-

More so than their colleagues nationwide, originators in the Southeast are concerned about how supply impacts their business.

September 8 -

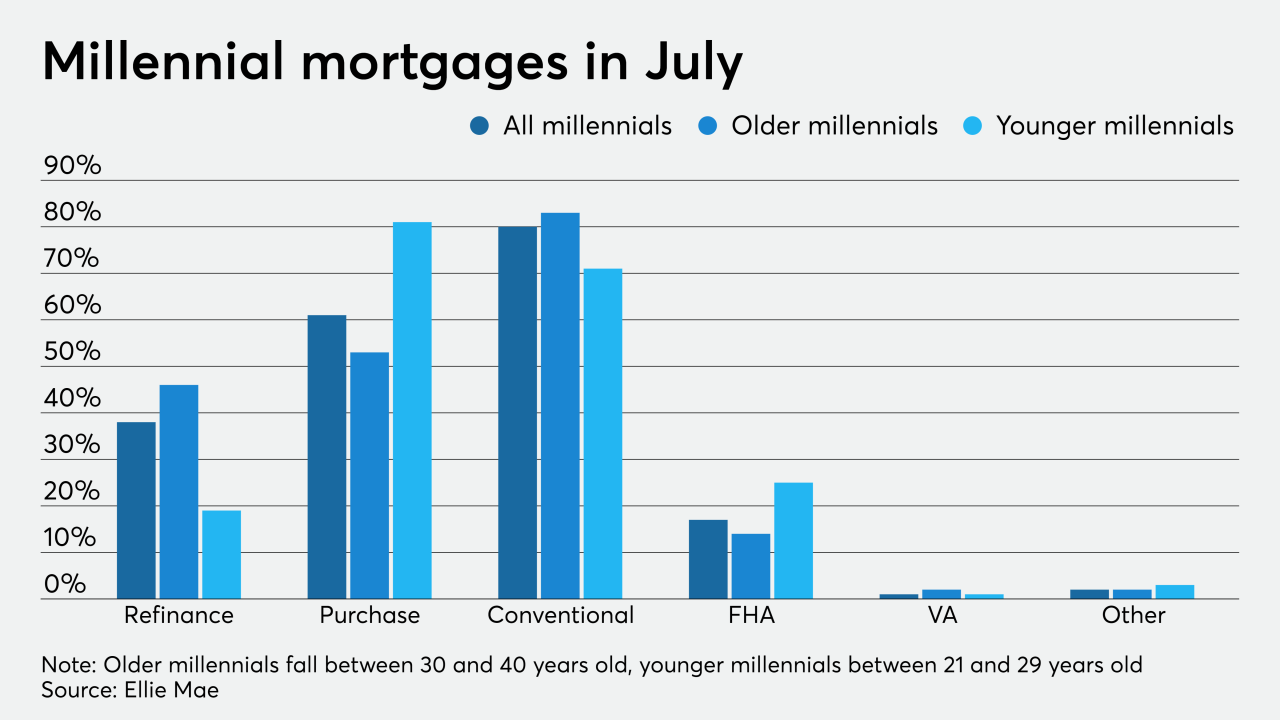

Millennials locked in the lowest mortgage rates on record and kept the summer housing market hot, according to Ellie Mae.

September 2 -

Driven by robust purchase demand and tight housing supply, housing price growth reached a two-year high in July, according to CoreLogic.

September 1 -

Like much during the pandemic, the latest news on home prices inspires a definite sense of deja vu.

August 26 -

About 54% of properties underwent bidding wars in July with some metro areas peaking at 75%, according to Redfin.

August 10 -

Seeking to reverse a decades-long disparity in homeownership, the Urban League of Greater Madison has launched a $5 million initiative to help more Black Madisonians own their own homes.

August 7 -

The American Dream Down Payment Act would let states establish and manage accounts, which would be similar in structure to 529 college savings plans.

August 6 -

With over 4 million millennials entering prime home buying age each year through 2023, purchase activity will be driven much higher, according to Ellie Mae.

August 5 -

Housing prices continued to grow in June, maintaining a streak in monthly increases that began in February 2012. But the trend could be reversed in 2021 with the resurgent effects of the coronavirus, according to CoreLogic.

August 4 -

The U.S. homeownership rate, led by young buyers, jumped to the highest since 2008, signaling that the housing boom underway before the pandemic has only accelerated.

July 28 -

Almost six in 10 completely agreed that company-provided technology met or exceeded their expectations.

July 23 -

The new normal created by the events so far in 2020 could make this the best year ever for lenders.

July 22 Paragon Digital Marketing Group

Paragon Digital Marketing Group -

Down payment assistance programs remain an important tool for increasing minority homeownership, but especially more so because of the pandemic.

July 14 Mountain Lake Consulting

Mountain Lake Consulting -

But the coronavirus put a hold on the market in April and remains an overhanging cloud for the future.

June 25 -

With the average borrower needing over two decades to save a 20% down payment for the median-priced home, private-mortgage-insured loans experienced major growth in 2019.

June 22 -

Framework Homeownership CEO Danielle Samalin helped support consumer organizations after the housing bubble burst. Now she’s using that experience to help borrowers and homebuyers navigate new challenges.

June 8 -

From the Midwest to mid-Atlantic, here's a look at 12 housing markets where first-time homebuyers find the most affordability, according to NerdWallet.

May 20 -

In a study of four metro areas, housing supply and demand gained momentum in the second half of April, even where the COVID-19 curve continued to grow.

May 11 -

As the coronavirus takes a major toll on housing inventory and credit availability, pent-up buyer demand could lead to market recovery, according to Redfin.

May 1 -

The Federal Housing Administration has provided struggling homeowners with payment flexibility and explored other measures. At the same time, the agency is mindful of protecting itself against downside risks.

April 23

![“We want to make sure that our cash [inflows] exceed our cash outflows, so again, we’re looking at a lot of different things, and premiums being one of them, but there are other things that we’re considering as well," FHA Commissioner Brian Montgomery said.](https://arizent.brightspotcdn.com/dims4/default/15b0d4f/2147483647/strip/true/crop/1260x709+0+0/resize/1280x720!/quality/90/?url=https%3A%2F%2Fsource-media-brightspot.s3.us-east-1.amazonaws.com%2Fc0%2Fd2%2F5bd96a5a4a9eb632ac3bfd4b8da9%2Fmontgomery-brian-fha.png)