-

From medical expenses to home improvements, here's a look at some of the most frequently cited reasons homeowners are borrowing against their home equity.

June 26 -

Though mortgage originations were down overall in the first quarter, home equity lines of credit spiked on higher home prices, according to Attom Data Solutions.

June 14 -

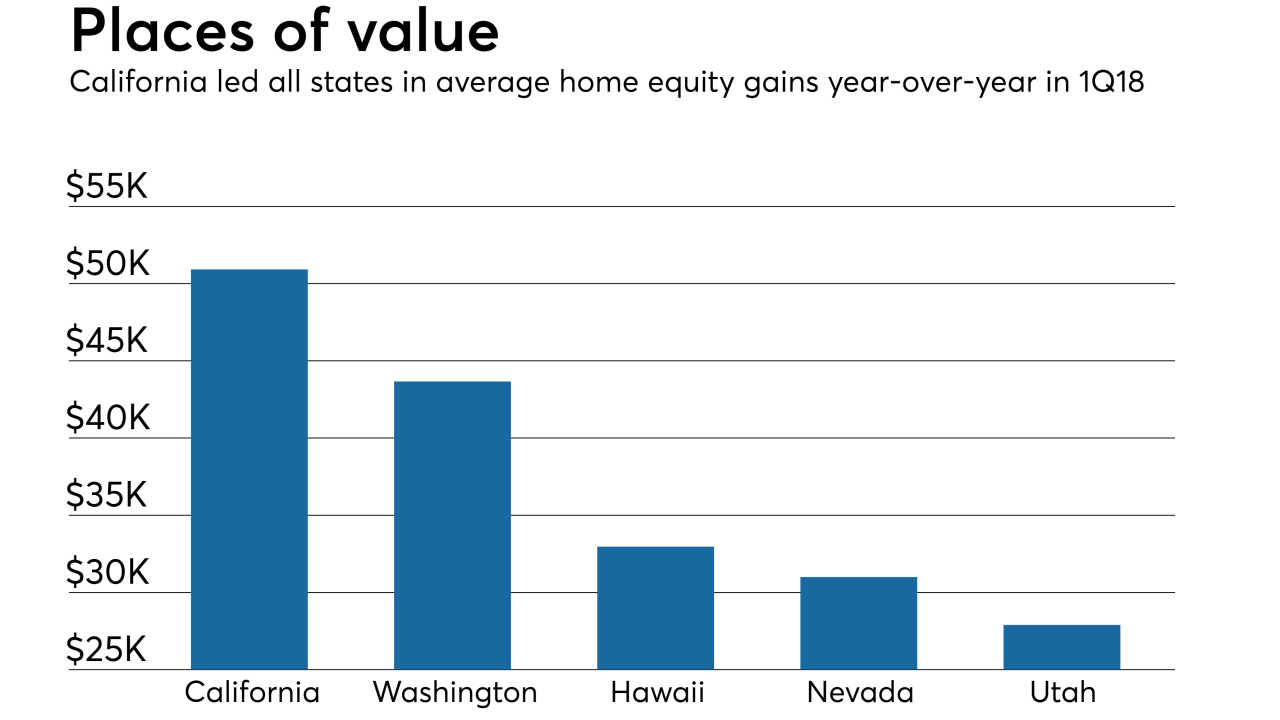

As house values continued growing, homeowners with mortgages saw their equity increase 13.3% year-over-year in the first quarter, a gain of over $1.01 trillion, according to CoreLogic.

June 8 -

The post-recession boom in auto loans and credit cards for borrowers with marred credit histories has been winding down in recent months.

May 17 -

Businesses are investing more, people are finding jobs, and inflation is picking up, meaning higher interest rates for homebuyers.

April 26 -

HELOCs make up just 2.9% of the $281 million pool of collateral; 81.8% of the HELOC borrowers are currently ineligible to make draws; another 18.2% are permanently frozen.

April 16 -

Mortgage borrowers collectively hold more equity in their homes than at any other time on record, but they've been slow to borrow against this newfound wealth, according to Black Knight.

April 2 -

Banks that scored high in customer-satisfaction ratings did so for their front-line service, not their tech capabilities, a study finds.

March 30 -

Despite growth in senior-held mortgage debt, home equity for homeowners 62 and older grew to $6.6 trillion in the fourth quarter, according to the National Reverse Mortgage Lenders Association and RiskSpan.

March 28 -

President Donald Trump's new tax law set off a false alarm for homeowners planning to borrow against the equity in their houses.

March 19