M&A

M&A

-

The deal will add $7.8 billion in reverse mortgage subservicing to Ocwen $6.7 billion portfolio.

June 18 -

The lender's founder and CEO says the acquisition of Roscoe State Bank will give it new products and referral sources.

June 14 -

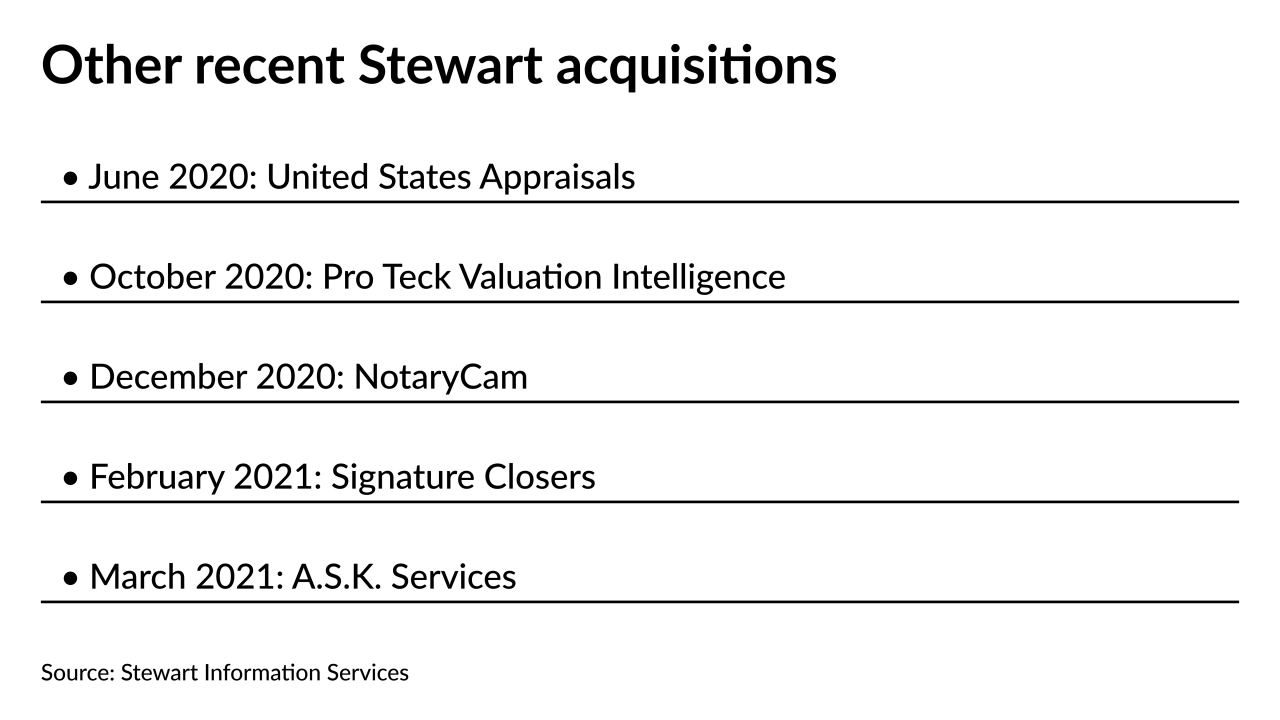

This is the multi-hyphenate company’s sixth deal since the start of 2020 — a series of acquisitions in a variety of sectors within the industry, ranging from analytics to artificial intelligence.

May 28 -

Rather than completing another equity raise, the five-year-old mortgage technology company went looking for a partner.

May 27 -

The company, on the cusp of going public via a merger, recently added Wells Fargo to its client roster.

May 26 -

The deal adds to the burgeoning technology stack at the Houston-based title underwriter, which added NotaryCam in December.

May 25 -

The transaction goes a long way toward the company’s goal to amass MSRs with a total unpaid principal balance of up to $150 billion.

May 25 -

Guild announced the $196.7 million acquisition after reporting that it more than doubled its net income in the first quarter, compared to the last three months of 2020.

May 11 -

After massive fundraises and IPO rumors swirled, the originator and servicer announced it will merge with Aurora Acquisition Corp. and go public in the fourth quarter of 2021.

May 11 -

The company is formally launching a new “non-mortgage” unit that will provide small loans for home improvement projects.

May 10 -

The real estate investment trust has been buying residential business-purpose loans from the company since 2017.

May 6 -

This is the first deal that serial acquirer FOA has announced since it went public on April 5.

April 28 -

The Dallas company will pay nearly $54 million for a 49% stake in a lender that operates in 10 states.

April 28 -

For a lot of IMBs facing shrinking backlogs and falling secondary market spreads, the attraction of hitting a bid and taking the easy way out via an acquisition may become irresistible, writes Chris Whalen.

April 27 -

At first the deal seemed an unlikely marriage of two mortgage-heavy companies. But acquiring the Michigan company would help New York Community accomplish its two chief goals — reducing deposit costs and its concentration of multifamily loans — while giving it the scale to pursue more deals.

April 26 -

The merger would create a company with nearly 400 branches, 87 loan production offices and $87 billion of assets.

April 26 -

Better for mortgage businesses to take on the purchase market “storm” than batten down the hatches in port, writes LodeStar Software Solutions CEO Jim Paolino.

April 23 -

The Dallas company agreed to sell MSRs tied to $14 billion of mortgages to PHH Mortgage.

April 21 -

An interactive dialogue with Founder and CEO of NorthOne on the fintech industry, the growing needs of challenger banks, and the future of SMB banking.

-

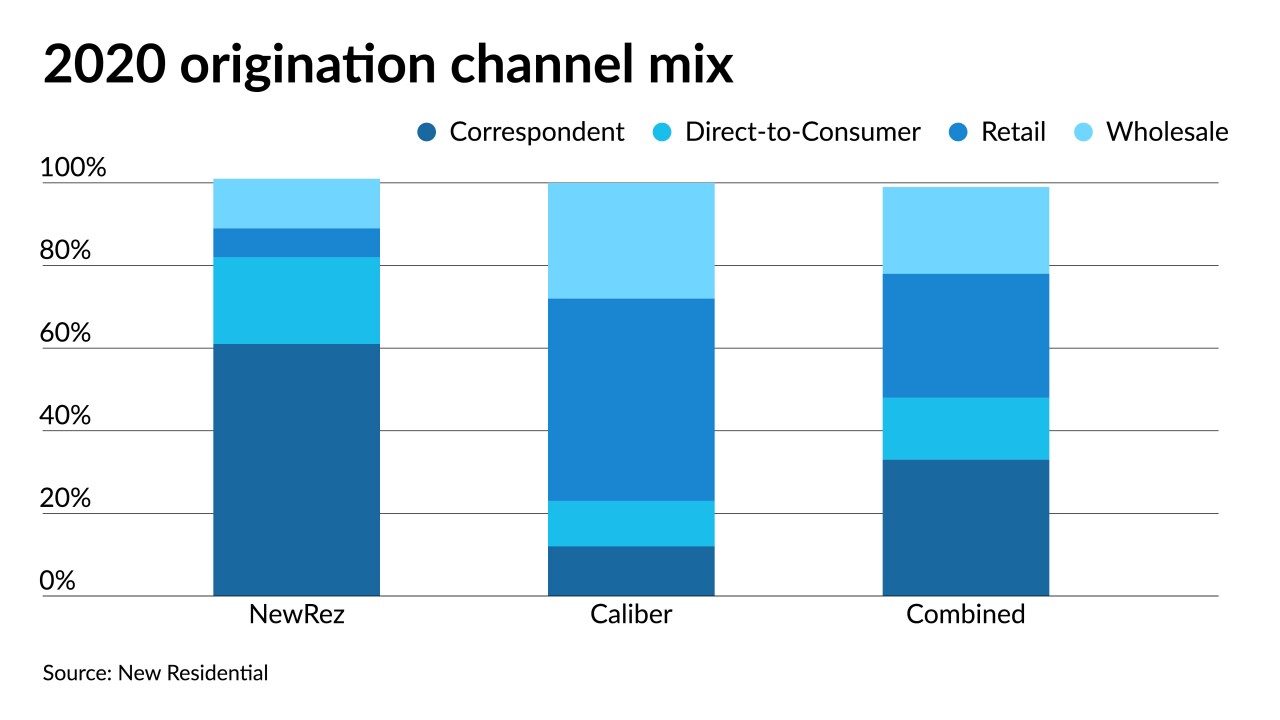

The REIT is planning its own stock sale to pay for the all-cash purchase from Lone Star Funds.

April 14