-

The Federal Housing Administration said in its annual actuarial report that the capital reserve ratio on its mutual mortgage insurance fund increased to 6.10% in fiscal year 2020, up from 4.84% a year earlier.

November 13 -

Rick Thornberry discusses the company's third-quarter results and the decision to drop traditional appraisals.

November 11 -

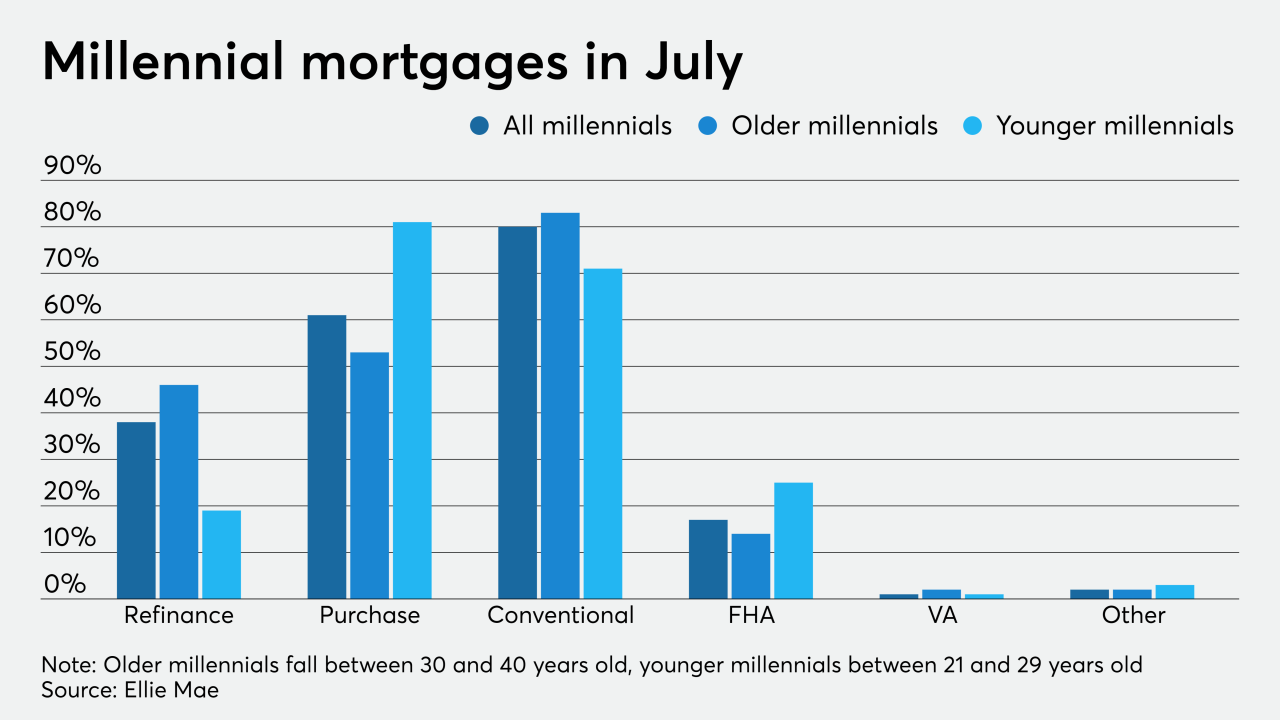

More borrowers between 21 and 40 are leveraging the historically low mortgage rates to either buy their first homes or slash their monthly payments, according to Ellie Mae.

November 4 -

In the first episode of the five-part Arizent documentary series, we look at how disparities in net worth and mortgage discrimination impact Black home ownership — and why it's impossible to close the gaps without attacking systemic racism.

October 26 -

In the first episode of the five-part documentary series, we look at how disparities in net worth and mortgage discrimination impact Black home ownership — and why it's impossible to close the gaps without attacking systemic racism.

October 26 -

The number of bidding wars increased for the fifth straight month, with Salt Lake City posting the highest rate of competitive listings in two years, according to Redfin.

October 20 -

Millennials continue to lock in the lowest average mortgage rates on record, keeping lenders busy and the housing market churning, according to Ellie Mae.

October 7 -

When the economy inevitably slides, leaders with a culture based on the mantra, "Treat people like family, and the money will take care of itself," won't need a miracle to survive.

October 6 Incenter

Incenter -

Whether low rates will continue to outweigh health and employment concerns for millennials and Generation Z remains to be seen.

October 2 -

Mortgage rates remained relatively flat, rising a single basis point off of last week's record low, according to Freddie Mac.

September 17 -

More so than their colleagues nationwide, originators in the Southeast are concerned about how supply impacts their business.

September 8 -

Millennials locked in the lowest mortgage rates on record and kept the summer housing market hot, according to Ellie Mae.

September 2 -

Driven by robust purchase demand and tight housing supply, housing price growth reached a two-year high in July, according to CoreLogic.

September 1 -

Like much during the pandemic, the latest news on home prices inspires a definite sense of deja vu.

August 26 -

About 54% of properties underwent bidding wars in July with some metro areas peaking at 75%, according to Redfin.

August 10 -

Seeking to reverse a decades-long disparity in homeownership, the Urban League of Greater Madison has launched a $5 million initiative to help more Black Madisonians own their own homes.

August 7 -

The American Dream Down Payment Act would let states establish and manage accounts, which would be similar in structure to 529 college savings plans.

August 6 -

With over 4 million millennials entering prime home buying age each year through 2023, purchase activity will be driven much higher, according to Ellie Mae.

August 5 -

Housing prices continued to grow in June, maintaining a streak in monthly increases that began in February 2012. But the trend could be reversed in 2021 with the resurgent effects of the coronavirus, according to CoreLogic.

August 4 -

The U.S. homeownership rate, led by young buyers, jumped to the highest since 2008, signaling that the housing boom underway before the pandemic has only accelerated.

July 28