M&A

M&A

-

The deal comes just days after Figure closed on a capital raise that valued it at $3.2 billion.

August 3 -

In late July, the Justice Department notified the Houston bank of a potential lawsuit alleging violations between 2013 and 2017, according to a securities filing. Cadence said that its prospective merger partner, BancorpSouth, supports the settlement discussions.

August 2 -

The acquirer will use the liquidation of a residential mortgage company’s assets to move several notches up in the rankings.

July 26 -

The proposed acquisition comes just days after Better.com announced plans to buy London-based online loan broker Trussle Lab.

July 16 -

One provision calls for the Consumer Financial Protection Bureau to look at unfair, deceptive or abusive acts and practices regarding competition.

July 16 -

The New York-based lender projects it has a $3.6 trillion market opportunity outside of the U.S.

July 12 -

The White House is calling on the Department of Justice and federal regulators to give bank deals more scrutiny as part of a broader executive order meant to encourage competition across the U.S. economy.

July 9 -

The company has seen business ramp up as servicers have sought additional help managing escrowed funds following last year’s refi boom.

July 7 -

This is the second acquisition in the private equity firm’s newly established technology vertical.

July 7 -

The deal comes after a tumultuous 12-month period for CoreLogic, which saw itself twice targeted for acquisition.

June 30 -

The deal will add $7.8 billion in reverse mortgage subservicing to Ocwen $6.7 billion portfolio.

June 18 -

The lender's founder and CEO says the acquisition of Roscoe State Bank will give it new products and referral sources.

June 14 -

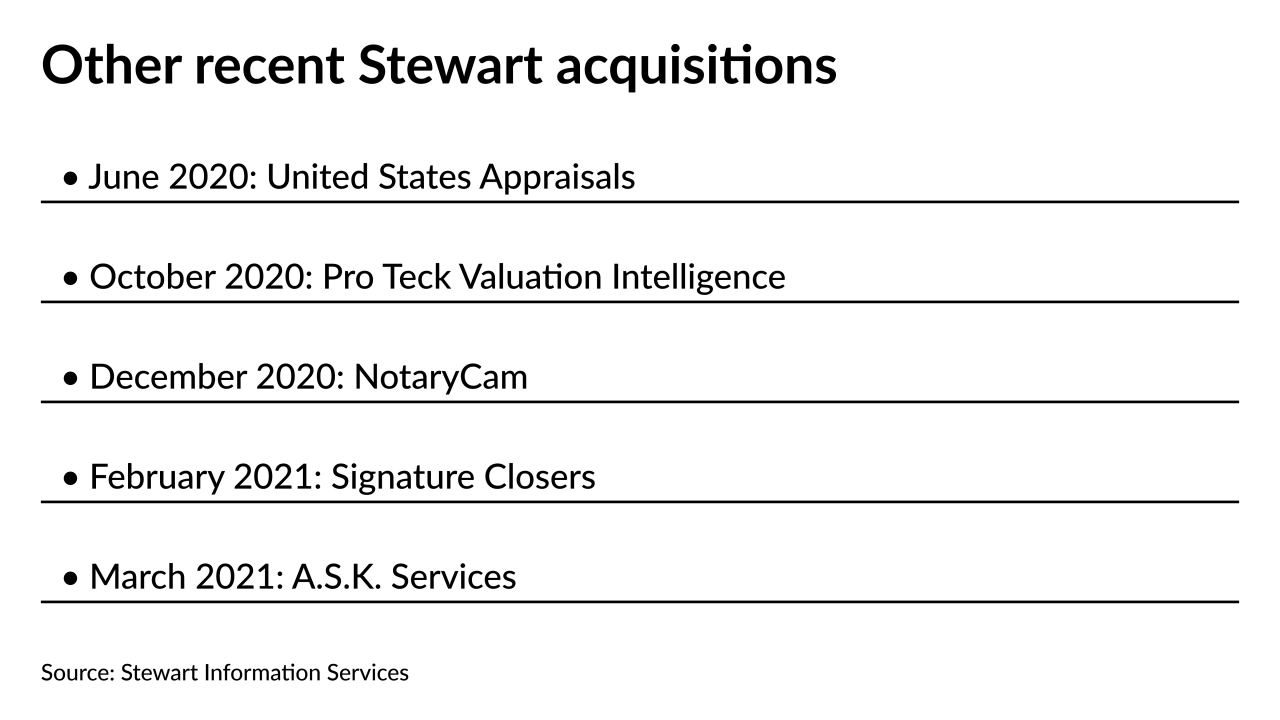

This is the multi-hyphenate company’s sixth deal since the start of 2020 — a series of acquisitions in a variety of sectors within the industry, ranging from analytics to artificial intelligence.

May 28 -

Rather than completing another equity raise, the five-year-old mortgage technology company went looking for a partner.

May 27 -

The company, on the cusp of going public via a merger, recently added Wells Fargo to its client roster.

May 26 -

The deal adds to the burgeoning technology stack at the Houston-based title underwriter, which added NotaryCam in December.

May 25 -

The transaction goes a long way toward the company’s goal to amass MSRs with a total unpaid principal balance of up to $150 billion.

May 25 -

Guild announced the $196.7 million acquisition after reporting that it more than doubled its net income in the first quarter, compared to the last three months of 2020.

May 11 -

After massive fundraises and IPO rumors swirled, the originator and servicer announced it will merge with Aurora Acquisition Corp. and go public in the fourth quarter of 2021.

May 11 -

The company is formally launching a new “non-mortgage” unit that will provide small loans for home improvement projects.

May 10