payments is perhaps the largest unfunded public mandate in American history.

April 1 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

The latest deadline for Genworth Financial's acquisition by China Oceanwide is June 30, but the parties are looking to get the transaction completed by the end of next month.

April 1 -

While the housing market will suffer from the COVID-19 crisis, it's stronger than it was in during its last crash in 2008, according to First American Financial.

March 31 -

Mortgage servicers need direction from federal agencies on how to implement the forbearance plans called for in the CARES Act, according to the Community Home Lenders Association.

March 31 -

After years of bustling sales and rising prices, Buffalo's housing market has come to a screeching halt.

March 31 -

As social distancing related to the coronavirus complicates work for appraisers, real estate agents and construction lenders, professionals turn to technology and, in some cases, ask consumers to pitch in.

March 30 -

Mortgage bankers are sounding alarms that the Federal Reserve's emergency purchases of bonds tied to home loans are unintentionally putting their industry at risk by triggering a flood of margin calls on hedges lenders have entered into to protect themselves from losses.

March 30 -

The real estate industry, struggling with coronavirus-linked limitations, got a boost with its sales business reclassified as an "essential" industry.

March 29 -

Mortgage technology efforts have historically been behind the curve, but some recent responses to the coronavirus highlight instances where it rises to the occasion.

March 27 -

The impending wave of loan delinquencies because of the coronavirus hurt private mortgage insurer earnings, but the companies will still have sufficient capital, a Keefe, Bruyette & Woods report said.

March 27 -

The government is cushioning the impact of the coronavirus on consumers, but independent mortgage bankers need funding to deal with increased levels of servicing advances because of forbearances.

March 27 Community Home Lenders of America

Community Home Lenders of America -

Residential estate brokers and agents are scrambling to determine what Massachusetts Gov. Charlie Baker's emergency order means for their industry.

March 27 -

Treasury Secretary Steven Mnuchin reiterated Thursday that he wants U.S. financial markets to remain open even as the coronavirus fuels wild volatility, while adding that he's focused on helping mortgage firms expected to be hit hard by the pandemic’s spreading economic pain.

March 27 -

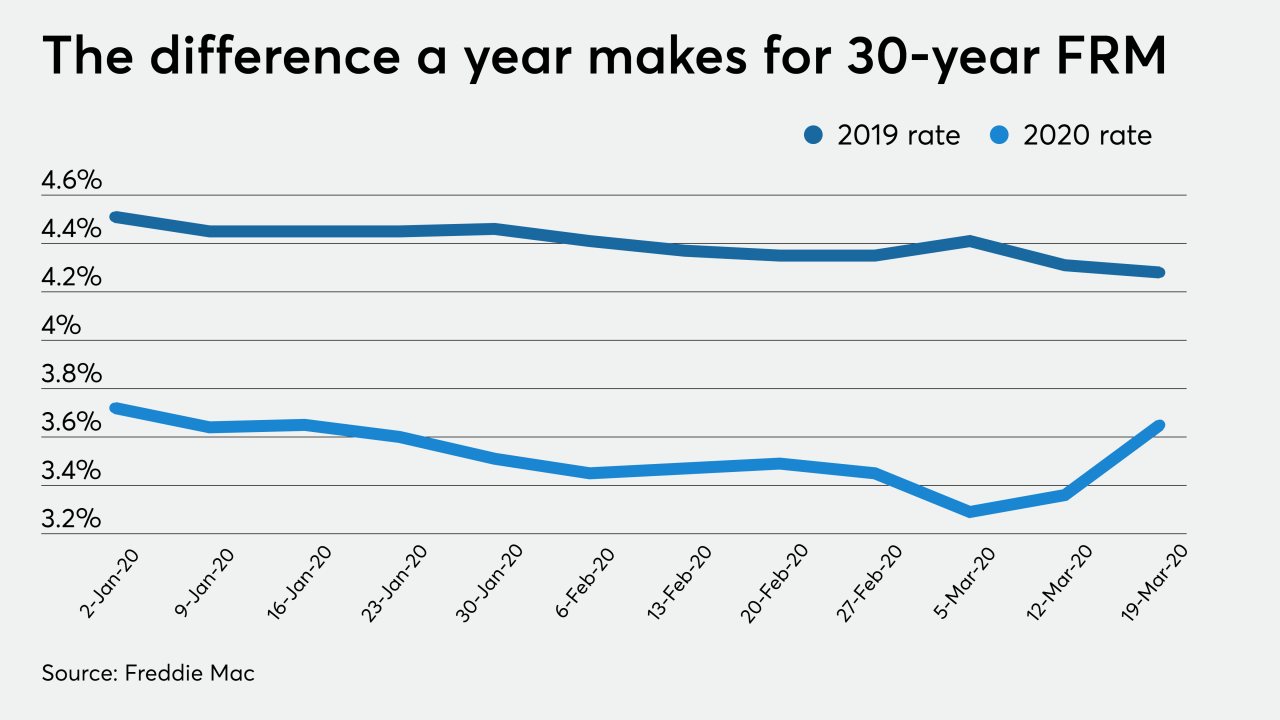

The actions taken by the Federal Reserve to calm the financial markets was key to the drop in mortgage rates this week, according to Freddie Mac.

March 26 -

Idaho Gov. Brad Little's order telling Idahoans to stay home for 21 days is likely to create havoc for the state's real estate industry.

March 26 -

Canadians' interest in searching for houses online is waning amid the COVID-19 pandemic, according to real estate portal Point2 Homes.

March 25 -

With ambiguity surrounding the length of the COVID-19 outbreak and damage it will cause, consumers are becoming diffident in taking out a mortgage for a major purchase, according to Zillow.

March 25 -

Detroit-based mortgage giant Quicken Loans could be facing a cash crunch in coming weeks and possibly need temporary emergency federal assistance if lots of borrowers stop making payments on their home mortgages during the coronavirus pandemic, according to a news report.

March 25 -

There was a nearly 30% week-to-week decline in loan applications as Americans reacted to the uncertainty, both economic and medical, from the spread of COVID-19, according to the Mortgage Bankers Association.

March 25 -

Independent mortgage bankers had their most profitable fourth quarter in seven years for originations, but the fallout from the coronavirus could upset the economics of the industry in the short term.

March 24