-

Nondepository mortgage bankers and brokers employment dipped slightly in July, ending a four-month run of hiring pickups.

September 1 -

The volume of homes sold to first-time buyers during the second quarter reached a high not seen since 1999 and accounted for more than half of purchase mortgage originations.

August 30 -

Millennial credit scores are lower than when Generation X consumers were coming of age, reflecting changes in credit consumption and other consumer behaviors.

August 30 -

Wells Fargo forced borrowers to pay millions of dollars in fees to extend interest rate locks that expired due to the bank's delays in processing mortgage applications, a lawsuit claims.

August 29 -

Homeowners are eager to hold onto the ultra-low mortgage interest rates they were able to get after the crash, and they are leery about taking a chance on a move.

August 28 -

A decline in purchases of new homes in July may be a sign the industry took a breather following an even stronger run of sales than previously reported.

August 23 -

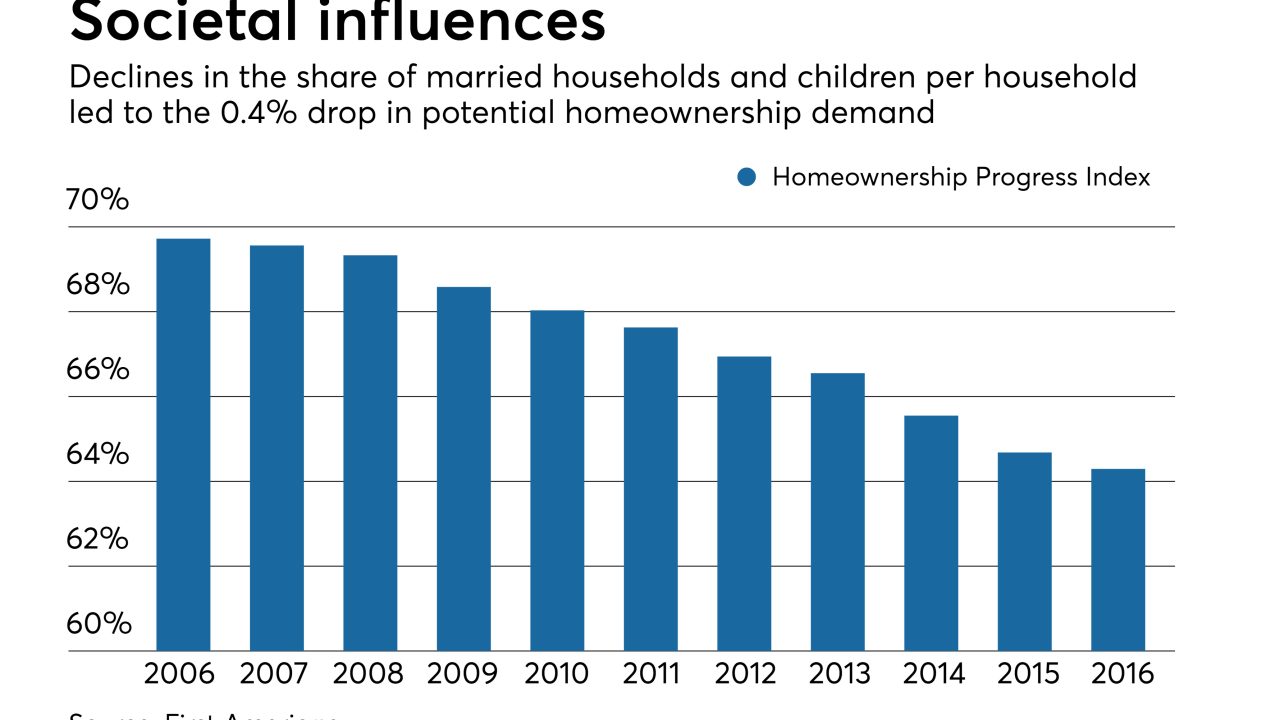

Though potential homeownership demand declined moderately between 2015 and 2016, the underlying fundamentals for demand remained positive.

August 18 -

Affordability issues along with a lack of knowledge about home buying are holding millennials back from pursuing homeownership, according to a survey from loanDepot.

August 16 -

FHA loans made to millennial home buyers have been steadily decreasing the past four months, indicating they may be able to afford more at the moment.

August 10 -

People 55 and older own 53% of U.S. owner-occupied houses, the biggest share since the government started collecting data in 1900.

August 8 -

For the first time ever, the median King County, Wash., home price has grown more than $100,000 in just a year, a new grim milestone for buyers already dealing with the hottest housing market in the country.

August 8 -

From funding sources to home prices, here's a look at five questions lenders must ask themselves before they can safely originate 1% down mortgages.

August 7 -

Housing construction in the Twin Cities metro rose nearly 17 percent in July, but most of that gain was apartments.

August 3 -

Garden State Home Loans has launched a 1% down payment program for first-time buyers, opening the door for millennial purchasers.

August 1 -

The cheapest housing markets aren't always the most affordable cities for first-time home buyers and existing homeowners. Here's a look at 12 cities with low home prices, but where other factors put a damper on purchasing power.

July 31 -

Home prices in South Florida increased 5.3% in May from a year ago, a sign that recent gains are moderating, a new report shows.

July 28 -

About 33% of millennials who purchased their first home say the desire to have a better space or yard for a dog influenced their decision to buy.

July 27 -

JPMorgan Chase’s home lending unit is trying to position itself as the solution for millennials who increasingly want to buy their first homes despite rising prices and other affordability hurdles.

July 26 -

Sales of existing homes grew less than 1% in June in Wisconsin and the United States, held back by a short supply of houses for sale.

July 25 -

Steady price gains in 20 U.S. cities in May indicate that a tight supply of properties paired with increased demand is boosting home values.

July 25