-

Putting down 20% of the sales price has been the industry standard when buying a house, but less than half of consumers do that much, according to Zillow.

December 14 -

Growing home prices and climbing interest rates didn't stop millennials from buying houses in October, Ellie Mae said.

December 5 -

It's in lenders' best interests to show first-time homebuyers how to avoid overextending themselves, which is easy to do in a housing market short on inventory and long on big down payments, the CEO of Freedom Mortgage says.

December 4 -

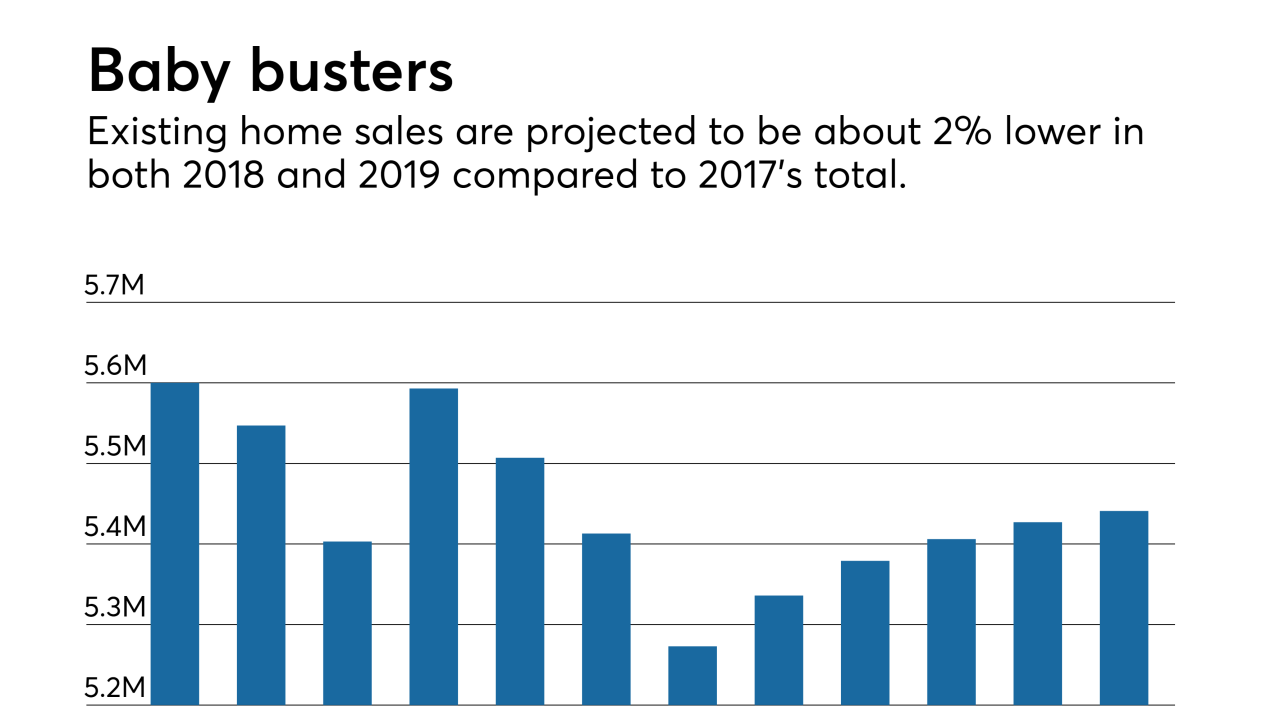

Existing-home sales are on pace to fall 2.3% year-over-year in 2018, and the baby boomer generation is a big reason why, according to Fannie Mae Chief Economist Doug Duncan.

November 29 -

Investing in community partnerships can feel counterintuitive at a time when most mortgage lenders are cutting costs, but it can pay off by attracting a key homebuyer demographic.

November 27 Cultural Outreach

Cultural Outreach -

From Provo, Utah, to Dallas, here's a look at 10 housing markets with the youngest average consumer age.

November 21 -

Rising interest rates are holding back existing homeowners from listing their properties, driving the gap between existing and potential sales even as that disparity narrows, First American Financial said.

November 19 -

As interest rates rise, mortgage originators need to teach millennial homebuyers about the product options outside of conventional loans, Ellie Mae said.

November 14 -

Consumers blame speculative home flippers and wealthy out-of-towners for soaring home prices, but the blame may be misplaced, given many economists' views about the broader factors at play.

November 13 -

Most millennials are purchasing fixer-uppers in order to afford a house, with 75% planning to finance renovations by tapping the equity in their home, according to a Chase Home Lending report conducted with Pinterest.

November 12 -

Eighty percent of millennials said they plan on moving within the next five years, while nearly three-quarters claim affordability as their biggest hurdle in the buying a home.

November 6 -

A combination of moderate rises in mortgage rates and dipping growth in home prices are projected to boost existing and new housing sales through 2020, according to Freddie Mac.

October 31 -

Student debt continues to weigh down potential homebuyers, as the share of first-timers decreased for the third-consecutive year, according to the National Association of Realtors.

October 29 -

With home values nearly doubling income growth in the last 20 years, it's now taking homebuyers 7.2 years to put together a down payment, according to Zillow.

October 23 -

While mortgage volume is expected to shrink next year, it should increase during the following two years and beyond as millennials start buying homes, the Mortgage Bankers Association forecasts.

October 16 -

One report found that 95% of homebuyers searched websites before buying a home, and that number jumps to 99% among millennials. In short, almost everyone starts shopping online, and a vast majority are going to Zillow.

October 10 J.D. Power

J.D. Power -

Millennials are targeting homeownership within the next few years, but many are buying into certain house-purchasing myths, according to Bank of America.

October 10 -

The state's red-hot housing market may be cooling a bit, according to the head of the New Hampshire Housing Authority.

October 5 -

August's share of conventional mortgages closed by millennials reached a three-year high as lenders added products to meet their lifestyle, Ellie Mae said.

October 3 -

Homebuyers put about 15% toward a down payment on house, spend $40,000 in one-time fees and thousands in closing costs, presenting an opportunity for lenders to leverage education and product offerings to prepare them for a purchase.

October 2