-

New-home construction fell in September on a decline in the South that may reflect disruptions from Hurricane Florence, government figures showed Wednesday.

October 17 -

While mortgage volume is expected to shrink next year, it should increase during the following two years and beyond as millennials start buying homes, the Mortgage Bankers Association forecasts.

October 16 -

Confidence among homebuilders unexpectedly rose in October, registering the first gain in five months amid falling lumber prices and solid demand.

October 16 -

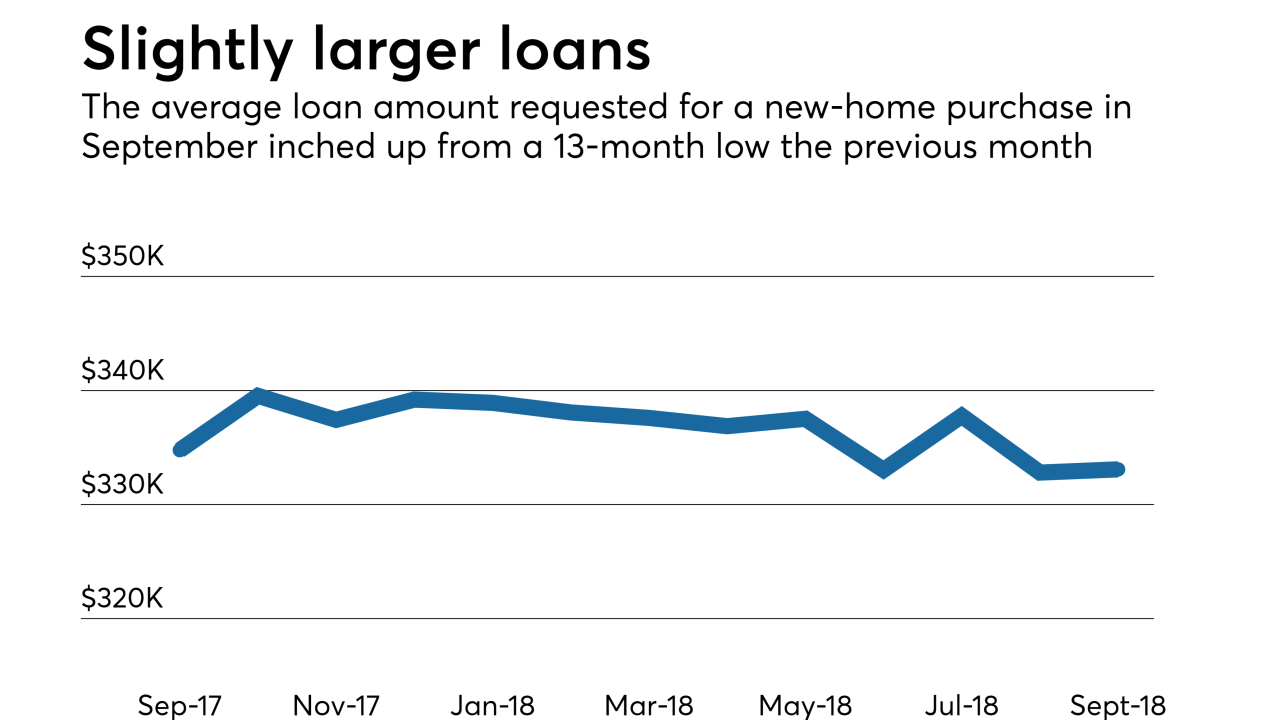

Mortgage borrowers buying new homes generated more loan applications this September than they did a year ago, even though interest rates are higher this year.

October 11 -

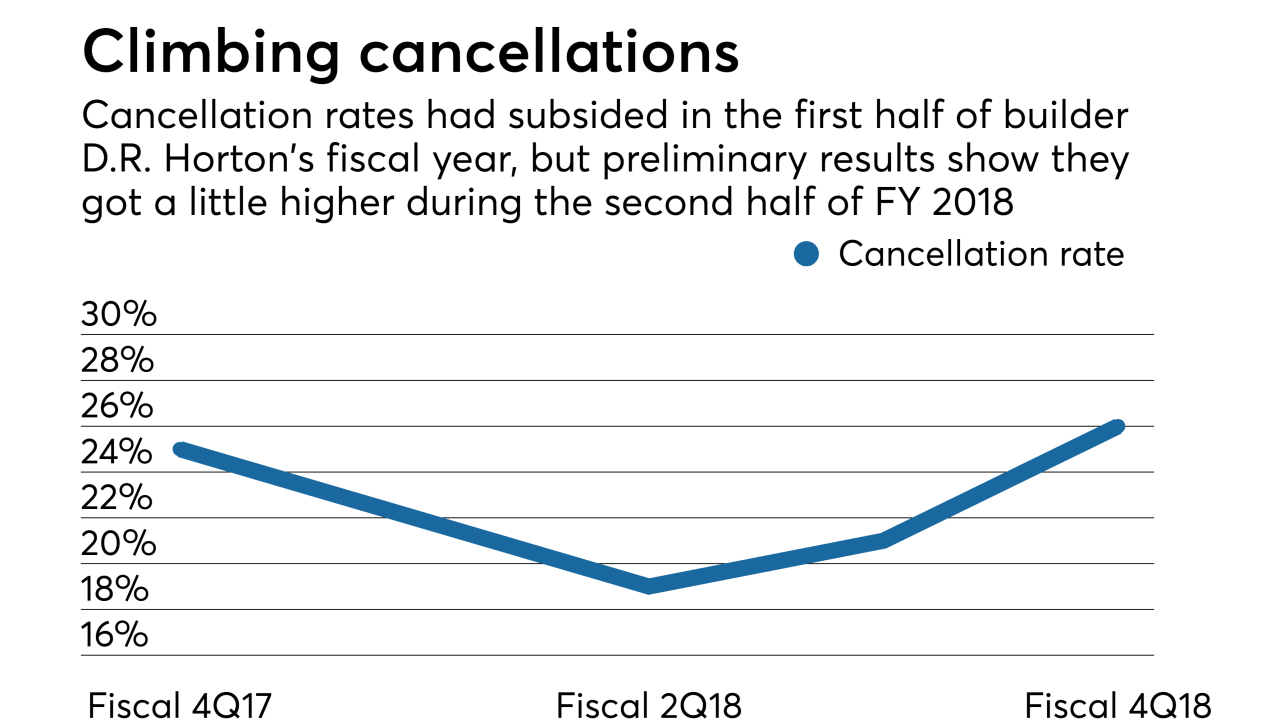

D.R. Horton is selling more homes, but its cancellation rates also are higher in the company's primary fiscal year results, a sign that rising mortgage rates may be affecting the market.

October 9 -

As the housing market enters a new era, shifts in the demand for mortgages will ultimately dictate the direction of technology, staffing and GSE reform.

October 4 -

The Packers plan to build more than 200 homes, with as many as 150 rentals and 90 for sale, a block from legendary Lambeau Field.

October 4 -

Builder Lennar Corp.'s purchase of CalAtlantic's financial services operations boosted its mortgage segment's earnings in the third quarter as the acquisition offset declines in per-loan profits and refinancing.

October 3 -

Local home construction dipped again last month, though the year-to-date pace of building continues to surpass that of 2017 by a healthy margin.

October 2 -

Gov. Jerry Brown signed a bill Sunday to streamline housing development around BART stations and ease the Bay Area's epic affordable housing problem at the expense of local officials' decision-making powers over land use.

October 1 -

Purchases of new homes rebounded in August from the slowest pace in almost a year, a potential sign of stabilization in the market, according to government data Wednesday.

September 26 -

The housing market is stalling, and homebuilder stocks are feeling the pain.

September 24 -

New-home construction rose more than forecast to a three-month high in August, while permits unexpectedly saw the biggest drop since February 2017, adding to signs that homebuilding is struggling to stabilize.

September 19 -

More buyers could be in the market for new homes as housing authorizations and maintenance volume increased while remodels fell, according to BuildFax.

September 18 -

Confidence among homebuilders stabilized in September as demand held up and lumber prices fell, a National Association of Home Builders/Wells Fargo report showed.

September 18 -

Increased sales of lower-priced newly built homes was not enough to counter a decline in mortgage application volume for the segment in August, according to the Mortgage Bankers Association.

September 14 -

Housing construction in the Twin Cities increased slightly last month, with most of the gain coming from a hefty increase in apartment construction.

September 6 -

The pace of home construction in the San Antonio market has surged to its highest level since 2007, but it likely won't be enough to correct a woeful shortage of affordable homes.

September 5 -

Lennar Corp. closed its first fully electronic digital mortgage with a remote notary, just a few months after the homebuilder made an equity investment in digital mortgage vendor Notarize.

September 4 -

The average new home in the U.S. went for $324,467 in June, 28% more than the $254,200 price for existing homes.

September 4