-

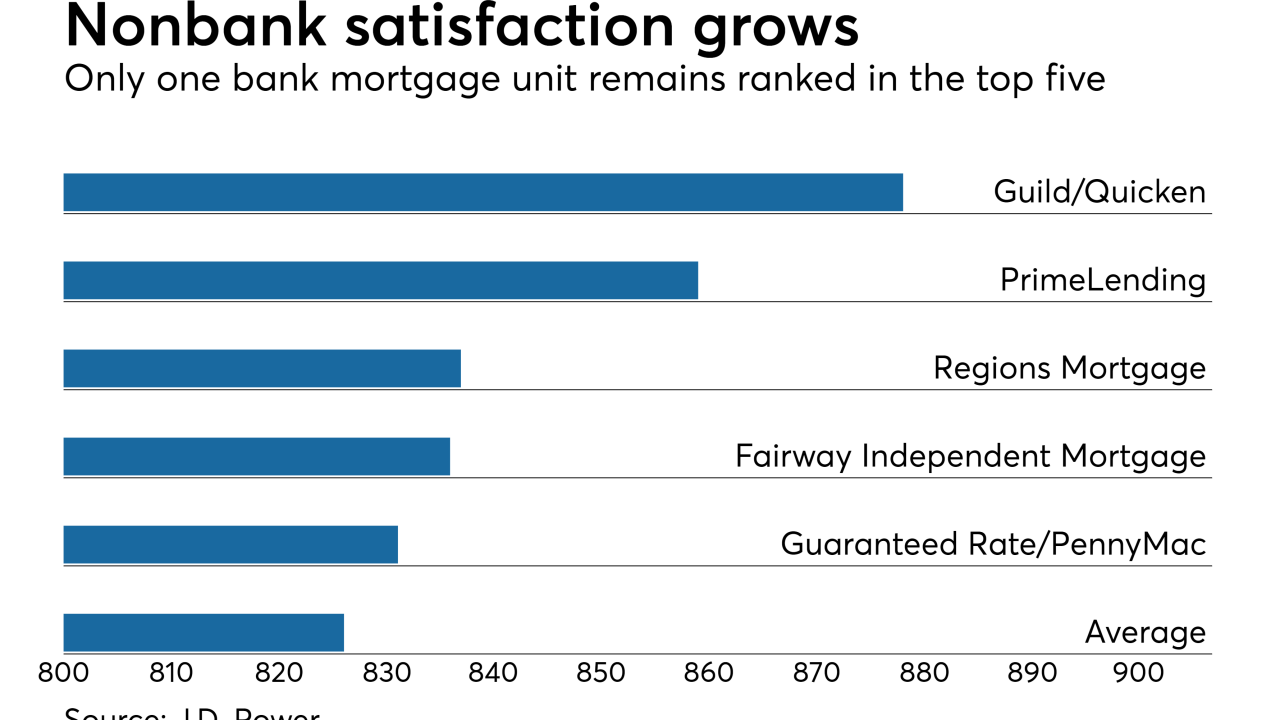

Despite digital mortgage advances, borrowers think it still takes too long to get a loan, J.D. Power finds in its annual customer satisfaction ranking of originators.

November 9 -

Third-quarter net income at mortgage technology provider Ellie Mae was higher year-over-year but came in below the previous quarter's number as the company worked to produce gains despite falling originations.

October 27 -

Gain important insights from experts in the field on key trends and advancements in digital mortgage.

October 23 -

The latest version of Ellie Mae's Encompass loan origination system includes new features for Home Mortgage Disclosure Act compliance and digital mortgages.

October 16 -

Quicken Loans Mortgage Services and Calyx Software developed a version of the Point loan origination system that's preconfigured with tools for small mortgage firms to work with the Detroit lender's TPO division.

October 11 -

Digital mortgages transform the customer experience with slick user interfaces and data integrations that streamline the process of getting a borrower hooked up with a lender. Now it's time to disrupt the rest of the process.

September 20 -

For the digital mortgage to reach its full potential, lenders and technology developers still have to solve for the disconnect between the front-end application process and the underwriting work required before a loan closes.

September 20 -

Automated data validations are integral to a seamless digital mortgage experience. But the extent of data exposed in the Equifax breach raises questions about the risk of fraudsters exploiting those technologies to further compromise consumer data.

September 20 -

While many mortgage lenders focus on updating the front end of the borrower experience, other lenders are making strides on the back end of the process with new electronic closing capabilities.

September 20 -

Technology isn't a magic bullet for success, and just doing mortgages digitally doesn't change how the business fundamentally works.

September 20 Roostify

Roostify -

Many lenders are focusing too much time on user experience and overlooking the frustratingly inefficient mortgage process happening behind their pretty loan applications.

September 20 cloudvirga

cloudvirga -

Ellie Mae, looking to expand the analytical capabilities of its customer-relationship management technology, is purchasing Velocify for $128 million in cash.

September 1 -

The share of refinance loans in the market bounced back slightly in July, according to Ellie Mae's latest monthly report.

August 16 -

Picking a new benchmark for adjustable-rate mortgages is the easy part. Industrywide implementation is where things get tricky.

August 10 -

Fiserv has acquired the assets of PCLender, a mortgage loan origination system vendor based in Reno, Nev.

August 1 -

Ellie Mae had second-quarter net income of $18.8 million, a 77% increase over the $10.6 million in the same period last year largely due to a tax accounting change.

July 27 -

Borrowers can now self-serve when submitting application information at U.S. Bank, but the bank also has proprietary technology aimed at keeping loan officers looped in to help with product selection.

July 27 -

Binh Dang, the co-founder and former president of LendingQB, is seeking a court to force MeridianLink, the loan origination system's parent company, to dissolve.

July 25 -

Homeowners insurance agencies are embedding their policy-underwriting technology into mortgage companies' origination and servicing systems in a bid to chase the same customers together.

May 23 -

Black Knight Financial Services has added an application program interface to its loan origination system that will allow consumers and loan officers to access it more easily through mobile devices.

April 21