"When these factors are compounded by high sticker prices, low supply — and then the economic

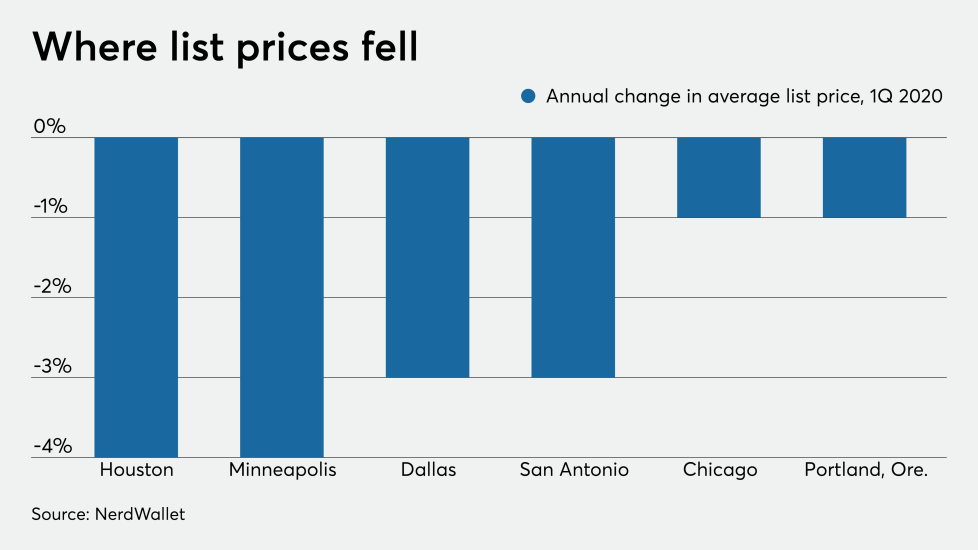

Searching for a starter home can be especially difficult in major metropolitan areas, where high demand translates to high pricing. Many housing markets along the California coast, for example, have an average listing price that's up to 12 times residents' incomes.

However, the study reveals that more than half of the 50 U.S. metro areas covered in the study are relatively affordable.

NerdWallet's analysis compares the median incomes of consumers between 25- and 44-years-old with the median home list prices in the opening quarter of 2020. The smaller the affordability ratio, the less of a financial burden for the buyer to purchase the home.

Here's a look at 12 housing markets where first-time homebuyers find the most affordability, according to NerdWallet.

No. 12 Indianapolis, Ind.

Median first-time homebuyer income 1Q 2020: $66,726

Median list price 1Q 2020: $275,182

No. 11 Minneapolis, Minn.

Median first-time homebuyer income 1Q 2020: $91,337

Median list price 1Q 2020: $373,137

No. 10 Birmingham, Ala.

Median first-time homebuyer income 1Q 2020: $63,362

Median list price 1Q 2020: $256,148

No. 9 Chicago, Ill.

Median first-time homebuyer income 1Q 2020: $78,689

Median list price 1Q 2020: $316,791

No. 8 Philadelphia, Pa.

Median first-time homebuyer income 1Q 2020: $78,112

Median list price 1Q 2020: $294,837

No. 7 Baltimore, Md.

Median first-time homebuyer income 1Q 2020: $87,154

Median list price 1Q 2020: $321,025

No. 6 Detroit, Mich.

Median first-time homebuyer income 1Q 2020: $67,134

Median list price 1Q 2020: $232,376

No. 5 Hartford, Conn.

Median first-time homebuyer income 1Q 2020: $82,261

Median list price 1Q 2020: $278,002

No. 4 Buffalo, N.Y.

Median first-time homebuyer income 1Q 2020: $64,042

Median list price 1Q 2020: $200,042

No. 3 Cleveland, Ohio

Median first-time homebuyer income 1Q 2020: $62,042

Median list price 1Q 2020: $191,396

No. 2 St. Louis, Mo.

Median first-time home buyer income 1Q 2020: $71,956

Median list price 1Q 2020: $221,364

No. 1 Pittsburgh, Pa.

Median first-time homebuyer income 1Q 2020: $74,549

Median list price 1Q 2020: $201,557