-

A Florida-based loan servicing company has agreed to pay $84,000 to cover attorneys fees, penalties and costs associated with improper foreclosures it initiated in Maine, the state said.

August 7 -

A Sacramento CEO has pleaded guilty to embezzling funds from his employees' pensions, according to the U.S. Attorney for the Eastern District of California.

August 2 -

Former Lend America executive Michael Ashley was sentenced to three years in prison for his actions that led to the implosion of the once-high-flying Melville, N.Y.-based mortgage lender.

July 18 -

A builder based near the Lake of the Ozarks swindled six families that sought new homes in Kirkwood, Mo., out of $356,000, the builder's federal plea agreement says.

July 16 -

A Nomura Holdings Inc. unit will repay customers about $25 million to settle U.S. regulators' allegations that it failed to supervise traders who made false statements in negotiating sales of mortgage securities.

July 15 -

An Indiana man was sentenced to seven years in federal prison after his conviction for participating in a foreclosure rescue fraud scheme.

July 5 -

A Bay Area real estate agent has been indicted on charges of fraud and money laundering after allegedly promising home loans to clients then taking their money.

July 5 -

The Government Accountability Office called on Ginnie Mae to undertake four reforms to its operations, citing concerns regarding the ongoing shift in size and capitalization of mortgage-backed securities issuers.

May 10 -

With nearly $90 million added in the past two months, Goldman Sachs marched closer to its $1.8 billion consumer-relief mortgage settlement with the U.S. Department of Justice.

May 2 -

The Department of Financial Services has created a statewide financial protection division focused on corporate compliance and consumer issues, in line with steps taken by New Jersey and Pennsylvania.

April 30 -

New licensing rules for mortgage professionals servicing loans secured by New Jersey properties will go into effect this summer, adding to a trend toward tighter state regulation of standalone servicers.

April 30 -

The debt collection proposal is expected to address how debt collectors can use text messages and emails to track down debtors.

April 29 -

Two Sacramento, Calif., defendants were found guilty of wire fraud stemming from a fraudulent real estate company that targeted members of Sacramento's Latino community, according to the U.S. Attorney's Office.

April 26 -

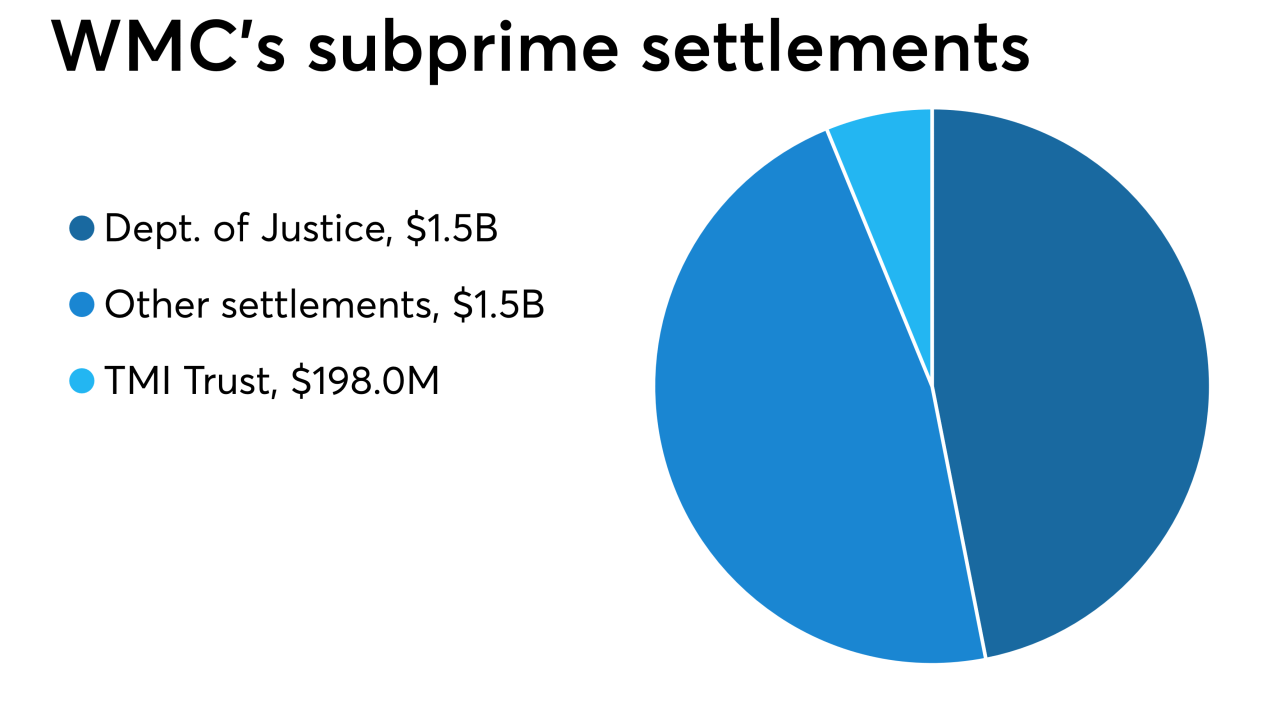

General Electric placed its WMC Mortgage unit into Chapter 11 bankruptcy protection as it has nearly $1.7 billion in legal settlements agreed to or pending.

April 24 -

General Electric Co. finalized an agreement to pay $1.5 billion to settle a U.S. investigation into the manufacturer's defunct subprime mortgage business.

April 12 -

A Staten Island, N.Y., man involved in a $2.5 million real estate investment scheme that targeted investors, many of whom were elderly and some of whom had dementia, was sentenced to three years in prison.

April 8 -

The legislation comes a day before CFPB Director Kathy Kraninger is set to testify to Congress.

March 6 -

Ginnie Mae has restricted loanDepot's ability to securitize Veterans Affairs mortgages because of apparent churning of recent originations.

January 30 -

The same TILA-RESPA integrated disclosure errors continue to plague mortgage lenders, though those documents have been required for over three years, a report from MetaSource said.

January 29 -

New York State is providing additional funding to municipalities that will boost efforts regarding mortgage servicer compliance with the state and local vacant property laws.

January 28