-

If California voters approve Proposition 10 in November, the ramifications will be felt on the state's affordable housing, according to the Mortgage Bankers Association.

October 2 -

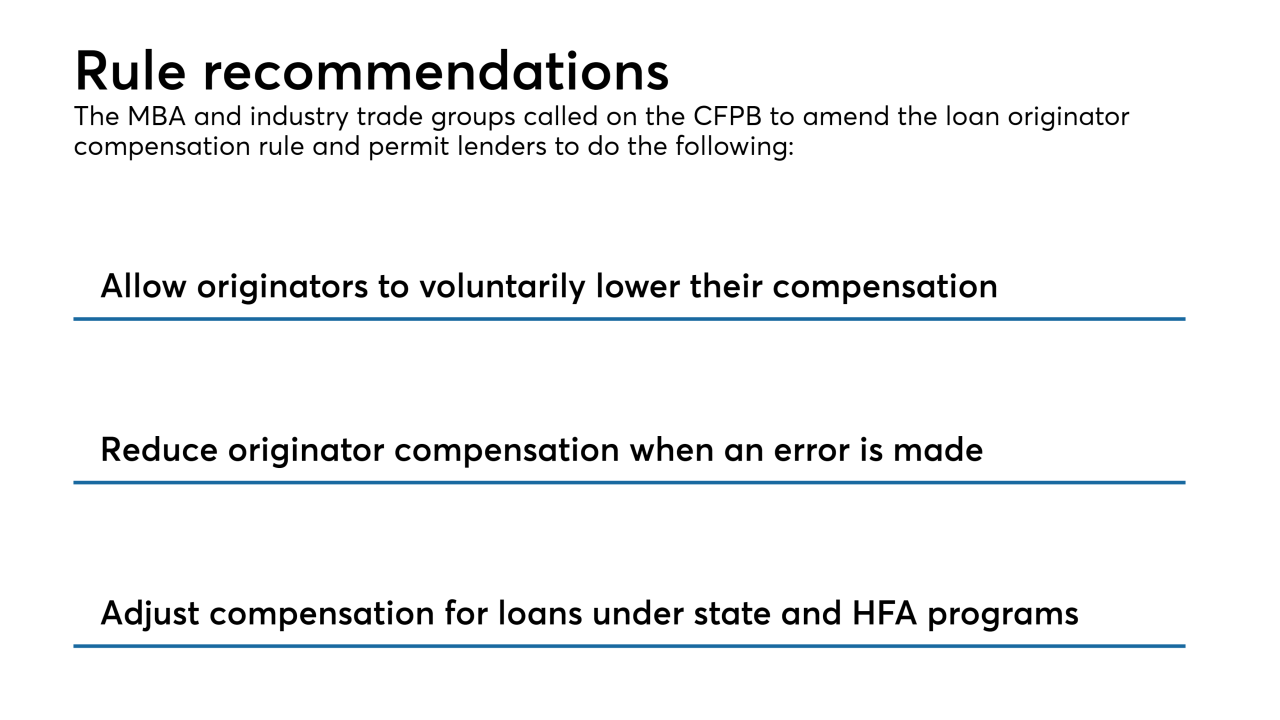

The mortgage industry is calling on the Consumer Financial Protection Bureau to revise its Loan Originator Compensation rule in favor of better protection for consumers and lesser regulatory burdens for lenders.

October 1 -

The bureau's findings and request for information came after acting Director Mick Mulvaney had cited data security as a flaw at the agency.

September 26 -

The CFPB's move is in line with the other banking regulators who have offices in Atlanta.

September 21 -

Advocates are seeking more federal funding for affordable housing. A federal investigation into the banks’ alleged manipulation of a popular tax-credit program can’t be helping their cause.

September 19

-

New Jersey Governor Phil Murphy signed a bill to revise the state's Residential Mortgage Lending Act to facilitate transitional licensing for loan officers and to streamline the law's provisions for borrower fees.

August 31 -

The Congressional Budget Office has found that restructuring the mortgage market would save the government billions of dollars but may increase the cost of housing.

August 27 -

A Minnesota Supreme Court decision that upholds limits on how much communities can charge developers is being hailed as a major victory for those who argue that such fees are making housing in the Twin Cities unaffordable.

August 22 -

Proposals to force Bay Area cities to allow housing development at BART stations and to help those squeezed by the new federal cap on tax deductions were among the bills to survive the latest round of cuts Thursday at California's Capitol.

August 17 -

The CFPB made changes to a rule that allows financial firms to be exempt from sending annual privacy notices to customers if they meet certain conditions.

August 10 -

As Californians reel from sky-high rents and home prices fueled by the economic boom, state lawmakers return Monday from their summer recess to debate proposals attacking the housing crisis.

August 7 -

Housing markets with the strictest land-use regulations saw home price appreciation shoot up by more than double the rate of those with lighter regulations, despite similar job growth, according to Zillow.

August 2 -

Earlier this year the Legislature appropriated $200 million to help finance new affordable rental housing. Now a state-led panel advises that an additional $1 billion should follow over the next decade to further address Hawaii's shortage of affordable apartments.

August 1 -

As regulators move forward with policy changes designed to curb so-called refinance churning of Department of Veterans Affairs-insured mortgages, concerns have surfaced about the fate of loans originated during the transition period.

July 25 -

The Internal Revenue Service's settlement with Radian Group may result in a $74 million tax benefit for the mortgage insurer that could improve its second-quarter results.

July 19 -

A federal appeals court in Texas agreed with Fannie Mae and Freddie Mac shareholders that the FHFA, led by a single director, violates the separation of powers.

July 17 -

Leandra English, who sued President Trump and Mick Mulvaney last year claiming to be the rightful director of the CFPB, said Friday that she plans to resign and drop the litigation.

July 6 -

At least 38 projects totaling 3,337 units were proposed statewide in 2017, which is far more than the five projects totaling 391 units proposed in 2010, the basement of the Great Recession.

July 2 -

Lawmakers want the agency to utilize two programs to help families still struggling to recover from the aftermath of Hurricane Maria.

July 2 -

The Senate's farm bill would prevent the July 31 lapse of the National Flood Insurance Program, but it still needs to be debated in conference with the House.

June 29