M&A

M&A

-

Guaranteed Rate is gearing up to acquire certain assets of Honolulu HomeLoans and Hawaii Lending Alliance and expand its existing footprint in a growing Hawaii housing market.

November 28 -

Altisource Portfolio Solutions plans to discontinue its buy-renovate-lease-sell business for single-family homes and sell its short-term inventory in order to cut costs and repay debt.

November 26 -

Mr. Cooper Group — the new name following the combination of Nationstar Mortgage and WMIH Corp. — posted a $54 million third-quarter profit and announced plans to buy Pacific Union Financial, as well as make other strategic acquisitions.

November 8 -

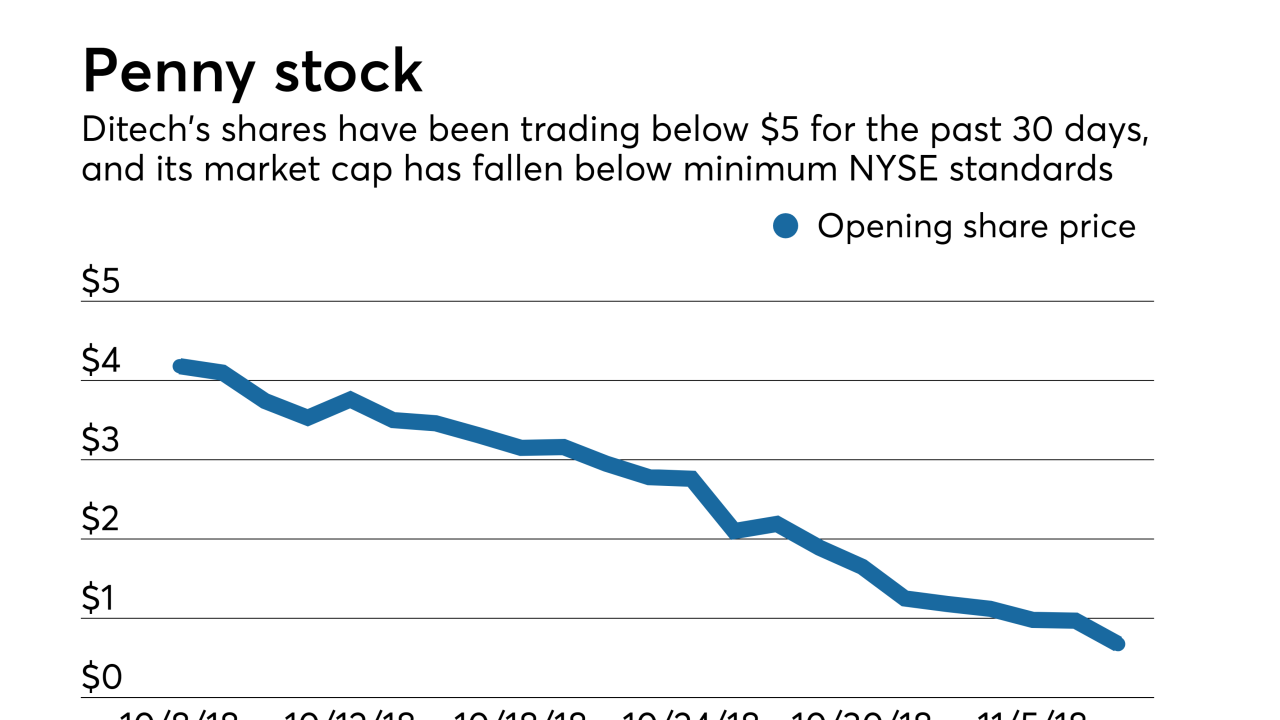

Ditech Holding Corp.'s stock is being delisted from the New York Stock Exchange, and the company is recommitting itself to finding an acquirer or other option that could improve investor value.

November 7 -

Black Knight added to its mortgage loan data product offerings by acquiring Ernst Publishing, an Albany, N.Y.-based provider of recording fee, transfer tax and title premium fee information.

November 7 -

Ocwen Financial Corp. recorded a deeper quarterly loss of $40 million after acquiring PHH Corp., but still expects the deal's economies of scale to eventually lower costs and restore profitability.

November 6 -

Walker & Dunlop acquired commercial mortgage banker iCap Realty Advisors as part of its strategic plan to increase its annual originations by at least one-third in the next two years.

November 2 -

Mutual of Omaha Bank company Synergy One Lending is preparing to acquire certain assets of BBMC Mortgage, a national mortgage company and division of Bridgeview Bank, which will expand its Midwest footprint and improve its strategic direction.

November 1 -

Lennar Corp. is selling a portion of its Rialto business to Stone Point Capital for $340 million, adding to Stone Point's holdings in the real estate and financial industries.

October 30 -

Rising interest rates and the continued slowdown in mortgage originations prompted Ellie Mae to cut its revenue forecast for the full year by at least $18 million.

October 25 -

Pretium Partners is buying Selene Finance, a residential mortgage servicer, from funds managed by Oaktree Capital Management and Ranieri Partners.

October 16 -

Washington Mutual successor WMIH Corp. has completed its pending 1-for-12 reverse stock split and its common shares will soon begin trading under the Mr. Cooper name it inherited from Nationstar Mortgage.

October 10 -

Intercontinental Exchange, the owner of the New York Stock Exchange, has purchased the remaining equity in Merscorp Holdings it did not already own.

October 4 -

Ocwen is putting plans in place to realize $100 million in savings using resources from its acquisition of PHH Corp., which has just closed.

October 4 -

After being acquired by Citizens Bank, Franklin American Mortgage has an expanded customer base and product offerings, but is also better positioned to embrace digital mortgage technology, says Franklin Chief Information Officer Matt Rider.

October 2 -

Ocwen Financial Corp. has gotten the go-ahead to acquire PHH Mortgage Corp., subject to revised New York restrictions on acquisitions of mortgage servicing rights, and other conditions imposed by the state.

September 28 -

Bemortgage, currently a division of Chicago's Bridgeview Bank formed last November by a former Guaranteed Rate executive, will become a part of CrossCountry Mortgage.

September 26 -

Stearns Lending is buying large equity stakes in smaller mortgage banking companies as it looks to grow its retail loan production business.

September 12 -

The Ohio company agreed to buy TransCounty Title Agency, which has five offices around Columbus.

September 4 -

Annaly Capital Management will be able to proceed with a delayed exchange offer needed for its acquisition of MTGE Investment Corp. because it has been able to satisfy incomplete deal conditions.

August 22