-

The mortgage delinquency rate dropped to its lowest level in 12 years despite foreclosure starts and active foreclosures both increasing in July, according to Black Knight.

September 10 -

The gap between equity-rich homeowners and mortgage borrowers who are seriously underwater narrowed in the second quarter, highlighting the uneven nature of the housing market's recovery since the Great Recession.

August 9 -

Despite available home equity shooting up in the first quarter, the share of total equity withdrawn by borrowers hit a four-year low, likely due to an increase in interest rates, according to Black Knight.

July 9 -

From medical expenses to home improvements, here's a look at some of the most frequently cited reasons homeowners are borrowing against their home equity.

June 26 -

Though mortgage originations were down overall in the first quarter, home equity lines of credit spiked on higher home prices, according to Attom Data Solutions.

June 14 -

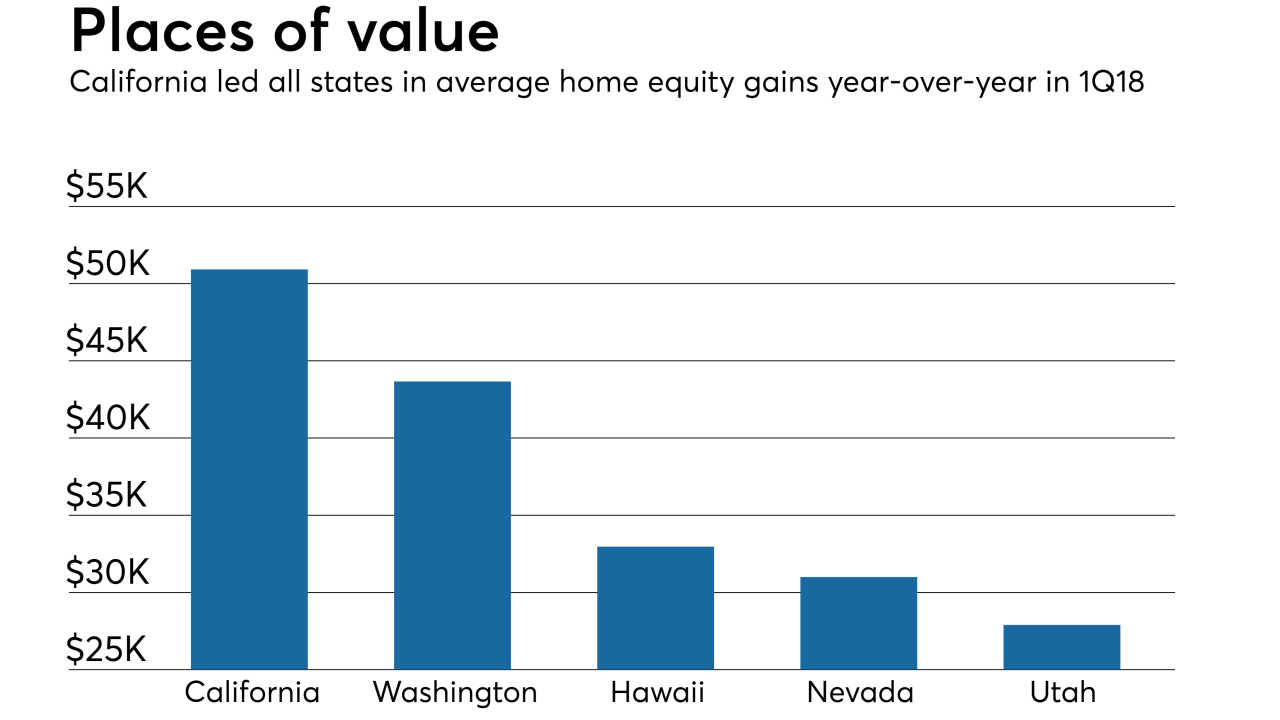

As house values continued growing, homeowners with mortgages saw their equity increase 13.3% year-over-year in the first quarter, a gain of over $1.01 trillion, according to CoreLogic.

June 8 -

The post-recession boom in auto loans and credit cards for borrowers with marred credit histories has been winding down in recent months.

May 17 -

Businesses are investing more, people are finding jobs, and inflation is picking up, meaning higher interest rates for homebuyers.

April 26 -

HELOCs make up just 2.9% of the $281 million pool of collateral; 81.8% of the HELOC borrowers are currently ineligible to make draws; another 18.2% are permanently frozen.

April 16 -

Mortgage borrowers collectively hold more equity in their homes than at any other time on record, but they've been slow to borrow against this newfound wealth, according to Black Knight.

April 2 -

Banks that scored high in customer-satisfaction ratings did so for their front-line service, not their tech capabilities, a study finds.

March 30 -

Despite growth in senior-held mortgage debt, home equity for homeowners 62 and older grew to $6.6 trillion in the fourth quarter, according to the National Reverse Mortgage Lenders Association and RiskSpan.

March 28 -

President Donald Trump's new tax law set off a false alarm for homeowners planning to borrow against the equity in their houses.

March 19 -

Residential mortgage originations fell 19% year-over-year in the fourth quarter of 2017, due primarily to a large drop in refinance volume, according to Attom Data Solutions.

March 16 -

Recent developments in the Federal Housing Administration's Home Equity Conversion Mortgage program are making it easier for lenders to originate reverse mortgages to borrowers who want to buy a new-construction home.

March 6 -

Canadians are borrowing against their houses at the fastest pace in more than five years, as home equity lines of credit emerge as a preferred means of accessing funds.

February 20 -

It was a record-setting year in terms of the low number of foreclosure starts, partially helped by the various post-storm moratoria, according to Black Knight.

February 5 -

Home remodeling activity reached a high not seen since 2001, signaling homeowners are either gearing up to sell their properties or committing to staying put for a bit longer.

January 22 -

The New York bank has begun marketing Marcus loans as a way to pay for home improvements, while also raising the maximum loan size to $40,000.

January 16 -

Homeowners can tap into more home equity than ever before, but deciding between a home equity line of credit and cash out refinance mortgage has gotten more complicated following recently passed tax reforms.

January 8