M&A

M&A

-

The real estate investment trust has been buying residential business-purpose loans from the company since 2017.

May 6 -

This is the first deal that serial acquirer FOA has announced since it went public on April 5.

April 28 -

The Dallas company will pay nearly $54 million for a 49% stake in a lender that operates in 10 states.

April 28 -

For a lot of IMBs facing shrinking backlogs and falling secondary market spreads, the attraction of hitting a bid and taking the easy way out via an acquisition may become irresistible, writes Chris Whalen.

April 27 -

At first the deal seemed an unlikely marriage of two mortgage-heavy companies. But acquiring the Michigan company would help New York Community accomplish its two chief goals — reducing deposit costs and its concentration of multifamily loans — while giving it the scale to pursue more deals.

April 26 -

The merger would create a company with nearly 400 branches, 87 loan production offices and $87 billion of assets.

April 26 -

Better for mortgage businesses to take on the purchase market “storm” than batten down the hatches in port, writes LodeStar Software Solutions CEO Jim Paolino.

April 23 -

The Dallas company agreed to sell MSRs tied to $14 billion of mortgages to PHH Mortgage.

April 21 -

An interactive dialogue with Founder and CEO of NorthOne on the fintech industry, the growing needs of challenger banks, and the future of SMB banking.

-

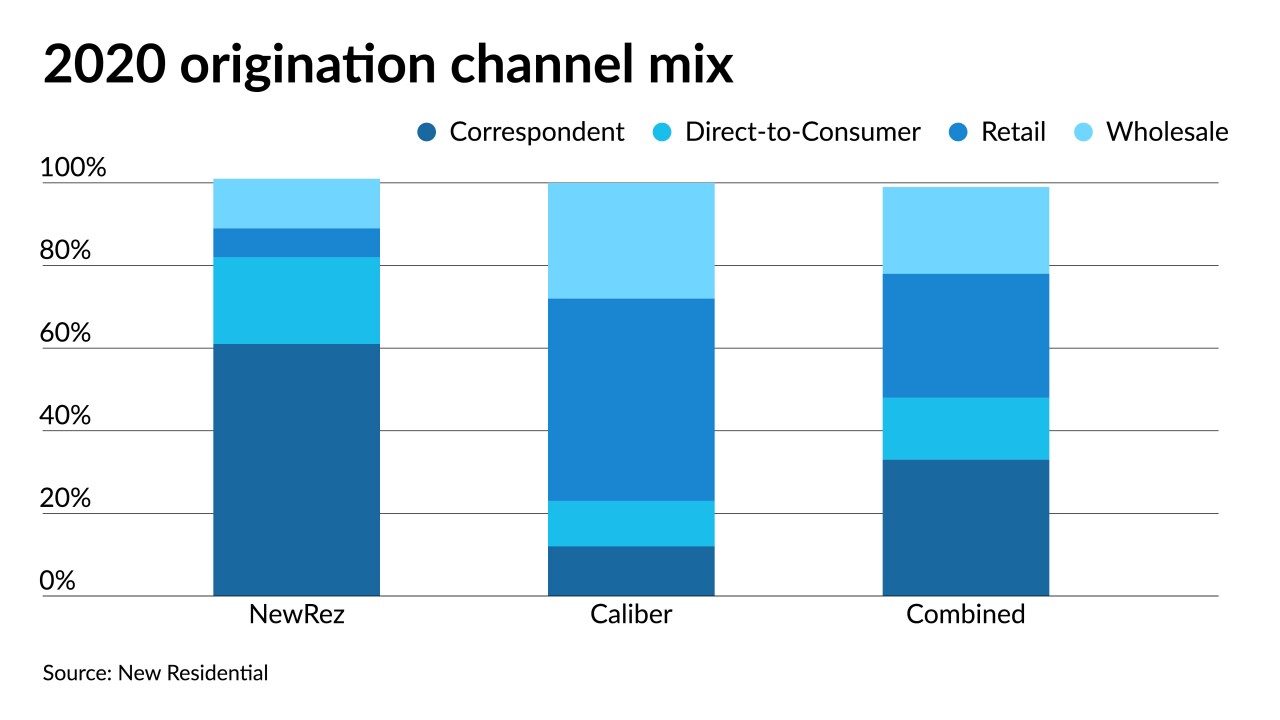

The REIT is planning its own stock sale to pay for the all-cash purchase from Lone Star Funds.

April 14 -

The inevitable cancellation of the takeover transaction by China Oceanwide means Genworth will be spinning out a portion of its U.S. mortgage insurance business.

April 6 -

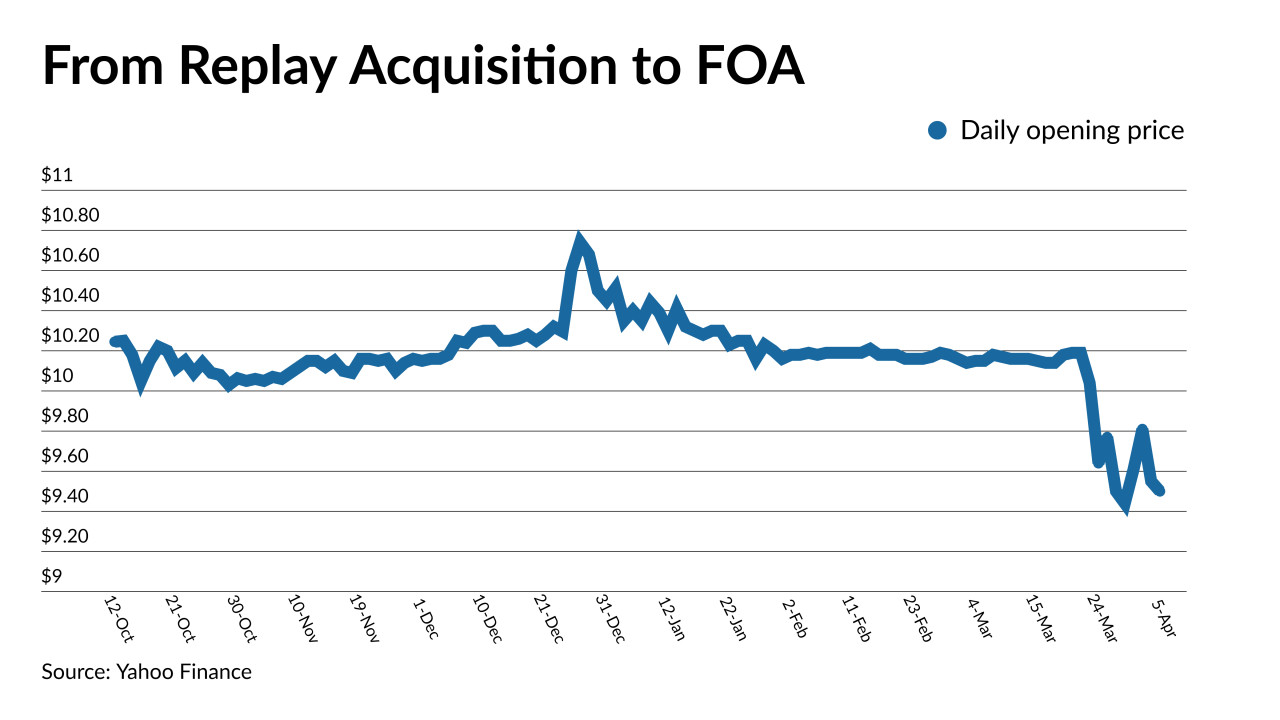

The forward and reverse mortgage lender completed its merger with blank check company Replay Acquisition Corp. on April 1.

April 5 -

The proceeds are expected to be reinvested into agency mortgage-backed securities, which already make up 93% of Annaly's portfolio.

March 26 -

The San Diego-based company produced $10.6 billion in the fourth quarter, and has done $6.1 billion in the first two months of 2021.

March 23 -

Also: How 9.3 million renters could enter the purchase market, lessons from Flagstar’s data breach and a possible 15-year plan for Fannie and Freddie.

March 19 -

Proptech CEOs and investors fully expect a huge year for the sector due to the pandemic’s “watershed” effect on digitization, according to Keefe, Bruyette & Woods.

March 18 -

Like the fintechs SoFi and LendingClub, DLP Real Estate Capital is acquiring a community bank largely to lower the cost of funding loans.

March 18 -

After its three acquisitions since last August, the Philadelphia area-based credit data firm predicts more industry consolidation is on the way.

March 17 -

The acquisition, which has a $500 million enterprise value, will extend the technology vendor’s capabilities beyond the point of sale into the stubbornly manual electronic closing process.

March 15 -

The abrupt move paves the way for the $6 billion cash deal with Stone Point and Insight Partners to move forward unimpeded.

March 4