-

Essent Group continued to benefit from the volatility in private mortgage insurers' market share, remaining in second place among the six active underwriters at the end of the recent quarter.

August 2 -

Mr. Cooper Group reported a second-quarter net loss of $87 million as the company took a $231 million fair value hit to its mortgage servicing rights portfolio.

August 1 -

Taylor Morrison Home Corp. recorded earnings that outpaced analysts' estimates and announced a partnership in the growing rental market.

July 31 -

The oft-delayed sale of Genworth Financial might need new approvals from U.S. insurance regulators if and when it disposes of its Canadian mortgage insurance stake.

July 31 -

Freddie Mac continues to churn out steady financial returns, with the growth in first-time home buyers and credit risk transfers providing the GSE stable footing when a recession comes, according to new CEO David Brickman.

July 31 -

New Residential Investment Corp. took a $32 million net loss in the second quarter as it diversified its business lines and repositioned to protect its mortgage servicing rights from falling rates.

July 30 -

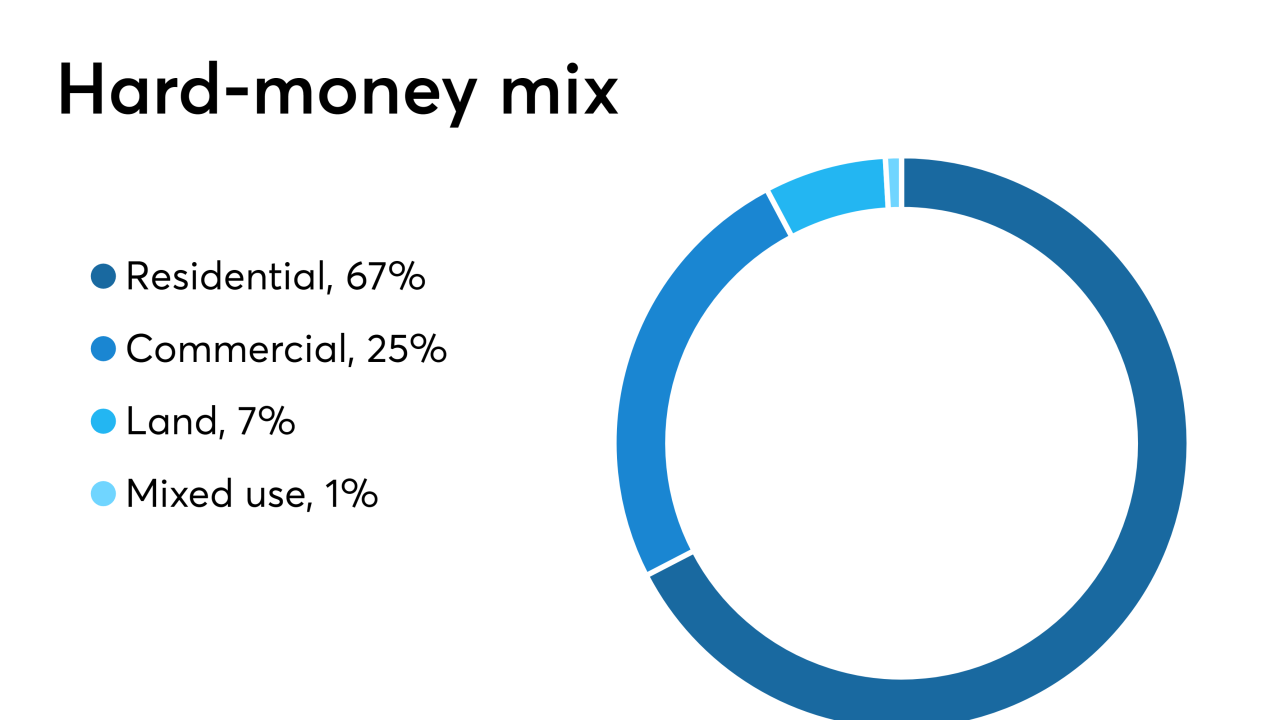

Sachem Capital Corp., a hard-money mortgage lender that makes short-term loans to investors, has raised $10 million in gross proceeds from a public offering of 2 million common shares.

July 29 -

Timothy Mattke replaced Patrick Sinks as CEO of MGIC Investment Corp., just two days after the company announced earnings that beat expectations.

July 26 -

Title insurers benefited from the increase in origination volume — especially refinancings — during the second quarter, as open order counts increased compared with one year prior.

July 25 -

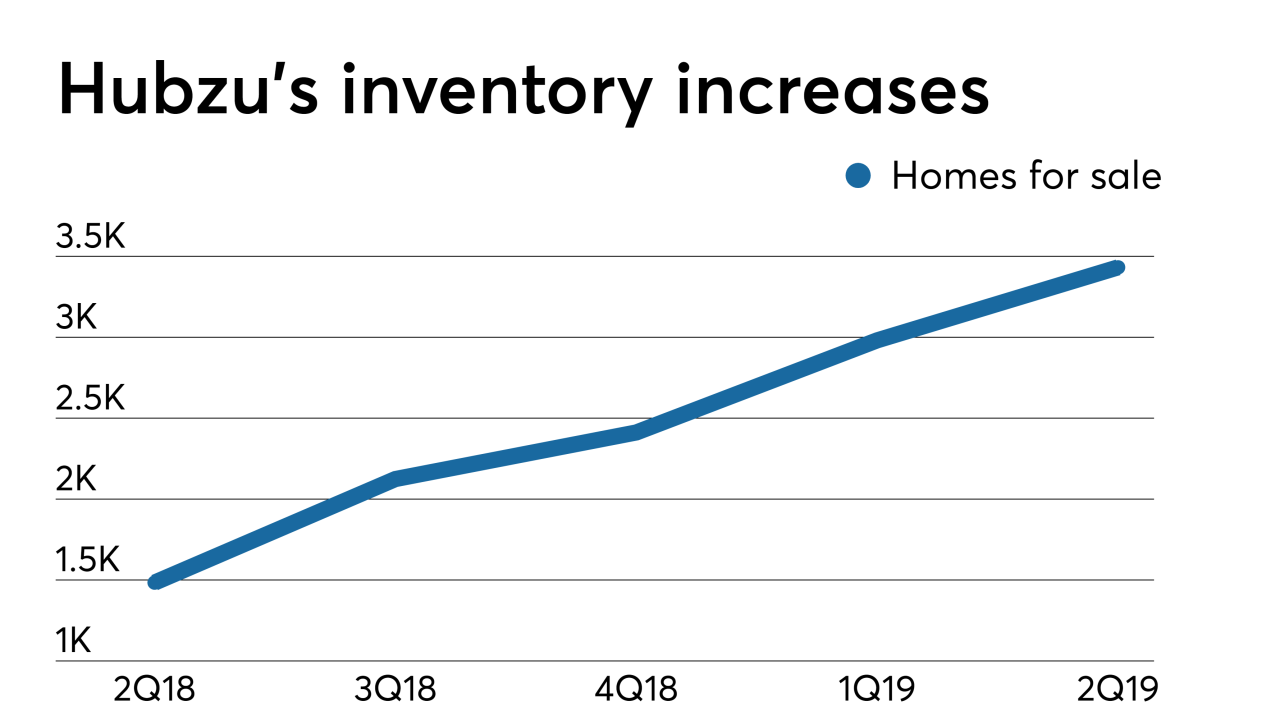

Altisource Portfolio Solutions cut its previous-quarter net loss by 49% in its most recent fiscal period, when property maintenance revenue and new Hubzu real estate auction site inventory increased.

July 25 -

From Big Sky Country to the peaks of Colorado, here's a look at the metro areas offering owners the most stability and appreciation in home prices over the past 25 years.

July 25 -

MGIC reported higher-than-expected earnings, seen as a positive for the other mortgage insurers, plus Flagstar and KeyCorp had strong quarters for their mortgage businesses.

July 23 -

Pretax mortgage income at NVR Inc. surged 37% year-over-year in the second quarter while originations rose 1%, contrasting more tepid home-loan earnings results relative to originations at big banks.

July 19 -

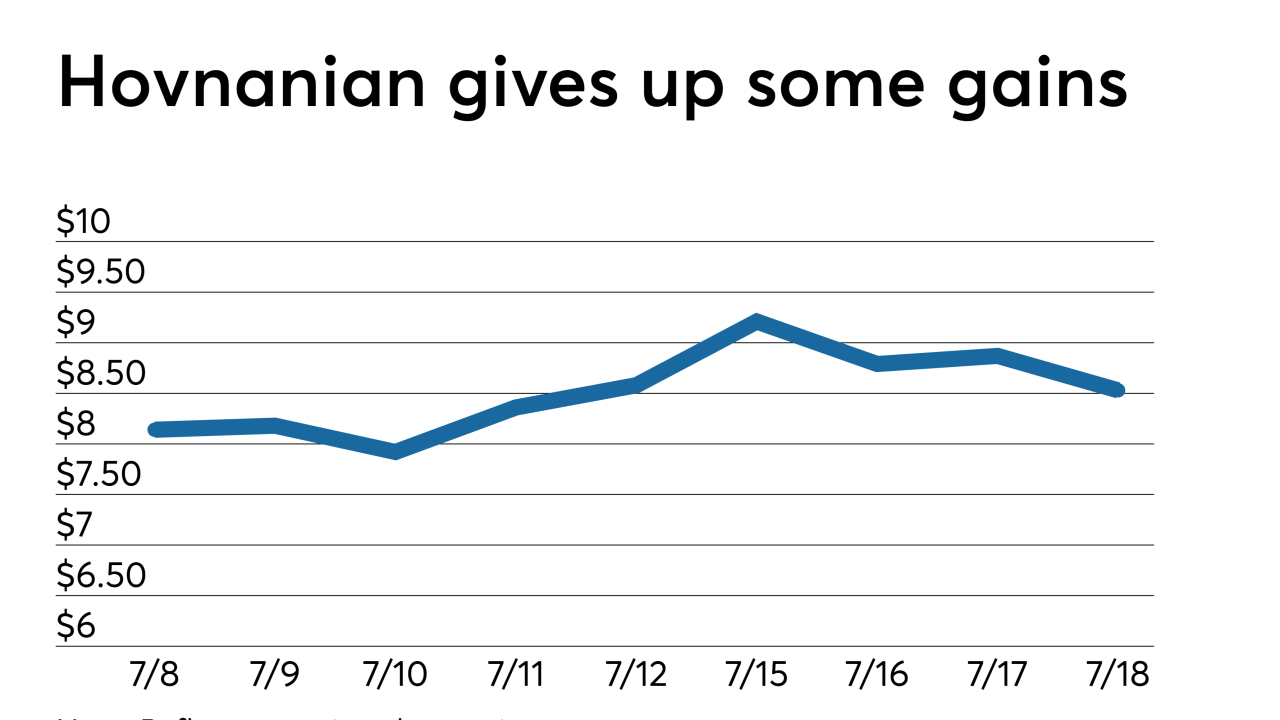

Hovnanian Enterprises, the corporate parent of homebuilder K Hovnanian Homes, received a new notice from the New York Stock Exchange indicating its low market capitalization could jeopardize its listing status.

July 18 -

The second quarter continues to shape up as a good one for bank mortgage lenders — and one ancillary service provider — that are benefiting from a spike in volume.

July 17 -

Despite a significant rise in first-mortgage production due to lower interest rates, profits from home lending in Citigroup's retail banking division fell slightly in the second quarter.

July 15 -

The more than $44 billion in new Ginnie Mae mortgage-backed securities that came to market in June marked the strongest month for the government bond insurer in more than two years.

July 11 -

Builder MDC Holdings' preliminary numbers for net new home orders registered their highest quarterly increase in years, adding to signs of growing demand for housing.

July 8 -

The post-crisis operational improvements at both Fannie Mae and Freddie Mac have resulted in stronger mortgage loan performance, a Fitch Ratings report said.

July 3 -

Mortgage rates ticked up slightly this week with opposing trends in the stock and bond markets fighting for dominance, according to Freddie Mac.

July 3