M&A

M&A

-

The coronavirus relief legislation could result in private mortgage insurers having to hold more capital, a B. Riley FBR analyst report said.

April 6 -

The latest deadline for Genworth Financial's acquisition by China Oceanwide is June 30, but the parties are looking to get the transaction completed by the end of next month.

April 1 -

The $2 trillion deal passed by the Senate late Wednesday would aim to put banks and consumers alike on stronger financial footing as they weather the coronavirus pandemic.

March 25 -

The North Carolina company will hold onto the loans after the Fed's decision to slash interest rates.

March 11 -

Insurance brokerage and risk management firm Brown & Brown plans to expand its lender-placed business by combining operations run by two former rivals with healthy respect for each other.

March 10 -

Mortgage-related companies finalized four partnerships, a servicing-retention firm went up for sale, and a long-delayed insurance-related transaction moved forward this week in a wave of industry merger and acquisition activity.

March 4 - Mortgage News

MVB in West Virginia will gain a 47% stake in the partnership in exchange for contributing its mortgage unit's assets to the new company.

March 3 -

The CEO of Freedom Mortgage, Stanley Middleman, provides his take on trends affecting independent mortgage bankers as well as the residential real estate finance industry at large.

February 20 -

Alexander most recently headed up mortgage lending and before that co-led the integration of Key's acquisition of First Niagara. He replaces Dennis Devine, who recently left the company.

February 18 -

Fidelity and Essent reported higher year-over-year profits in the last three months of 2019 as refinancing increased business volume, but Black Knight took a hit on its Dun & Bradstreet investment.

February 14 -

First American Financial, a title insurance underwriter and settlement services provider, is acquiring mortgage document firm Docutech for $350 million in cash.

February 13 -

Whether a deal involves a minority stake or a whole company carve-out, buyers and sellers should be aware of five issues that may pose transaction risk in the mortgage market.

February 11 -

Simon Property Group agreed to buy rival shopping-mall operator Taubman Centers for about $3.6 billion, a combination that comes as e-commerce continues to roil brick-and-mortar retail.

February 10 -

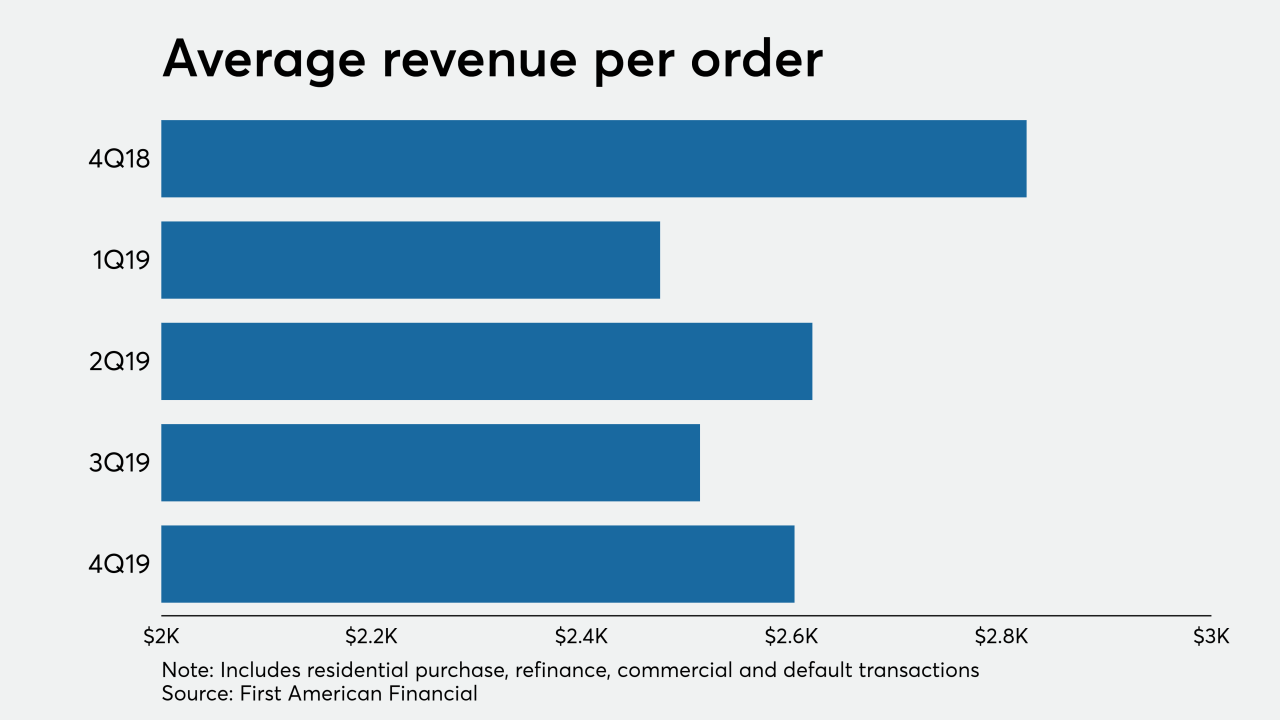

The strong refinance market in the fourth quarter propelled earnings at three different mortgage-related business that also were dealing with merger and acquisition activity during and after the period.

February 6 -

The U.S. mortgage insurance business remained a bright spot for Genworth Financial, as fourth quarter adjusted operating income increased 29% and new insurance written rose nearly 95% over the prior year.

February 5 -

A 10-basis-point year-over-year increase in gross margin on loans sold, along with a nearly 30% increase in origination volume, helped Waterstone Mortgage turn around its fourth-quarter results.

January 31 -

Howard Bancorp is transferring its mortgage business, along with VAMortgage.com, to a limited liability company formed by former managers in the division

January 24 -

Provident Bank in Amesbury, Mass., has entered warehouse lending after buying a business from People’s United Financial in Bridgeport, Conn.

January 22 -

Radian Group sold Clayton Services, a due diligence company it acquired in the 2014 purchase of Clayton Holdings, to Covius Holdings.

January 22 -

Sagent Lending Technologies has agreed to buy ISGN Corp. in a deal that would enlarge the company's loan servicing division.

December 24