-

Home equity lenders expect origination activity to remain dreary through next year even though consumers can potentially access more proceeds now than in 2006, a Mortgage Bankers Association survey found.

September 3 -

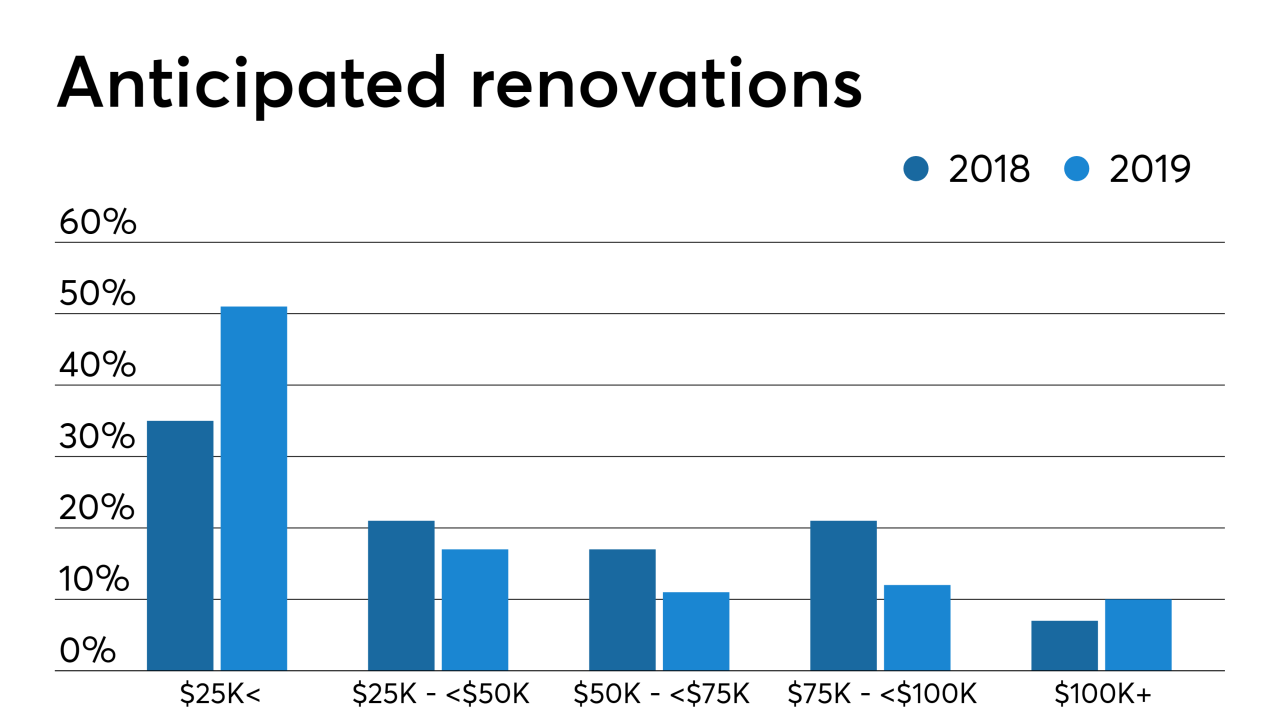

With nearly half of homeowners renovating in the next two years, HELOCs stand as the most likely form of lending sought out by consumers, according to TD Bank.

July 10 -

Cerberus affiliate FirstKey Mortgage will pool outstanding first- and second-lien loans totaling $277.7 million drawn from 1,732 seasoned and performing HELOCs.

June 14 -

It’s the one consumer loan category where balances continue to fall, and disruption from nimbler fintechs is a big reason why. To win back market share, banks will need to beat the upstarts at their own game.

June 7 -

The shift to nonbank lenders will put the breaks on non-qualified mortgage and home equity line of credit origination growth.

May 20 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

Live Well Financial, a reverse and traditional mortgage lender that abruptly stopped originating on May 3, will lay off 103 employees, according to a Virginia Employment Commission filing.

May 7 -

The number of homeowners likely to qualify for a refinance nearly doubled in a single week following the largest mortgage rate decline since the housing bubble burst, according to Black Knight.

April 1 -

Point, which provides an alternative to traditional home equity lending products, has raised $122 million in new capital from eight investors to expand its reach.

March 20 -

Home equity is at an all-time high, but consumers aren't taking advantage of this financing option, according to LendingTree.

March 19 -

Having an all-digital process results in lower customer satisfaction for home equity line of credit providers than an all in-person or a mix of methods, a J.D. Power survey found.

March 14