-

Sales of previously owned U.S. homes rose to a four-month high, indicating demand was firming at the start of the quarter as the impact from the late summer hurricanes faded, according to a National Association of Realtors report.

November 21 -

Potential first-time home buyers can save money for a down payment if they are able to use a special account just for that purpose.

November 17 Bilt Rewards

Bilt Rewards -

Over half of mortgage industry executives anticipate first-time home buyer growth in 2018, estimating that market will grow at a faster pace than the overall housing market, according to Genworth Financial.

November 17 -

As the economy improves and millennials move around the country in search of jobs, some are finding themselves far from the youth culture they learned to expect from city life in other parts of the country.

November 9 -

With home values projected to rise in every major U.S. metro in 2018, a 20% down payment will cost thousands of dollars more, according to Zillow.

November 9 -

Serious delinquencies on Federal Housing Administration loans popular among first-time home buyers with affordability constraints have improved this year, but may be reaching a plateau.

November 6 -

Millennials took advantage of lower interest rates in September to refinance their mortgages, according to Ellie Mae.

November 1 -

Homes on Staten Island are reaching "unaffordable levels," at a time when there are less homes on the market than buyers who want to purchase them.

October 31 -

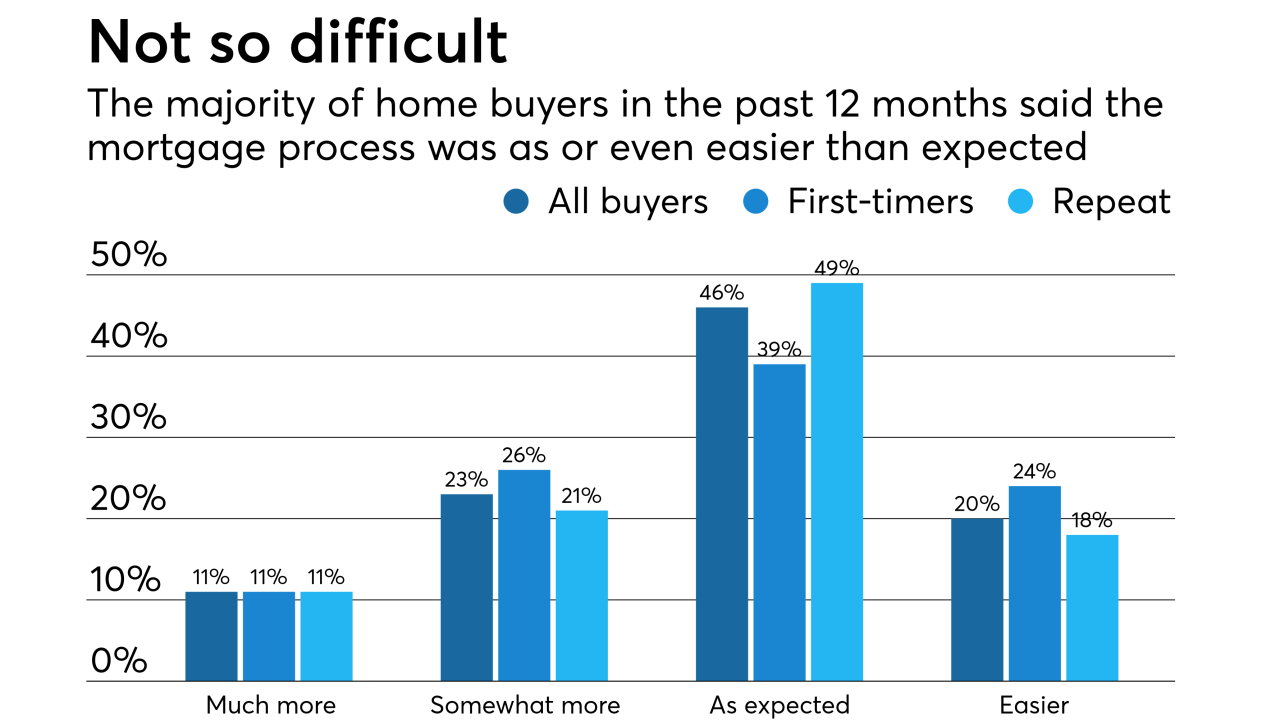

Recent home buyers found it easier getting a mortgage compared with last year's purchasers, but first-timers are being held back by a lack of inventory and student debt, according to a National Association of Realtors survey.

October 31 -

A flurry of new townhouses and suburban starter homes is helping boost homebuilding in the Twin Cities metro.

October 30 -

To protect veterans from predatory lending practices, Ginnie Mae and the Department of Veterans Affairs should remove lenders' financial incentive for originating Interest Rate Reduction Refinance Loans.

October 20 Chrysalis Holdings

Chrysalis Holdings -

A shortage of entry-level houses is putting a chill on the housing market in the Twin Cities.

October 18 -

With the housing crisis and the Great Recession well in the rear-view mirror, more and more credit unions are offering mortgage options with low or no down payment requirements.

October 17 -

Rising home prices, wages that haven't kept pace with those increases and high levels of student debt are forcing first-time home buyers on Long Island, N.Y., to find creative ways to afford the biggest purchase of their lives.

October 16 -

The gap between what consumers think a home is worth and its appraised value narrowed in September because of rising prices due to the continued inventory shortage.

October 11 -

Where do millennials go when they want the advantages of a big-city economy, job market and lifestyle but they can't afford the higher cost-of-living? Some are choosing Owensboro, Ky.

October 10 -

As a year of record-breaking home-price increases continues across the Seattle area, millennials and other first-time buyers are coming to grips with the reality that they simply can't save up quickly enough to match the rise in home costs.

October 6 -

Here's a look at 12 cities where the median home sales price is below $215,000, but the combination of housing costs, local wages and other market forces is making home purchasing power disappear in these once-cheapest places to live.

October 5 -

Building off the success of policy changes in 2016, there are now even more ways for mortgage lenders to help student loan borrowers become homeowners.

October 4 Bilt Rewards

Bilt Rewards -

In housing markets dominated by young borrowers, millennials took an even bigger share of overall mortgage activity in August.

October 4