-

The Federal Housing Finance Agency in the Trump administration had been preoccupied with Fannie Mae and Freddie Mac’s capital position. Acting Director Sandra Thompson has shifted the agency’s focus to affordable housing and fair lending.

August 27 -

The COVID-19 pandemic has exacerbated income inequality in America, and that has implications for banks and other lenders. Among those suffering most: renters, front-line workers and minority small-business owners.

August 23 -

Community banks have played and will continue to play a key role in supporting local economies across the country. Join us in a lively conversation with Dennis E. Nixon, President & CEO of International Bank of Commerce (Laredo, Texas) & Chairman, International Bancshares Corporation and Eddie Aldrete, Senior Vice President at International Bank of Commerce as we discuss: (1) the need for bankers and the business community to become involved in political issues. From minimum wage and issues that affect small businesses to regulatory issues that directly affect the banking industry, banking and business leaders need to be thought leaders in the public conversation and (2) how bankers can play a pivotal advocacy role in the free trade process.

-

This year's assessment for Fannie Mae and Freddie Mac is the first to take into account a January agreement between the Federal Housing Finance Agency and the Treasury Department that allowed the companies to retain more earnings.

August 13 -

The guarantor of mortgage-backed securities has been without a Senate-confirmed president for four and a half years. The vacancy makes it difficult for other government agencies to coordinate housing objectives, according to stakeholders.

August 12 -

The company’s $204 million in net income was down from unusual highs seen recently but still historically strong thanks to the balance between its loan channels and servicing operation, representatives said.

August 6 -

Increased purchase lending and added pressure from Fannie Mae and Freddie Mac’s new loan limits should drive the likelihood of borrower misrepresentation.

August 6 -

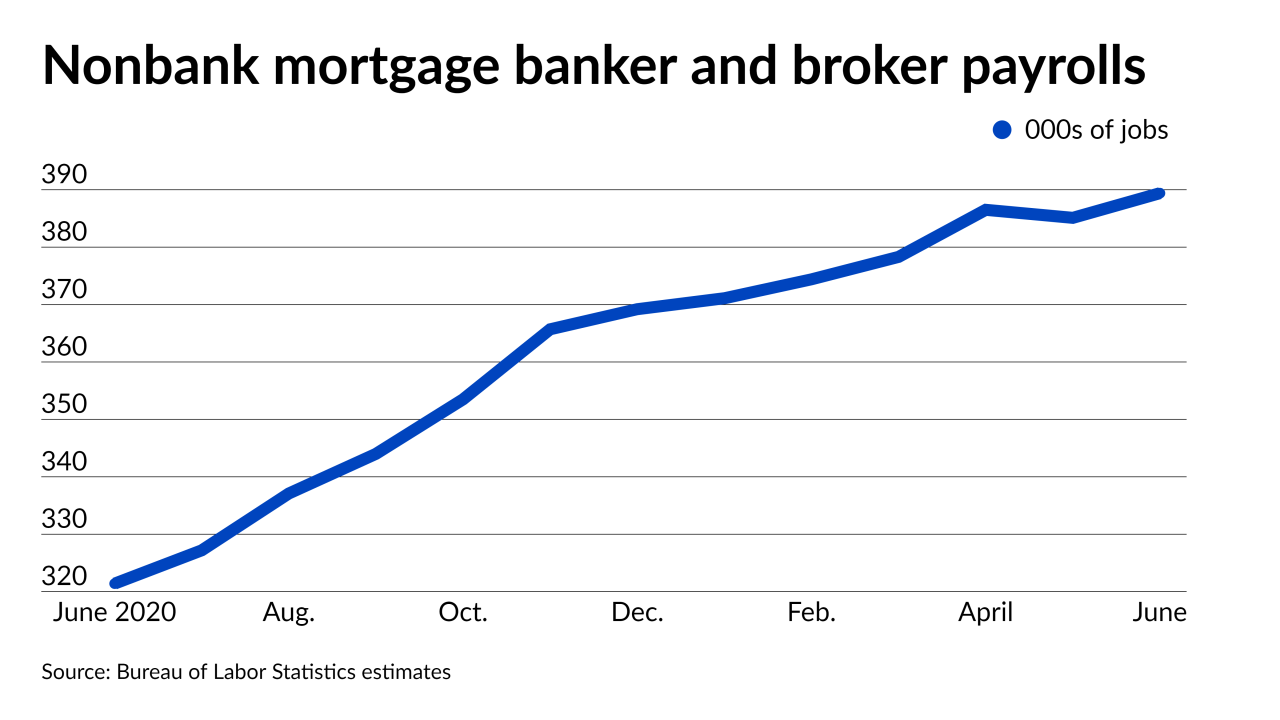

The gain reinforces other estimates that suggest more work-intensive purchase originations have spurred companies to increase staffing. Hiring addressing changing needs in servicing may come next.

August 6 -

The hot hot real estate market has pulled homeowners out of a debt trap that many had been stuck in since the great financial crisis more than a decade earlier.

August 6 -

While the hot market’s actual and forecast home price gains were key drivers of Fannie’s results, they also present a challenge to the affordable housing mission that it’s working to address.

August 3 -

The industry had tightened up last year in the face of COVID-19. But as the economic outlook improves, banks are now easing criteria amid heightened competition, according to the Federal Reserve’s survey of loan officers.

August 2 -

The proposal should be withdrawn or reworked around the needs of small players they impose a disproportionate burden on, the Community Home Lenders Association said.

July 30 -

Borrowers reacted positively to the increased interaction and engagement resulting forbearances and payoff requests, J.D. Power found.

July 29 -

The government-sponsored enterprise's single-family credit reserve release caused earnings to spike.

July 29 -

A hike in guarantee fees charged to lenders for the companies’ backing of loans was due to expire this year, but lawmakers now want to extend it to raise $21 billion for the bipartisan package.

July 29 -

While federal regulators attempt to overhaul the Community Reinvestment Act for banks, Congress has shown little interest in applying it to other lenders. But recent moves in Illinois and New York have given some stakeholders hope that state lawmakers will pick up the slack.

July 26 -

Ensuring the safety and soundness of Fannie Mae, Freddie Mac and the Federal Home Loan banks is the core responsibility of the Federal Housing Finance Agency. That shouldn't change now that the president has the authority to fire the FHFA's director at will.

July 26 Risk Management Association

Risk Management Association -

Sales of new U.S. homes dropped unexpectedly in June to the lowest since April 2020, showing a further weakening in demand against a backdrop of elevated prices and tight supply.

July 26 -

The guarantor has for the first time proposed a risk-based capital requirement for companies not subject to other federal regulation. The industry says the plan, which would impose a heavy charge for servicing portfolios, could drive lenders away from government-backed programs.

July 26 -

In 2011 Congress paid for payroll tax relief by raising secondary market guarantee fees for 10 years. The Mortgage Bankers Association, and others, don’t want to see that happen again.

July 23