-

Republicans on the House Oversight Committee concluded that last year’s massive data breach at Equifax was fully preventable, but stopped short of recommending new laws aimed at averting future hacks. Democrats called the final report a “missed opportunity.”

December 10 -

The administration’s reported interest in having the White House aide run Fannie Mae and Freddie Mac's regulator signals a focus on constraining the mortgage giants’ role in the housing market.

December 10 -

Over the last 20 years, at least 145,000 Detroit properties have been put up for sale in the annual Wayne County Tax Auction, and, of that number, an estimated 50,000 properties were occupied at the time of foreclosure.

November 20 -

Providing city-owned land to build more homes, easing regulations for property owners to put up casitas, expanding down payment programs for prospective new homeowners — these are just a few of the recommendations in a new report on Santa Fe's housing problems.

November 14 -

Real estate and mortgage industry groups outspent proponents 3-to-1 to defeat Proposition 10, a measure to allow California municipalities to set local rent control laws.

November 7 -

Austin's record-breaking $250 million affordable housing bond appeared to be on its way to approval late Tuesday.

November 7 -

Mortgage industry executives claim sparse affordable housing supply is the most impactful hurdle for first-time homebuyers entering the market in 2019, but the majority don't think regulatory policy will help the cause.

November 6 -

New York's Department of Housing Preservation and Development has released a "Speculation Watch List" of rent-regulated homes sold that the agency said could potentially put tenants at risk.

November 1 -

The fight for stronger rent control in California appears headed for a fiery demise, according to the latest poll by the Public Policy Institute of California.

October 25 -

From discussing the future of mortgage tech to debating the shifting sands of political policies, here's a preview of the big issues, topics and ideas when the industry gathers in the nation's capital for the Mortgage Bankers Association's Annual Convention & Expo.

October 12 -

If California voters approve Proposition 10 in November, the ramifications will be felt on the state's affordable housing, according to the Mortgage Bankers Association.

October 2 -

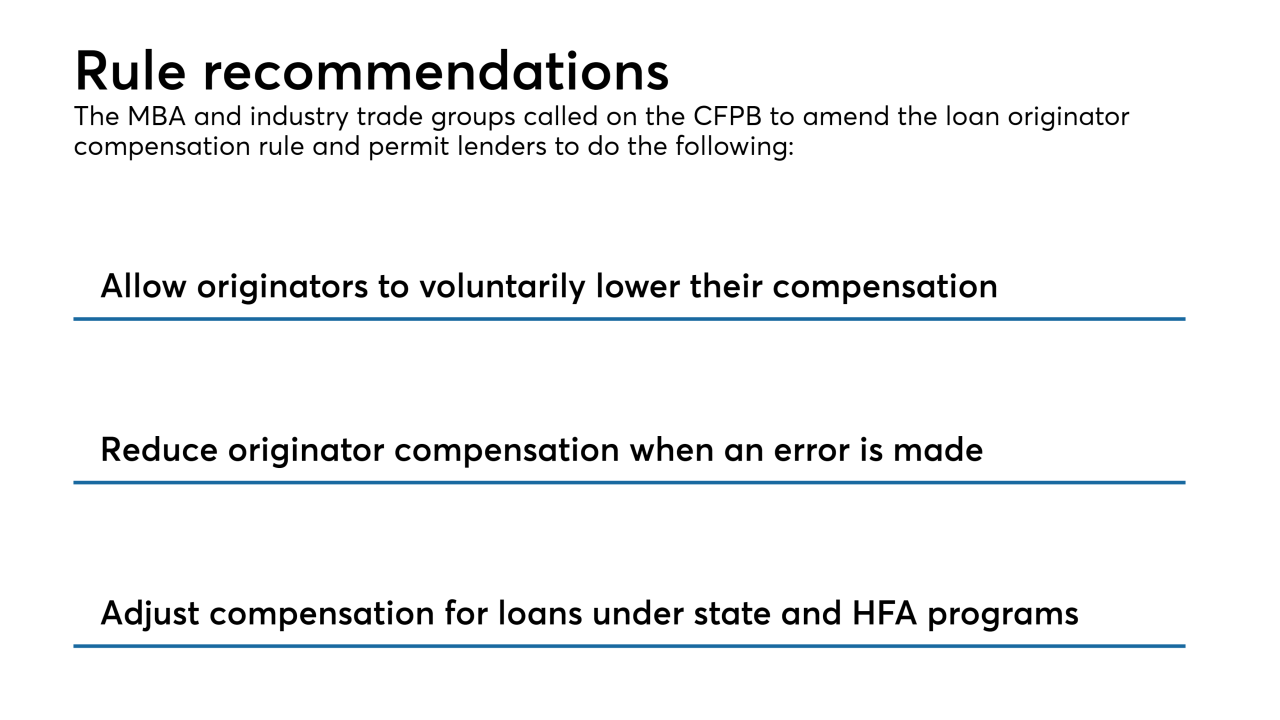

The mortgage industry is calling on the Consumer Financial Protection Bureau to revise its Loan Originator Compensation rule in favor of better protection for consumers and lesser regulatory burdens for lenders.

October 1 -

The bureau's findings and request for information came after acting Director Mick Mulvaney had cited data security as a flaw at the agency.

September 26 -

The CFPB's move is in line with the other banking regulators who have offices in Atlanta.

September 21 -

Advocates are seeking more federal funding for affordable housing. A federal investigation into the banks’ alleged manipulation of a popular tax-credit program can’t be helping their cause.

September 19

-

New Jersey Governor Phil Murphy signed a bill to revise the state's Residential Mortgage Lending Act to facilitate transitional licensing for loan officers and to streamline the law's provisions for borrower fees.

August 31 -

The Congressional Budget Office has found that restructuring the mortgage market would save the government billions of dollars but may increase the cost of housing.

August 27 -

A Minnesota Supreme Court decision that upholds limits on how much communities can charge developers is being hailed as a major victory for those who argue that such fees are making housing in the Twin Cities unaffordable.

August 22 -

Proposals to force Bay Area cities to allow housing development at BART stations and to help those squeezed by the new federal cap on tax deductions were among the bills to survive the latest round of cuts Thursday at California's Capitol.

August 17 -

The CFPB made changes to a rule that allows financial firms to be exempt from sending annual privacy notices to customers if they meet certain conditions.

August 10