-

JPMorgan Chase may be leading the next trend for banks seeking to shift risk away from their mortgage portfolios — if regulators give Wall Street the green light.

November 13 -

And the government-sponsored enterprises could hold initial public offerings in 2021 or 2022 to ensure they hold adequate capital, FHFA Director Mark Calabria said.

November 13 -

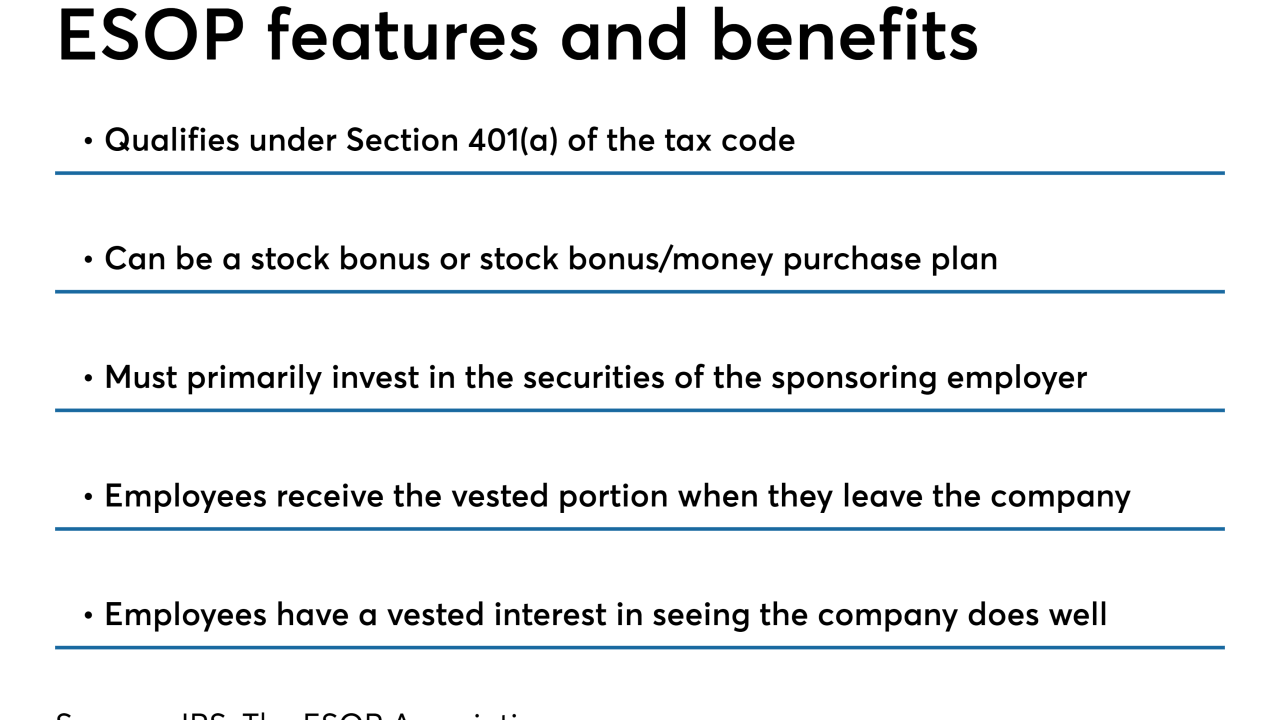

The American Mortgage Network name is being revived again, this time for a de novo company that will be 100% employee owned.

November 13 -

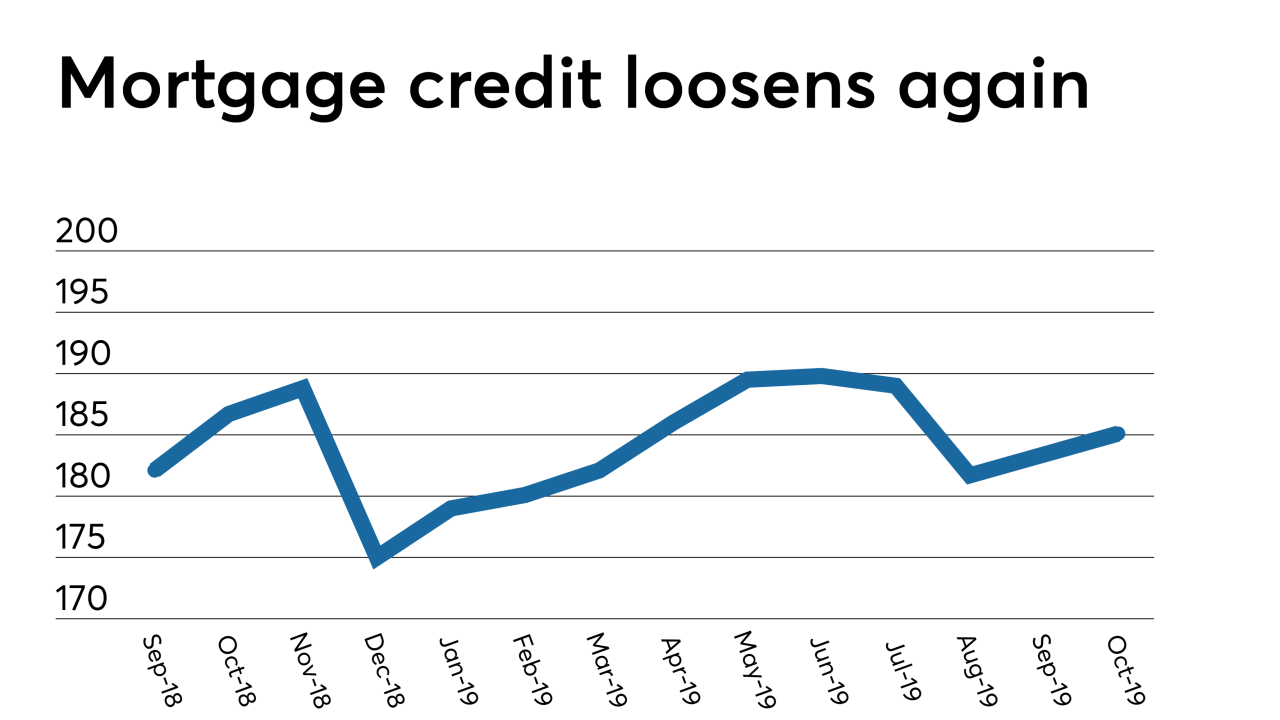

Mortgage credit availability increased in October from the previous month, as mortgage lenders increased their product offerings outside the government market, according to the Mortgage Bankers Association.

November 12 -

Fannie Mae and Freddie Mac’s exemption from the Qualified Mortgage rule is on borrowed time, but a House bill would allow lenders to use the mortgage giants’ guidelines for documenting borrower income.

November 12 -

The two newest private mortgage insurance companies had their best quarters ever for new insurance written, aided by the increase in consumers refinancing with less than 20% home equity.

November 8 -

Though still comparatively strong, consumer confidence in the housing market dropped again in October in response to economic uncertainty and lack of affordability, according to Fannie Mae.

November 7 -

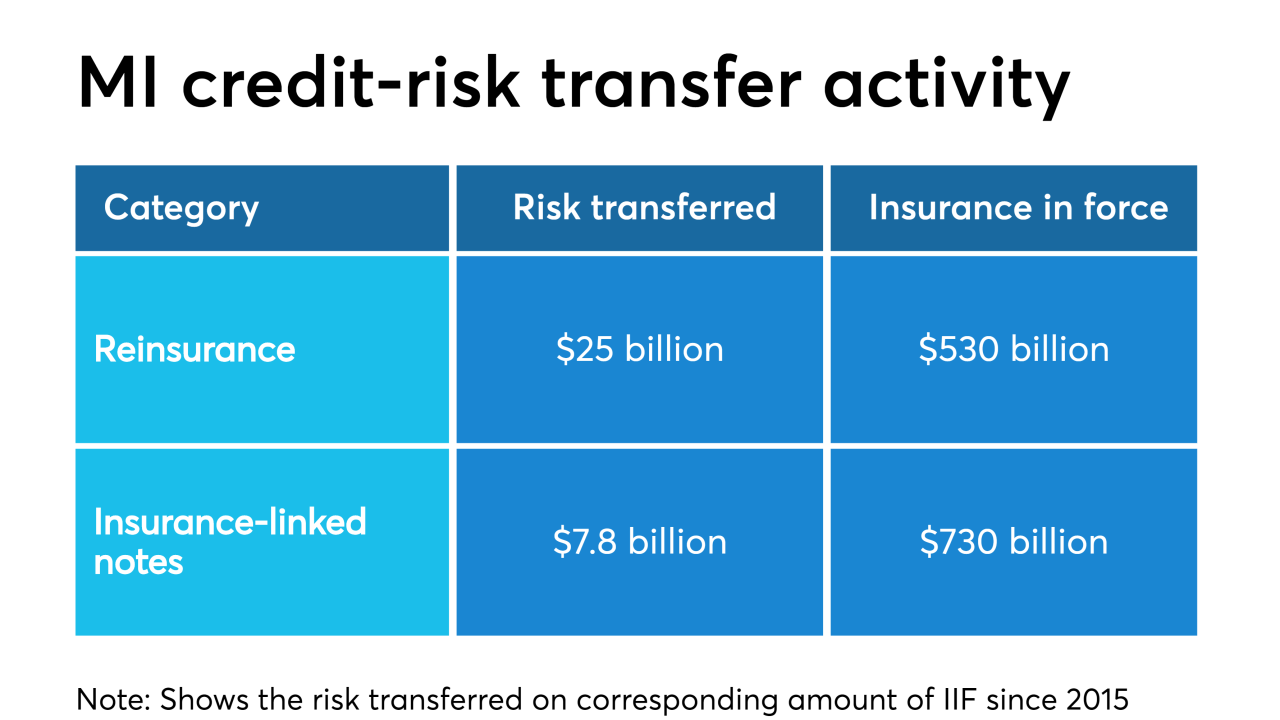

An increase in credit risk transfer activity since 2015 signifies a sea change for private mortgage insurers that may be about to intensify, according to an industry trade group.

November 5 -

The Supreme Court is ready to weigh in on the CFPB’s leadership structure, but both agencies are facing similar constitutional challenges, suggesting a broader impact of any decision.

November 4 -

The Federal Housing Finance Agency is seeking comment on a proposal that could pave the way for potential Fannie Mae and Freddie Mac competitors to use the uniform mortgage-backed security structure.

November 4 -

Early payment mortgage defaults went to the highest level in nearly a decade, particularly among loans included in Ginnie Mae securities, a Black Knight report said.

November 4 -

Freddie Mac is now forecasting back-to-back years of $2 trillion in mortgage loan originations rather than a drop-off in 2020.

November 1 -

More private mortgage insurers reported significant year-over-year gains in new business during the third quarter, mainly driven by the increase in refinance volume.

October 31 -

A risk management model revision that decreased single-family loan-loss allowances and a strong mortgage lending environment contributed to consistent earnings results at Fannie Mae in the third quarter.

October 31 -

Freddie Mac will make haste to leave conservatorship in line with new regulatory directives, but it's uncertain how quickly it can move, CEO David Brickman said in an earnings call.

October 30 -

A lower court “erred” when it sided with Fannie Mae and Freddie Mac’s investors, the Justice Department said in its petition to the high court.

October 30 -

VantageScore totaled 12.3 billion scores across consumer credit loan categories over a 12-month period between 2018 and 2019 with minimal mortgage volume, leaving potential for a major ramp up.

October 29 -

When it comes to possible new competitors in the secondary market, the heads of the two current outlets more than welcomed the possibility of additional players in their space because of housing finance reform.

October 28 -

Ginnie Mae is looking for input on its proposed guidelines for electronic promissory notes and other mortgage documents that it plans to test through a digital collateral pilot.

October 28 -

The regulator of Fannie Mae and Freddie Mac discussed steps the companies have already taken to limit their risk, as well as efforts to prevent housing market “overlap” with the FHA.

October 28