-

But several recent news developments are creating the perception that the risk of a recession is on the wane and that could end the downward pressure on rates.

January 26 -

The U.S. economy expanded at a healthy pace in the fourth quarter, though an extended salvo of Federal Reserve interest-rate hikes is seen jeopardizing growth prospects this year.

January 26 -

Foreclosure prevention actions overall fell for the sixth time in seven months in October, according to the FHFA.

January 24 -

The Federal Reserve's focus on what's happening in the labor market makes an economic downturn likely, but many watching the markets expect a policy easing in the second half of the year and growth following that.

January 20 -

Federal Reserve Bank of New York President John Williams said officials have not completed their aggressive tightening campaign to reduce stubborn price pressures.

January 20 -

Generally positive news about the U.S. economy helped push rates lower, but worries about Congressional infighting over the debt ceiling could reverse the trend, Freddie Mac and Zillow said.

January 19 -

But lower mortgage rates and better traffic have made homebuilders a bit more optimistic, the Mortgage Bankers Association said.

January 19 -

Gen Zers and millennials want to "test drive" potential long-term living arrangements and neighborhoods, Javelin Strategy and Research found in a recent survey.

January 18 -

High inflation, rising interest rates and increased economic uncertainty may be telegraphing a further slowdown in U.S. new household formation during the closing months of 2022.

January 16 -

The most extreme example of FOMC interest rate market manipulation in 2020 to 2021 has now created a huge potential risk for lenders and investors, writes the chairman of Whalen Global Advisors.

January 12 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

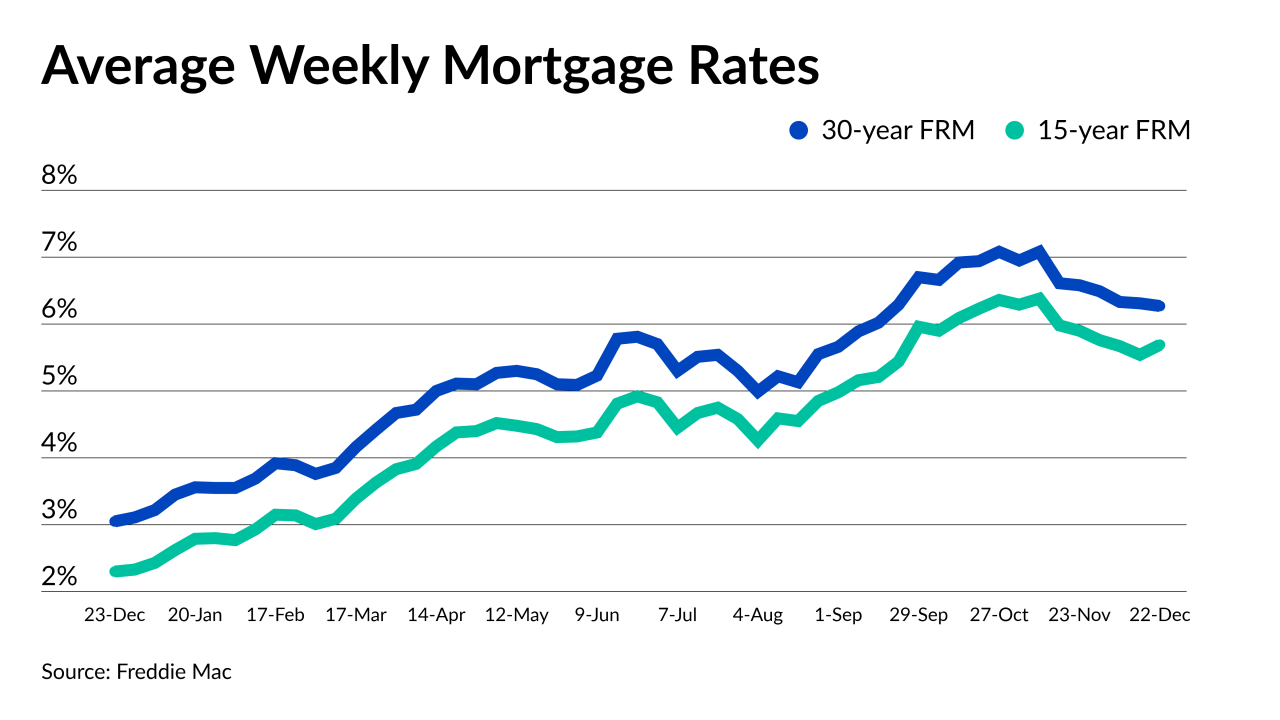

The 30-year fixed loan rate dropped 15 basis points compared with last week as bond market investors acted in advance of this morning's Consumer Price Index report.

January 12 -

The U.S. Supreme Court turned away four appeals from shareholders of the government-sponsored enterprises who said they were entitled to compensation after the Treasury collected more than $100 billion in profits from the government-sponsored enterprises.

January 9 -

Declining mortgage rates and home prices drove more positive views compared to the prior month, but December's overall outlook remained negative, Fannie Mae said.

January 9 -

However, the jobs picture for December was better than what was expected, the Bureau of Labor Statistics data found.

January 6 -

The sector is not immune to the same economic instability that affects the single-family residential market, the Mortgage Bankers Association said.

January 5 -

However, trackers from Optimal Blue and Zillow found that rates moved in line with the drop in the 10-year Treasury yield.

January 5 -

Difficult economic conditions will persist, with inflation and a potential recession weighing on minds, but investment in mortgage technology remains a priority, according to new survey research.

January 5 -

Special purpose credit programs, down payment assistance and potential mortgage insurance premium cuts came into focus over the past year.

December 29 -

The past 12 months were chock full of impactful changes to the home lending industry but keep an eye on these in particular in the new year.

December 28 -

But the 15-year interest rate rose last week, in line with 10-year Treasury yields, as bond investors used a quiet week to reflect on broader trends.

December 22