-

The three companies agreed to pay a total of $74 million in remediation.

December 7 -

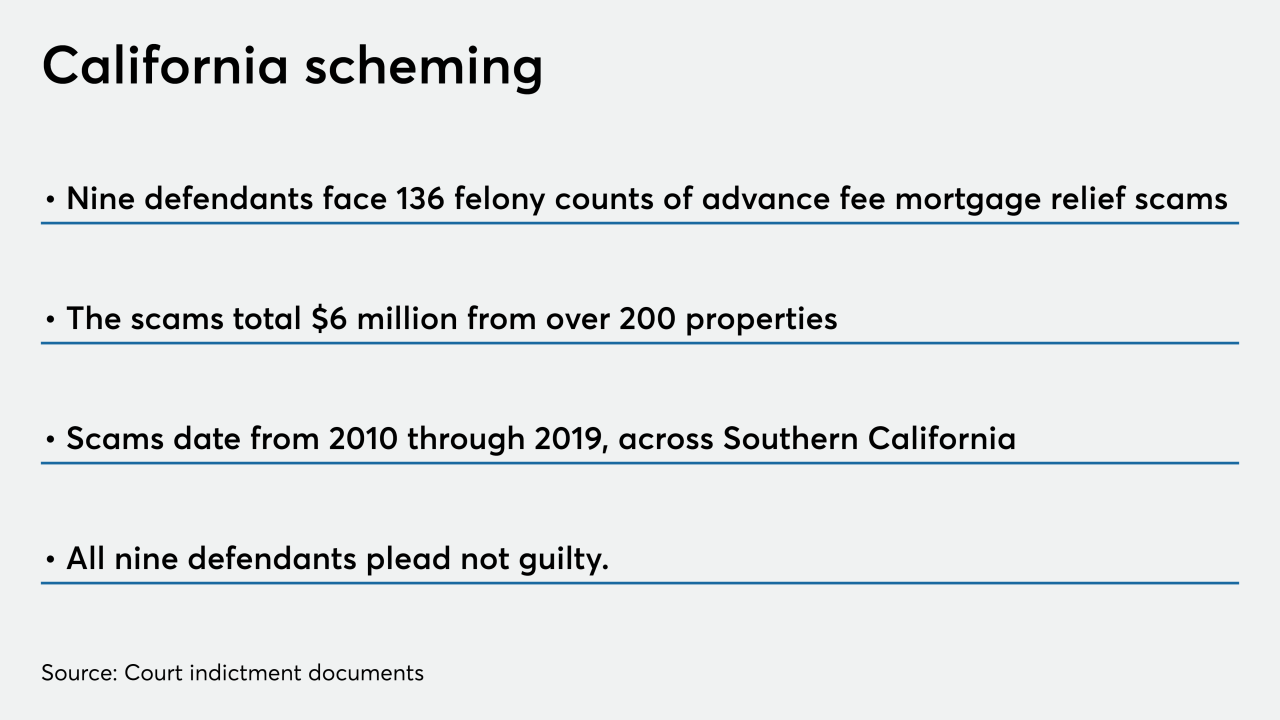

The nine arraigned individuals face 136 counts of felony charges for allegedly running an advance fee mortgage relief scheme over the last decade, totaling $6 million.

November 24 -

The president-elect has legal backing to fire Director Kathy Kraninger thanks to a recent court ruling, but Republicans are prepared to challenge his ability to choose her successor.

November 23 -

The agency’s final rule modernizing the Fair Debt Collection Practice Act limits calls to seven per week, but collectors won stronger protections from liability claims and other key changes to the original proposal.

October 30 -

The agency’s consolidation of supervision and enforcement policy into one office could compromise the independence of those deciding when to investigate alleged wrongdoing by banks and others, critics of the move say.

October 22 -

The Buffalo, N.Y., bank will pay a $546,000 penalty, which will be passed on to the National Flood Insurance Program to help offset costs.

October 15 -

If the tally included loans with some form of payment relief, the rate would be close to 8%.

October 5 -

The class-action lawsuit claims the company used deceptive contracts, locking low-income Black homebuyers into disadvantageous long-term mortgages without proper lending disclosures.

October 1 -

A former home mortgage consultant with the company alleges she was subjected to a lower compensation structure, awards and benefits compared to her male counterparts.

August 12 -

Democrats Elizabeth Warren of Massachusetts and Brian Schatz of Hawaii have sent a letter to CEO Charlie Scharf demanding a response to news reports that the bank has been placing borrowers into forbearance plans without their consent.

July 30 -

The mortgage REIT's external manager responded by filing a new lawsuit against it, calling the move "baseless and retaliatory."

July 23 -

Moody's says anchor stores like J.C. Penney and Neiman Marcus represent only a small portion of CMBS retail exposure, but their deteriorating fortunes will hasten the decline in credit quality of CMBS-held loans backed by Class "B" and "C" malls.

July 21 -

Mortgages taken out to fund business operations can now be modified in bankruptcy. That’s a relief to borrowers — particularly with business failures expected to increase as the pandemic drags on — but a possible headache for banks and investors that hold the loans.

July 20 -

The agency sought to provide certainty that most actions from the past eight years remain in effect despite the ruling that the bureau's leadership structure is unconstitutional.

July 7 -

The Supreme Court threw out a key statutory provision concerning the agency’s leadership structure, but the presidential election and possible legislative reforms could bring about more changes to the embattled bureau.

June 29 -

With just 13 decisions remaining on the docket this session, the high court's highly anticipated ruling in a case challenging the agency's leadership structure could come as early as next Monday.

June 25 -

A bankruptcy judge will be asked to sign off on the sale of BHF's Shoreline portfolio in Chicago and will hold an initial Chapter 11 hearing on another portfolio.

June 19 -

A lawsuit filed Tuesday argues that the bureau's establishment of the panel looking into regulatory changes violated the Federal Advisory Committee Act.

June 16 -

A $740 million jury verdict against Amrock was thrown out by a Texas appeals court that said tech firm HouseCanary failed to prove the big title insurer stole its trade secrets to build a competing real estate analysis tool.

June 5 -

Real estate crowdfunding company Sharestates launched a program Wednesday offering liquidity to private lenders and loan aggregators contending with margin calls as a result of market volatility related to the coronavirus outbreak.

April 1