-

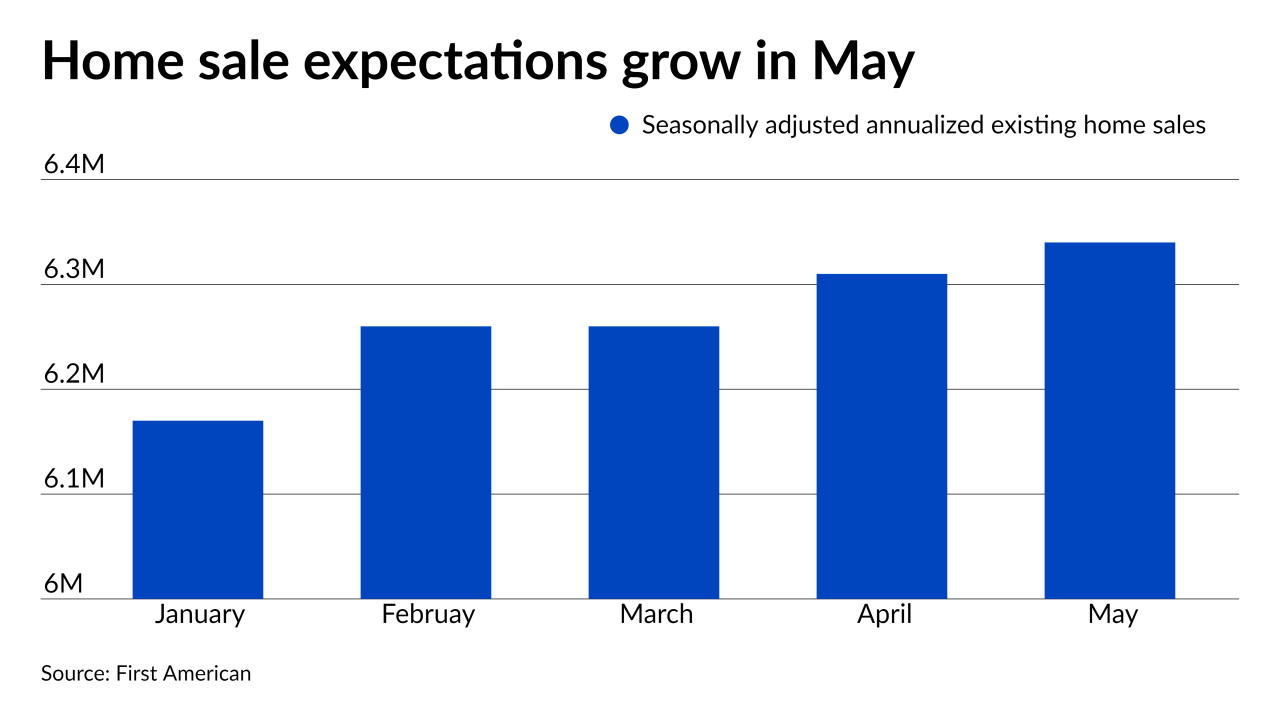

While purchasing power grew for the 16th straight month in April, surging property values and increased mortgage rate forecasts will keep driving down affordability, according to First American.

June 28 -

The lack of homes for sale is supporting the record values, unlike what happened in the mid-2000s, analysts say.

June 28 -

Median home prices are higher than the historical average in 61% of U.S. counties, Attom Data Solutions said, and it's unclear if the situation gets better or worse.

June 24 -

While purchasing power rose due to low rates and increasing income, “homebodies” suppressed inventory, according to First American.

June 22 -

Contract closings decreased 0.9% from the prior month to an annualized 5.8 million, according to data out Tuesday from the National Association of Realtors.

June 22 -

As home prices set new records, a shift in consumer attitude led to fewer bidding wars and a growing number of listings, according to Zillow and Redfin.

June 16 -

Residential starts rose 3.6% last month to a 1.57 million annualized rate, according to government data released Wednesday

June 16 -

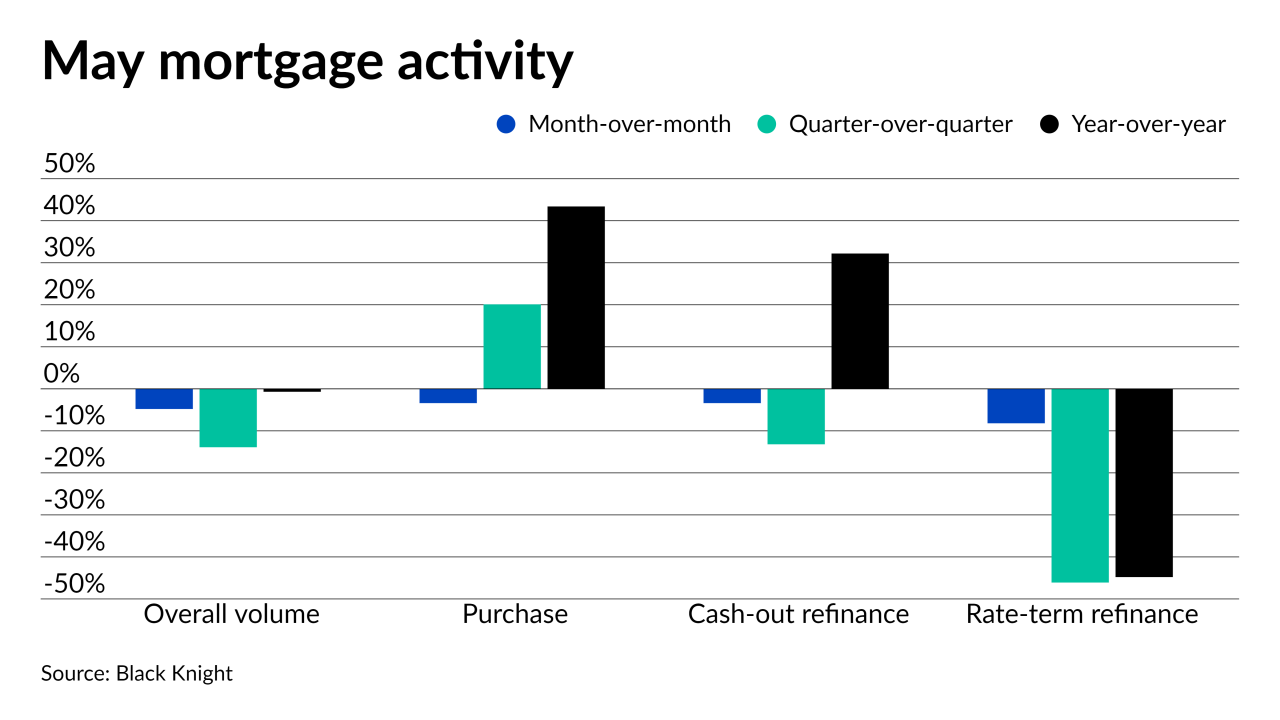

Changed borrower psychology and the severe housing inventory shortage dropped lending activity across the board, according to Black Knight.

June 14 -

There’s now a unique, additional source of demand that’s opening up in an already fiercely-competitive housing market that VA lenders have to solve for.

June 14 -

While a growing share of consumers feel optimistic about the economic recovery underway, the extreme seller’s market made the majority of prospective borrowers pessimistic for only the second time in 10 years, according to Fannie Mae.

June 7