-

The lack of homes for sale is supporting the record values, unlike what happened in the mid-2000s, analysts say.

June 28 -

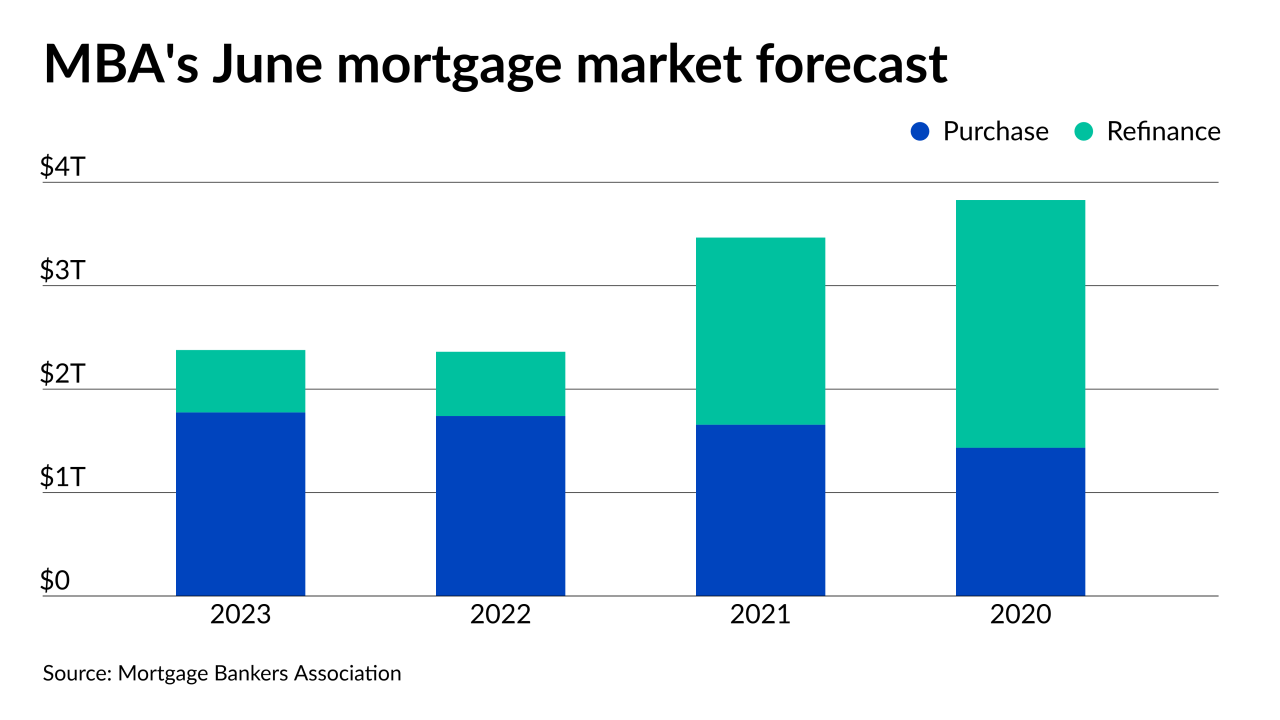

Even though volumes are expected to taper from 2020’s record highs, lenders plan to take on more employees in 2021, according to the Mortgage Bankers Association and McLagan Data.

June 25 -

The Supreme Court decision cleared the way for further revisions to the agreements between the Federal Housing Finance Agency and the Treasury, which could include dismissing the January changes.

June 25 -

The Community Home Lenders Association has called for suspension of federal limits on the loan volumes that Fannie Mae and Freddie Mac can purchase from individual lenders. The demand came on the same day that the Biden administration fired FHFA Director Mark Calabria and started the process of nominating his successor.

June 24 -

Thompson, who was most recently the deputy director of the FHFA’s Division of Housing and Mission Goals, replaces Mark Calabria, who was fired Wednesday afternoon.

June 23 -

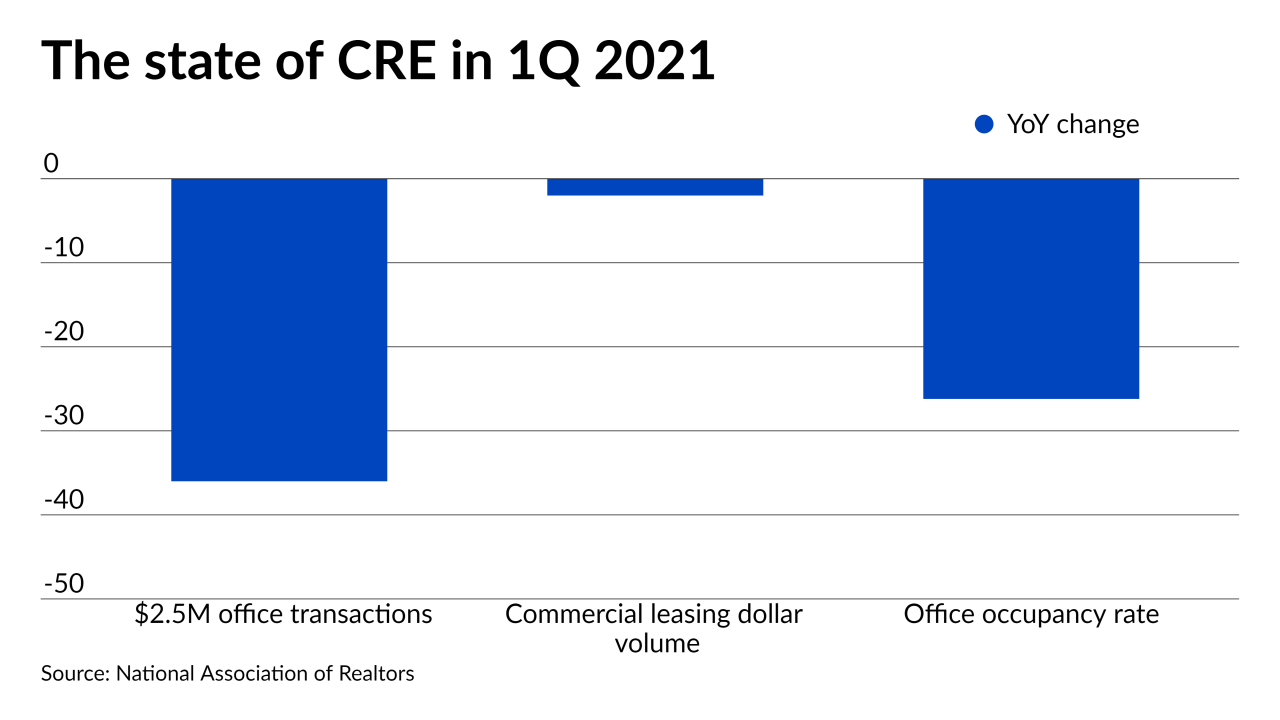

Growing CRE mortgage volumes raised the bar for the coming year despite lingering concerns, according to the CRE Finance Council.

June 23 -

President Biden removed Mark Calabria as Federal Housing Finance Agency director hours after a Supreme Court ruling made the move possible. The administration is expected to offer up a nominee who will prioritize affordable housing and racial equity in housing instead of reforming Fannie Mae and Freddie Mac.

June 23 -

The president will oust Federal Housing Finance Agency Director Mark Calabria, a Trump appointee, now that the high court says the chief executive can do so at will. It's "critical that the agency implement the administration’s housing policies," said a White House official.

June 23 -

The justices on Wednesday threw out a key part of a challenge brought by firms including Paulson & Co., Pershing Square Capital Management and Fairholme Funds to the government’s collection of more than $100 billion in profits from Fannie Mae and Freddie Mac.

June 23 -

A majority of the justices concluded that the law establishing the Federal Housing Finance Agency violated the Constitution when it said a president may only remove the agency's chief "for cause."

June 23 -

The Community Home Lenders Association’s letter adds to criticism of the changes made to the GSEs’ preferred stock purchase agreement and indicates that its mandates are proving tough to meet.

June 17 -

Federal Reserve officials held interest rates near zero while signaling they expect two increases by the end of 2023, pulling forward the date of liftoff and projecting a faster-than-anticipated pace of tightening as the economy recovers.

June 16 -

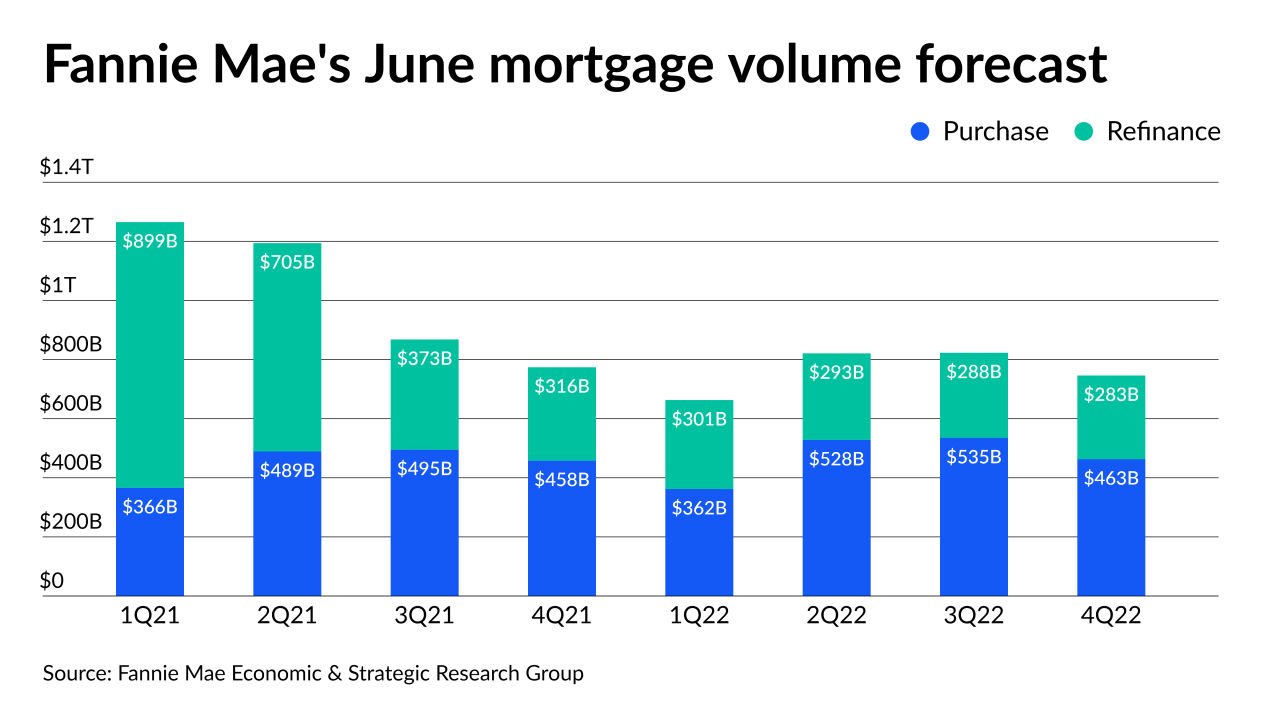

But the government-sponsored enterprise raised its total origination volume forecast for 2021 based on slightly stronger than expected refinance activity.

June 16 -

Residential starts rose 3.6% last month to a 1.57 million annualized rate, according to government data released Wednesday

June 16 -

A $28.8 billion rise in multifamily debt made up 65% of the $44.6 billion quarter-to-quarter gain, the Mortgage Bankers Association reported.

June 15 -

The real estate technology company had a $498 million valuation, according to PitchBook, but it could get a sizable premium to that if it were to go public.

June 15 -

The guidance addresses confusion related to how lenders should handle situations in which borrowers have not paid for a year and need additional help due to a natural disaster.

June 11 -

With residential supply severely lagging behind demand, redeveloping unused office space into multifamily properties seems like a perfect solution, but it’ll take governmental collaboration and tax breaks to make such projects financially compelling, developers say.

June 11 -

The Federal Housing Finance Agency said it is reviewing compensation policies for Fannie Mae and Freddie Mac and requesting feedback from the public. Some have said the $600,000 limit for executives imposed by Congress makes it hard to find talent.

June 10 -

According to the latest Federal Deposit Insurance Corporation (FDIC)’s “How America Banks” report, there is an estimated 7.1 million unbanked households in 2019. Given the record levels of unemployment, the pandemic has brought on the FDIC expects this number to rise. Join Joe Adler, American Banker’s Washington Bureau Chief and Leonard Chanin, Deputy to the Chairman of the FDIC as they discuss the FDIC’s stance on financial inclusion and how banks can get millions of unbanked Americans into the traditional banking system.